Stocks, Bonds, Interest Rates, and Serbia, Camp Kotok 2017

Stock-Markets / Financial Markets 2017 Aug 16, 2017 - 01:07 AM GMTBy: John_Mauldin

I went to Camp Kotok, an invitation-only gathering of economists, market analysts, fund managers, and a few journalists. I go every year, and I always learn more than I can manage to remember.

I went to Camp Kotok, an invitation-only gathering of economists, market analysts, fund managers, and a few journalists. I go every year, and I always learn more than I can manage to remember.

It’s a three-day economic thought-fest (and more rich food and wine than is good for me or anyone else at the camp). For me, that’s about as good as life gets.

Come along with me as I share some of my main takeaways and consensus forecasts from this year’s camp.

Takeaway 1: A Correction Before the End of This Year

Almost everyone expects a serious market correction before the end of the year. Most of the people I talked to were concerned about market complacency; and even if they were bullish, they were surprised that we've gone this long without a correction Could one be starting this week? We’ll see…

Takeaway 2: Bond Valuations Are More Concerning Than the Stock Market

In talks with people I seriously respect, I found more concern about valuations and spreads in the bond market than about valuations in the stock market.

As I sat with a few people and “war-gamed” what the next recession will look like, a general agreement emerged that the credit markets will be far more volatile than they were last time, even though banks are better capitalized today than they were 10 years ago.

The problem is simply that credit markets have no liquidity and valuations are extraordinarily stretched. And not just in the US.

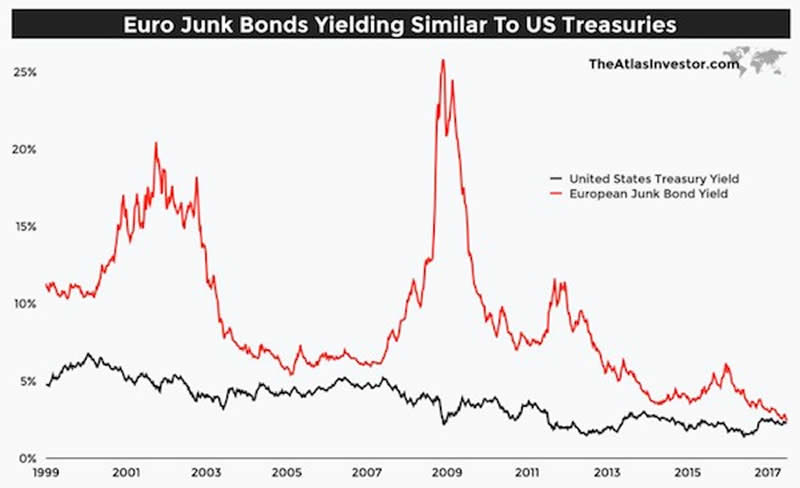

One of the participants told me to look at this chart:

Dear gods, when European junk bonds pay the same as US Treasuries do, there is really something out of whack in the world. Look at that spike in European junk in 2009 and the one back in 2002.

European junk bond investors have never been more complacent. The reach for yield is staggering. The participants in that market think that Draghi and the European Central Bank have their backs.

If the situation starts to get volatile, they expect the ECB to step in. But the ECB would have to change its mandate in order to buy junk bonds, and that means getting the more conservative members of the eurozone to agree.

I hesitate to bet on that. This could be the European equivalent of the Big Short in the next global recession.

Takeaway 3: The Fed Will Likely Hike in December

Much of the private discussion centered around how much the Fed will tighten this year.

Some thought the Fed wouldn’t raise any further, and some thought we would get at least one or two more rate hikes. The consensus seemed to be that a December rate hike is on the table unless we get some really unsettling data between now and then.

It certainly doesn’t look as though we’ll see a hike in September, though. If there is one, it will be a surprise to everyone I talked to.

Takeaway 4: The Fed’s Negative Balance Sheet Doesn’t Matter

There was a conversation between a very serious Fed watcher and a former Fed economist. The question was, what would happen if the Fed’s balance sheet went negative, i.e., if they were selling their bonds back into the market at a loss?

The answer was that the Fed is not required to record losses on asset sales against capital. There is an agreement with the US Treasury that says the Fed can create a negative asset account, but at that point it withholds remittances until the balance sheet is positive again.

The Fed would be technically insolvent, but that wouldn’t matter because it’s backed by the US Treasury.

Takeaway 5: Serbia is a Hot Frontier Market

One gentleman who has been coming to the camp for several years runs a fund and is an expert on frontier markets. Because I have been to 62 countries—many of them on the very frontier of the frontier markets, I’m always interested in talking with him.

So I always ask him what his favorite frontier market is, and what he sees happening in that space. For the last three or four years, he has been consistently big on Vietnam.

This year he surprised me by answering “Serbia.” I probably shouldn’t have been surprised, as almost the entire Central and Eastern European sector is hot, hot, hot. When I asked why, he pointed out the country has really made itself investor-friendly.

But that plus is not all that easy to trade, so there’s a lot of undervalued potential in what is essentially a well-educated and growing economy. And he still loves Vietnam and also mentioned Myanmar and a few countries in East Africa.

Consensus Forecasts

Each year, most camp participants fill out a survey (and some of us place small side bets, typically five dollars a choice) on a number of different economic indicators. Let me just give you the average predictions as to where things will be one year from now.

• Three-month LIBOR: 1.64% from 1.30% today and 0.82% a year ago – that’s a doubling in the rate in two years.

• Ten-year Treasury note: 2.57%

• WTI crude oil: $50.20 (but the range was all over the place, from $30 to $76)

• S&P 500: 1,340, with surprisingly few really bearish views

• Gold: $1,340, and while there were a few outliers in both directions, people were generally looking for a strong movement upward.

• Dollars per euro: $1.14

• Dollars per UK pound: $1.23

• Yen per yollar: 115 (and surprisingly, my suggested number was not the highest prediction)

• Unemployment rate: 4.4%

• Core CPI: 1.9%

• US GDP: 2.12%, again with a very wide range, but interestingly, nobody was predicting a negative GDP or an outright recession.

In short, the average predictions pretty much repeated the current consensus of the market, which is to say, they are averages that reflect a complacent outlook. But I can tell you, there was a wide range on most of the predictions, and that disparity in views certainly came out in the discussions.

Join hundreds of thousands of other readers of Thoughts from the Frontline

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.