Stock Market Aggressive Sell Signals, but Discretion is Warranted

Stock-Markets / Stock Market 2017 Dec 15, 2017 - 03:09 PM GMT SPX futures are higher with the expectation of the passage of the tax reform bill. Yesterday’s decline may not be impulsive and did not make it to Short-term support. Let’s see how the bounce develops before taking positions. I would suggest that Short-term support should be broken before short positions are added.

SPX futures are higher with the expectation of the passage of the tax reform bill. Yesterday’s decline may not be impulsive and did not make it to Short-term support. Let’s see how the bounce develops before taking positions. I would suggest that Short-term support should be broken before short positions are added.

ZeroHedge reports, “U.S. equity index futures point to a higher open, having rebounded some 10 points off session lows with the VIX stuck on the edge between single and double digits, while European and Asian shares decline as investors assess central banks’ shift toward tighter monetary policy and concern over tax overhaul ahead of final plan. “

ZH further comments, “With Bloomberg writing this morning that "Mystery, Suspense Mount" two days after President Donald Trump told the American public that Congress was “just days away” on tax reform, two more senators - including one-time Trump rival - Marco Rubio appear to be getting cold feet - much to the market’s chagrin. Yesterday afternoon, stocks dropped and the VIX jumped above 10 as Rubio and Utah’s Mike Lee said they had reservations about the draft bill being put together by the conference committee.”

NDX futures are also higher. While the bounce is only partial, the decline does not leave enough space to declare a top just yet.

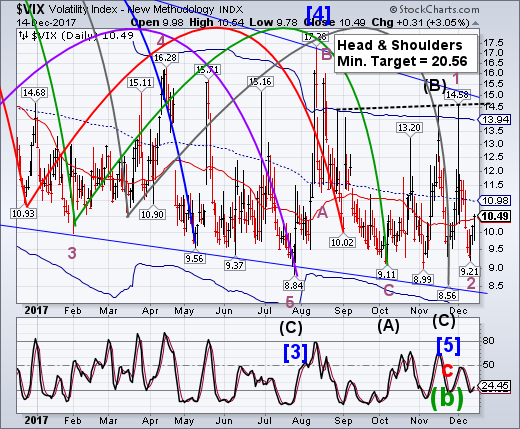

VIX futures pulled back this morning after closing above the 50-day Moving Average in the final minutes of yesterday’s session. A close above the 50-day Moving Average is an aggressive sell signal. Exercise caution as suggested above.

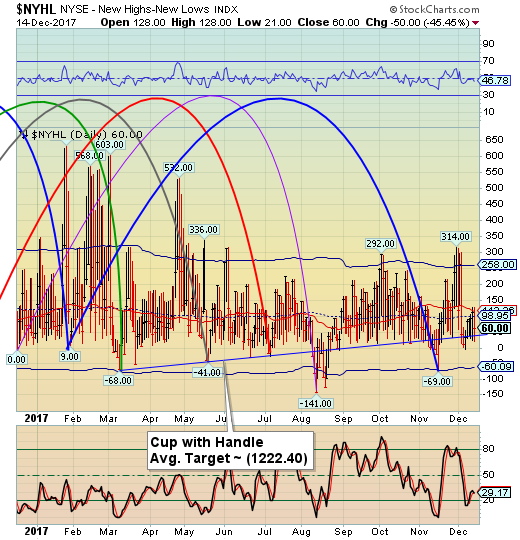

The NYSE Hi-Lo Index closed in an aggressive sell signal. We’ll monitor it later today for a deeper low and a possible close beneath the trendline.

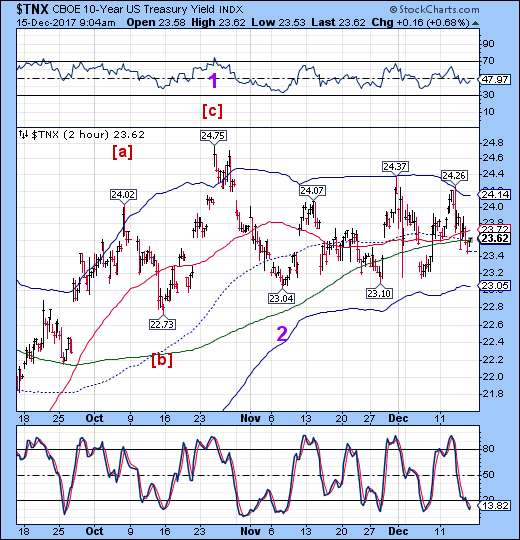

TNX bounced to challenge the mid-Cycle resistance and 50-day Moving Average at 23.60. The pattern is corrective, but may be applicable to a Wave 2 extension.

ZeroHedge observes, “Before you shut down that terminal for the year, hoping that the year is - mercifully - finally over, you may want to consider that according to former Lehman trader and current Bloomberg macro commentator Mark Cudmore, the Christmas pain trade is about to be unveiled, and it will be especially painful for all those short Treasurys. As Cudmore warns, with ten-years stuck in a 2.3%-2.43% range for the past seven weeks, "the arguments are adding up for a violent downside break during the weeks ahead."

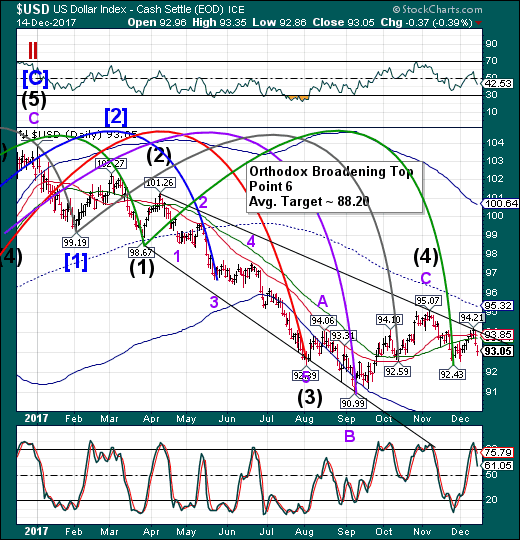

USD futures are flat this morning. It’s fair to say that the decline may have just begun. USD is on a sell signal That may take it to the end of January when the next Master Cycle low is expected.

USD/JPY is also trending down, having made a low of 112.03 this morning.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.