GOLD Price Creates Bullish Higher Low

Stock-Markets / Financial Markets 2017 Oct 20, 2017 - 12:35 PM GMTBy: Enda_Glynn

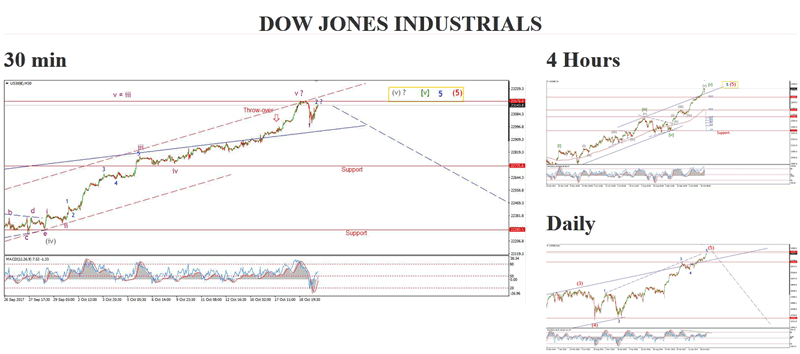

We had an interesting development in stocks today.

We had an interesting development in stocks today.

The market hit a no-bid 'air pocket' and the price dropped dropped 100 points right out of the gate.

This is not a good sign if you are a bull,

The price has recovered this evening but I am marking this one in my diary as the first shot across the bow.

I will elaborate on that later.

TOMORROWS RISK EVENTS:

USD: Existing Home Sales, Fed Chair Yellen Speaks.

EUR: N/A.

GBP: Public Sector Net Borrowing.

JPY: N/A.

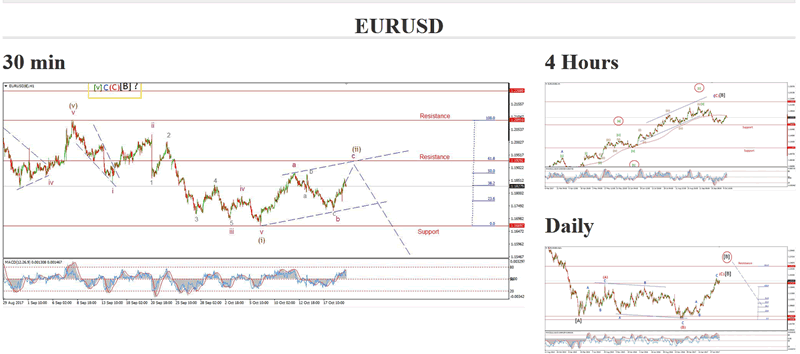

My Bias: long term bearish

Wave Structure: downward impulse wave

Long term wave count: lower in wave (3) red

EURUSD is up off the lower trend channel line again today,

Wave 'c' of (ii) is well on its way to the target at 1.1930,

to create a possible three wave zigzag correction higher.

once this correction completes,

This market will have created a bearish Elliott wave signal off the high.

For tomorrow;

If the price continues to rise,

Watch for a reaction to the downside in the region of 1.1930.

Wave (iii) brown should carry the price lower in an impulsive fashion.

My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Possibly topping in wave (5)

Todays decline in the DOW is labeled as a possible impulse wave '1' and corrective wave '2'.

It is very early days in the top formation,

But the fact that the market hit an air pocket this morning does illustrate that there is less bullish appetite out there at these prices.

We may be seeing the first question marks being raised by the market as to the actual fair value of these stocks.

the 4hr chart shows the extreme momentum reading reached this week, 92.75.

That extreme was followed by today's decline.

The larger wave count is complete as a five wave advance in both green labels and grey label's.

It remains to be seen if the short term wave count can extract one more new high for the road.

But,

As I said earlier in the week,

This market is dead, as a value measurement instrument!

The dumb money has all bought in at this stage going by the margin debt data just released.

The wave count will soon reveal a five wave decline to the downside

and then a bearish Elliott wave signal at a lower high.

And then this market will punish as many souls as possible in the next half cycle.

A further sharp decline tomorrow may be wave '3' blue.

lets see if today's action continues to create that bearish signal we are on the lookout for.

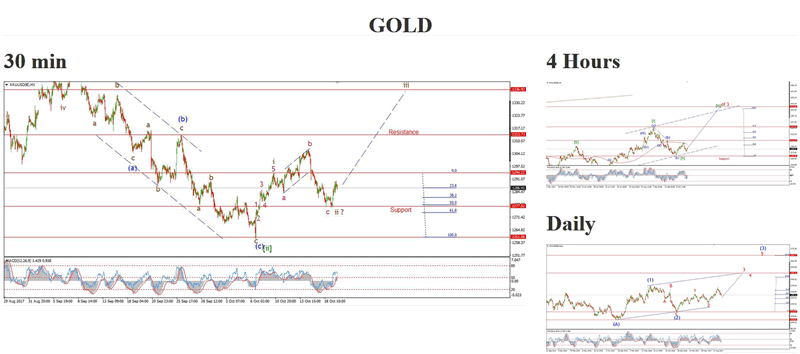

My Bias: Long to a new all time high above 1827.

Wave Structure: Impulse structure to a new high.

Long term wave count: wave (3) above 1666.

GOLD bounced off support at the 50% retracement level today.

The price has again taken an impulsive form,

So the probability is high for a rally in wave 'iii' brown.

The initial point of resistance lies at 1294,

which is the high of wave 'i' brown.

IF the bullish signal proves correct,

Then wave [iii] green should rally powerfully,

the target for wave [iii] is in the region of 1510,

where wave [iii] reaches 161.8% of wave [i] green.

This is shown on the 4hr chart.

So the prize on offer is a nice one!

For tomorrow;

Watch for another higher low above today's low of 1276.98.

A break of 1313.30 will signal wave [iii] green has begun.

WANT TO KNOW the next big move in the Dollar, GOLD and the DOW???

Check out our membership plan over at Bullwaves.org,

You can see into the Elliott wave future every night!

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2017 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.