More Trade Barriers Are Coming—Make Sure You’re On The Right Side

Economics / Protectionism Nov 02, 2017 - 12:57 PM GMTBy: John_Mauldin

BY PATRICK WATSON : If you think economics is boring, bring up “free trade” and see what happens. I guarantee sparks will fly.

BY PATRICK WATSON : If you think economics is boring, bring up “free trade” and see what happens. I guarantee sparks will fly.

Some people preach free trade’s many blessings. Others curse the very idea, insisting free trade hurts honest working people.

Lately, this has become more than a theoretical argument.

President Trump came into office pledging to renegotiate or cancel trade agreements he thought unfair to the US. Meanwhile, the UK seems headed toward a “hard Brexit” from the European Union.

Whether you think those are good moves or not, they’re important to the world economy. Millions of jobs and lives are at stake.

I think both sides are wrong… and it’s going to cause big trouble.

Free Trade Is Anything but Free

Rational discussion is impossible if you can’t agree on definitions. So what is free trade, anyway? Here’s how Investopedia defines it:

Free trade is the economic policy of not discriminating against imports from and exports to foreign jurisdictions. Buyers and sellers from separate economies may voluntarily trade without the domestic government applying tariffs, quotas, subsidies or prohibitions on their goods and services. Free trade is the opposite of trade protectionism or economic isolationism.

By that definition, free trade exists almost nowhere on Earth. Even so-called free-trade zones like NAFTA aren’t free. They have extensive rules defining how the parties can discriminate. It’s managed trade, not free trade.

I think if we actually had free trade, it just might work.

The closest thing we have is interstate trade within the US. It works pretty well, thanks in part to having a single currency and fiscal policy. Take those away, and the US would look more like the European Union.

Barring a one-world government, international trade will always have some degree of protectionism.

But someone in the Trump White House recently decided to turn it up a notch.

Free Trade’s Downside Goes Beyond Economics

Peter Navarro is an economist who directs the White House Office of Trade and Manufacturing Policy. He’s a hard-line protectionist, especially toward China.

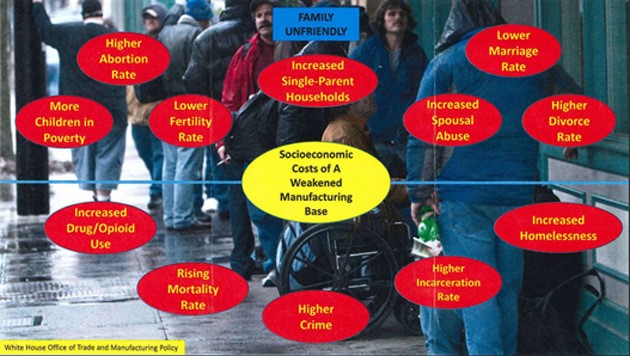

Last week, the news media obtained a slide presentation by Navarro that earned immediate ridicule. Here’s the most-shared slide.

In Navarro’s view, insufficiently protectionist trade policies weakened the US manufacturing base. He thinks this created other socioeconomic costs—from domestic violence to lower fertility rates—all springing from the same root cause.

The Twitterati roared with bipartisan laughter at Navarro’s slides. What a crazy idea to think that closing factories could change fertility rates!

I have to confess, that was my first reaction too. But as I thought more about it, I realized that Navarro has a point here... and an important one.

The Socioeconomics Impact of Job Loss

Losing your job is no fun, particularly when you have no savings and no good prospects for a new job. That describes a lot of US manufacturing workers in the last decade or two.

What happens inside those households after the axe drops?

Well, with no income they start falling behind on bills. Government benefits help, but they still don’t replace what was once there.

That leads to arguments between spouses. Kids hear it, get scared, and vent their fear by misbehaving at school.

The stress that comes from trying to find a new job—or from working three “McJobs” to make ends meet—can create a tense atmosphere. Then the car breaks down, or somebody gets sick, and it gets even worse. People turn to drugs, have affairs, commit crimes. Bill collectors start calling. Teens make bad choices.

None of this is imaginary. It happens all the time.

Yes, people bring some of this on themselves. But it still originates from that initial job loss, which was a consequence of national trade policies.

Other economists have reported similar findings. For instance, see “The China Trade Shock” by David Autor, David Dorn, and Gordon Hanson. They don’t endorse Navarro, to my knowledge, but their research supports some of his points.

Peter Navarro may not have all the right answers, but he’s not wrong about these socioeconomic problems.

They happen, they hurt people, and trade policy is one of the causes.

Both Camps Are Wrong

As I said, people fall in two camps about trade:

- Free trade is great for the economy.

- Free trade is unfair and hurts people.

Specific policy preferences flow out of those beliefs. On the surface, they look irreconcilable, but I think both are correct.

Yes, free trade—or at least taking steps toward it—helps the economy.

And yes, free trade is unfair and causes a lot of problems.

This isn’t an either/or condition. Both can happen as the process unfolds over time.

It’s true the people who get hurt by foreign competition might eventually find new and better opportunities, but that “eventually” period is painful. All those problems Navarro listed can linger a long time.

Even if everyone who lost their job finds a better job a year later, the scars from that year don’t disappear. Marriages break up, kids learn bad habits, communities fall apart.

Those who sing free trade’s praises tend to overlook this. Economic growth will fix everything, they think. Just wait.

For them, the waiting is easy. Not so for everyone.

Until that problem gets fixed, anything called “free trade” won’t get very far.

Free-traders will be lucky not to go backward. President Trump already ended US participation in the nascent Trans-Pacific Partnership (TPP). He may well pull the US out of NAFTA too.

Fierce opposition from business leaders has kept Trump and Navarro from moving as fast as they want, but I don’t think they will give up. The trade barriers that exist now will stay in place, and new ones are probably coming.

That will affect stock markets all over the world, but not equally.

The walls are rising. Make sure you’re on the right side.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.