Will the Last Week of December Surprise the Financial Markets?

Stock-Markets / Financial Markets 2017 Dec 26, 2017 - 01:09 PM GMT Holiday Greetings!

Holiday Greetings!

I hope you and those you love are doing well over the holidays. My wife and I were happy to learn that another grandchild is on the way. SPX futures are marginally lower, but continue to find support at the upper trendline of the Broadening formation.

ZeroHedge reports, “For the second day in a row, most Asian markets - at least the ones that are open - were dragged lower by tech stocks and Apple suppliers, with the MSCI Asia Pacific Index down 0.2% led by Samsung Electronics and Taiwan Semiconductor Manufacturing in response to the previously noted report that Apple will slash Q1 sales forecasts for iPhone X sales by 40% from 50 million to 30 million. Most Asian equity benchmarks fell except those in China. European stocks were mixed in a quiet session while U.S. equity futures are little changed as markets reopen after the Christmas holiday.”

NDX futures, on the other hand, have no such support and has declined toward Short-term support at 6414.28.

ZeroHedge comments, “With most global markets closed for Christmas, the only overnight action was in Asia, which saw Chinese equities fall with tech stocks and names linked to Apple the worst performers after a report that Apple cut forecast iPhone X sales forecasts, while property firms surged on speculation of coming consolidation. As a result, after opening higher, the Shanghai Composite Index closed 0.5% lower on the day, the blue-chip CSI 300 Index fell 0.3%, the Shenzhen Composite Index retreated 0.9%, while the ChiNext small-cap and tech Index dropped 1.3%. The PBOC's refusal to conduct a reverse repo for the second day did not boost the market mood.”

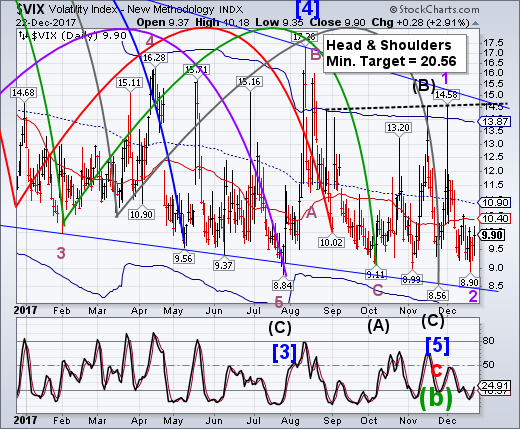

VIX futures have risen above the 50-day Moving Average this morning. You may recall that I suggested a preference for a breakout above the previous December high at 10.54. Take your pick, but realize that this is an aggressive signal so far. We will be monitoring the Hi-Lo index which closed marginally above its signal levels last week after the open.

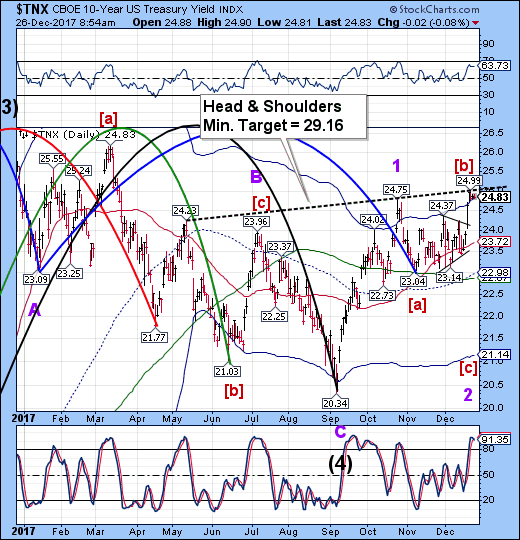

TNX is consolidating at the Cycle Top support/resistance at 24.83 this morning. As mentioned before, TNX may be working on its right shoulder and is likely to decline to the mid-Cycle support at 22.98 or the 50-day Moving Average at 22.87.

In a panic situation it may decline as far as the Cycle Bottom at 21.14. At issue is the fact that TNX is due for a Master Cycle low in the next week or so.

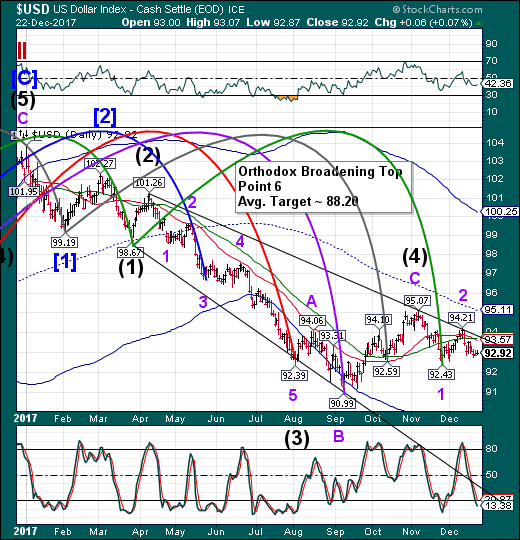

USD futures made a low of 92.80 this morning, lending credence to the decline that is underway. It, too may be due for a Master Cycle low in the next week or two.

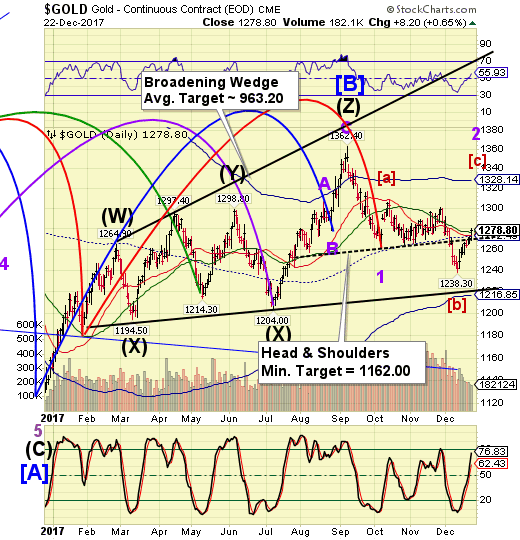

Gold futures are higher this morning as it appears that it may complete its retracement at or above 1300.00. The Cycles Model suggests up to a week of strength ahead.

WTI futures are higher as well. Crude is also on a final week of strength.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.