Stocks, Gold, Dollar, Bitcoin Markets Analysis

Stock-Markets / Financial Markets 2017 Sep 23, 2017 - 01:05 PM GMTBy: SurfCity

As always, I will be adding to this over the weekend and should have all my updates done by 2pm PST on Sunday so please check back then.

As always, I will be adding to this over the weekend and should have all my updates done by 2pm PST on Sunday so please check back then.

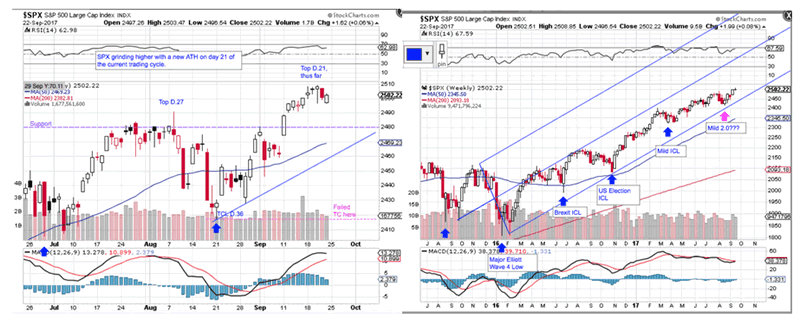

Stocks (SPX):

Cycle Status/Outlook: Short term bullish after another new ATH on the SPX this week on day 21. We are slightly lower on day 23 but a 21 day high shifts the odds in favor of a right translated cycle that will make a higher low.

My longer Intermediate Cycle count is looking lower unless we may well have had another mild ICL in mid-August.

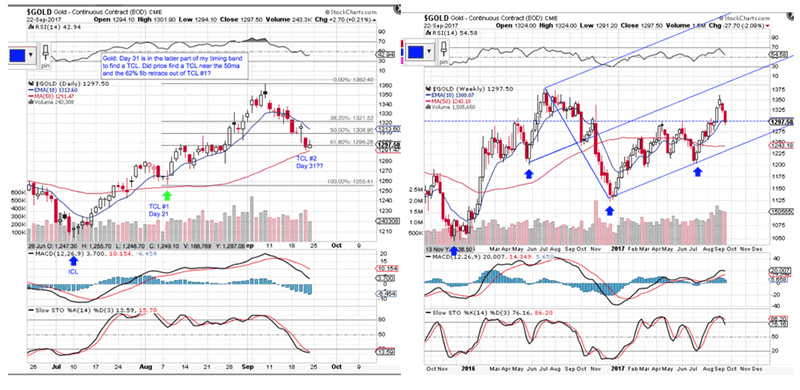

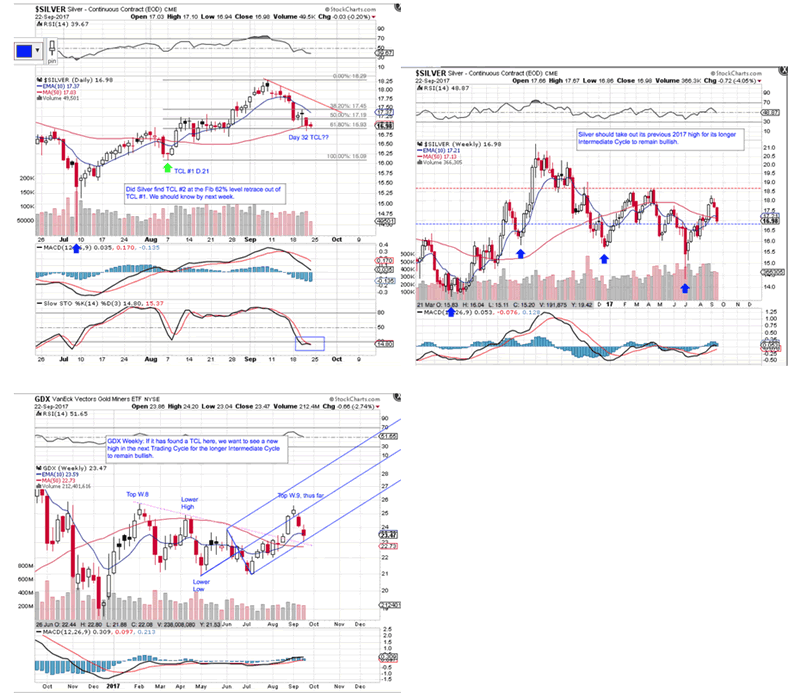

Gold and PMs:

Cycle Status/Outlook: We won’t know for sur until next week but Gold may have found a TCL last Thursday on day 31. After a top on day 22. we should be nearing a TCL/DCL very soon from. Should Gold move lower next week, my faith in the longer Intermediate Cycle will be shaken. Same with the Miners and Silver. All are at critical support that need to hold over the next few days.

Remember that only Gold has made a new 2017 high in this Intermediate Cycle. Silver and the Miners still have much to prove in the weeks ahead as the next bounce will be into Trading Cycle 3 where most of Gold’s longer Intermediate Cycles top. We want to see all three make higher highs in TC3 before topping out.

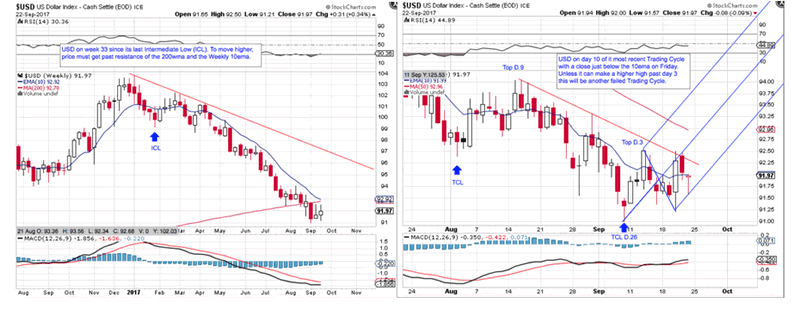

USD:

Cycle Status/Outlook: Short term USD is on day 10 of a new Trading or Daily Cycle but lost the 10ema on Friday and needs to recover it quickly or it will roll over into another failed cycle..

Long term I believe the USD found a 15 Year Super Cycle top in early 2017. That said, the USD is overdue to find an Intermediate Cycle low and Yearly low as well. While the next TCL/DCL could also be an ICL, my expectations are that even a rally out of a YCL will be corrective in nature. Strong resistance should be found in the 98.50 to 100 range.

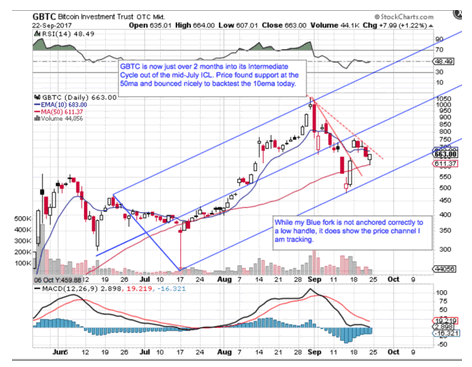

BitCoin GBTC: My shorter count on GBTC is a mess but I don’t think that the BitCoin BTC Intermediate Cycle has topped out just yet. GBTC had a nice bounce off the 50ma which is what I was looking for to stay in the trade.

Bonds:

Cycle Status/Outlook: I am bearish on Bonds (TLT) and will post more later.

By Surf City

Everything about Cycle Investing

© 2017 Surf City - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.