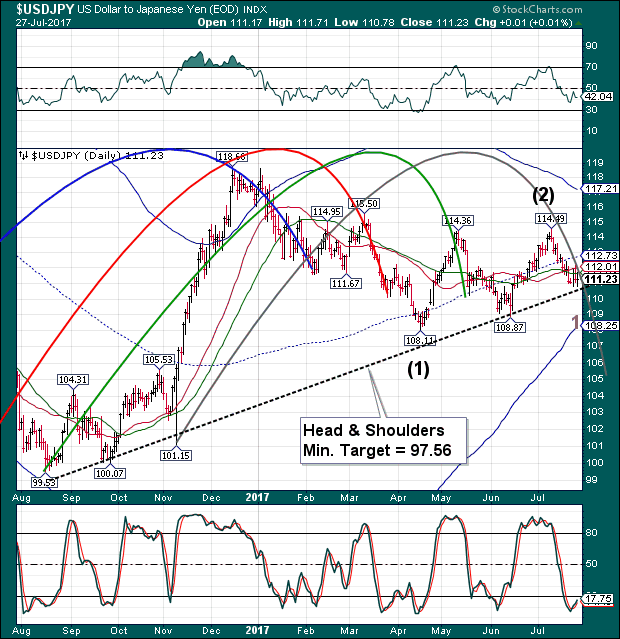

Could USD/JPY go into Freefall?

Stock-Markets / Financial Markets 2017 Jul 28, 2017 - 01:58 PM GMT SPX futures are down, but have not exceeded yesterday’s intraday low.

SPX futures are down, but have not exceeded yesterday’s intraday low.

Today being Friday, there may be an effort to keep the decline from going too low. That suggests a probable bounce at Short-term support at 2457.17 to rally back to breakeven by the end of the day. Should this take place, it may offer another short entry opportunity by the end of the day. But this is only one outcome out of several possible scenarios. A second scenario may be an immediate launch into a Wave three scenario with a minimum 8-12% decline in the next three days. Yesterday may have been day one of a 4.3-day panic Cycle.

ZeroHedge reports, “S&P futures have tracked both European and Asian markets lower, which were dragged down by the big EPS miss and guidance cut reported by Amazon on Thursday. Meanwhile, the pounding of the dollar has resumed with the euro and sterling strengthening against the dollar due to renewed political concerns after this morning's stunning failure by the Senate GOP to pass a "skinny" Obamacare repeal after John McCain sided with democrats.”

The NDX futures challenged it intraday low, but did not exceed it. NDX has a similar probable path of testing Sort-term support at 5842.42 before a bounce that may allow an aggressive short entry position.

Bloomberg has a video report on yesterday’s Amazon Q2 earnings.

VIX futures are higher, having exceeded it 2 hour mid-Cycle resistance at 10.46. The Cycles Model suggests a probable probe to the Cycle Top at 12.04 to complete Wave 1, then a pullback to mid-Cycle support for another long entry for the VIX ETFs.

The NYSE Hi-Lo Index closed at 139 yesterday, not far from the mid-cycle support found at 106.96. A close beneath that level may enhance the VIX aggressive sell signal. The Hi-Lo confirmation may come below -15.00, should it happen today.

USD made a new low yesterday, confirming my analysis of an extension that may find its final low either today or Tuesday. Both days are strong pivot days. The price target may still remain at 92.65, but an extension until Tuesday may take the USD considerably lower. I have already suggested taking profits on short positions with only aggressive investors staying for the final low.

Sir John Templeton (with whom I had several valuable conversations) was asked why he always sold too soon. His smiling answer was, “I always leave a bit of profit for the next person.”

USD/JPY just took a nosedive through the Head & Shoulders neckline in the premarket this morning. This suggests something more serious may be taking place behind the scenes. It is in the window for the next Master Cycle low. This window could easily extend to next Tuesday, as I have indicated earlier. The USD/JPY target appears to be its Cycle Bottom support at 108.25, where it may bounce to retest the neckline. However, being a Wave 3 of (3), it may just go into freefall to meet the Head & shoulders target.

Stay tuned!

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.