North Korea Showdown: Pivotal Market Turning Point

Stock-Markets / Financial Markets 2017 Aug 15, 2017 - 01:07 AM GMTBy: The_Gold_Report

The next two weeks could be a make-or-break period for President Trump, says Lior Gantz, founder of Wealth Research Group.

The next two weeks could be a make-or-break period for President Trump, says Lior Gantz, founder of Wealth Research Group.

We're witnessing a classic political attention diverting operation.

Like many before him, President Trump is provoking a foreign affair crisis in order to take our minds off of the problematic U.S. domestic economic and political tensions and focus on matters the government can blame on others instead of themselves.

As you know, Trump's administration and political capital are at stake in September as he pushes to pass a bill regarding the wall, the infrastructure plan, the budget, and the debt ceiling.

These topics will play a major role in determining the fate of natural resources, commodities, safe havens and cryptocurrencies.

The pressure is on as we approach a year in the President's term in office.

Complete Rundown of Upcoming Events:

1. North Korea Conflict: The war of words between President Trump and North Korea's Kim Jong Un is not slowing down at all.

Trump denied that his remarks—where he warned that North Korean threats would be responded with "fire and fury"—had gone too far. Instead, he commented that he may not have gone far enough—that's clear propaganda.

Trump is a master negotiator, so we know this is part of an elaborate strategy, but Ray Dalio, the world's largest hedge fund manager, along with Dennis Gartman, one of the best commodity analysts ever, and even PIMCO, the bond investment conglomerate, and Jeff Gundlach, the bond god, have all increased gold allocation themselves and advised clients to do the same.

Gold has closed the week at $1,289 with silver being the top-performing precious metal, up 5.18%.

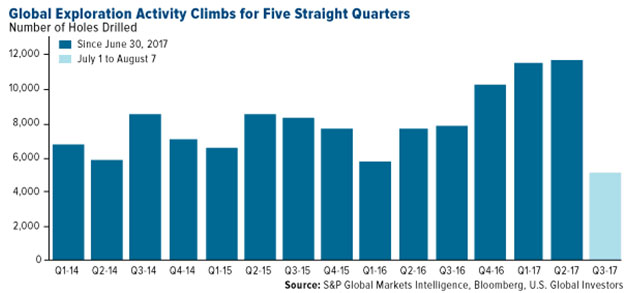

Courtesy: U.S. Global Investors

You're going to love this: gold exploration budgets are finally on the rise.

Wealth Research Group updated you just a few days ago saying that for gold stocks to finally kick into 6th gear, we need discoveries and takeovers—we're starting to see both.

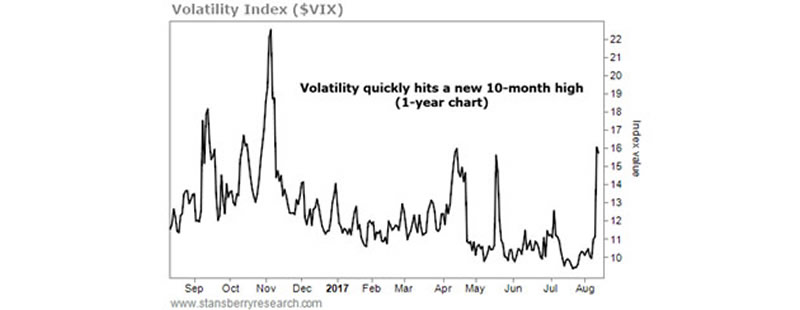

2. Volatility is Back: It was no more than a week ago when Wealth Research Group alerted that the VIX is about to spike and that betting on rising volatility is a phenomenal short-term trade.

Our call was dead-on.

Courtesy: Stansberry Research

September is historically the worst-performing month of the year for the U.S. stock market, so we could be in the midst of a correction already.

Some 200 stocks in the S&P 500 had fallen 10%+, which means nearly half are in correction mentality.

3. Industrial Metals: China, as opposed to the United States, doesn't have to endure a long, drawn out political debate on things that matter—they simply execute.

Their infrastructure plans are huge and have driven aluminum prices to over $2,000 per ton for the first time in three years.

In fact, most metals are in an uptrend.

Courtesy: U.S. Global Investors

This is significant, and it means that the missing piece of this puzzle is rising oil prices.

When we experience this, either by the escalation of the North Korean showdown or by supply cuts, inflation will be doing a 180 from its slumber and will hit Main Street.

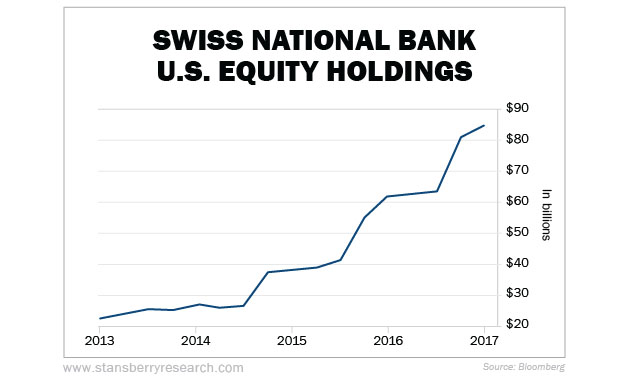

4. Central Banks Disgust Me: When do you finally admit failure and begin fixing what's wrong?

The Swiss central bank is a disgrace.

In the second quarter alone, it bought Apple, Microsoft, Amazon, Facebook, and Alphabet, among others—almost $90,000 in securities per Swiss citizen.

Courtesy: Stansberry Research

At the end of the day someone will begin paying the price for all of this, and I'd love to see how this all plays out.

The Bitcoin position keeps ballooning like few things ever can, and I'm about to shock you with a new crypto suggestion that will be like no other.

Make sure you and your family are prepared for anything, own safe havens, and live life to the fullest.

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.