Dollar, Bitcoin, Markets - Is There A New Flight To Safety?

Stock-Markets / Financial Markets 2017 Jul 26, 2017 - 02:20 PM GMTBy: Chris_Vermeulen

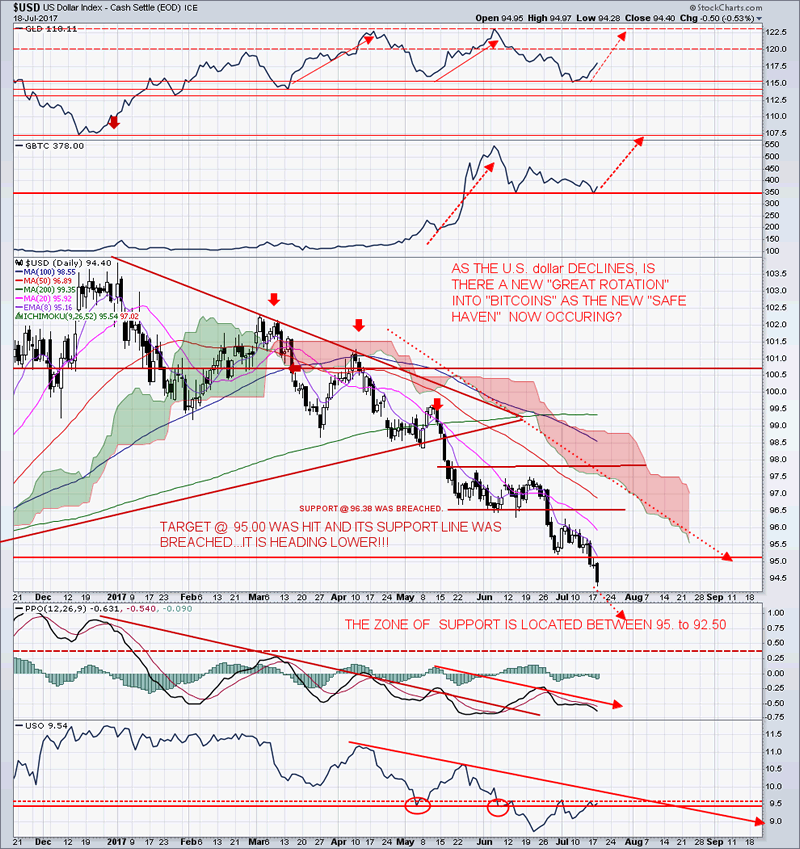

The dollar has been taken beating on ‘false promises’ of any major fiscal reform from the Trump administration.

The dollar has been taken beating on ‘false promises’ of any major fiscal reform from the Trump administration.

On July 18th, 2017, President Trump lacked the support of the U.S. Senate to pass any new measures on healthcare bill, in the U.S. At least, three Republicans along with the Democrat lawmakers have expressed opposition for any changes to the current “Obamacare”.

All investors have their doubts that the Trump Administration might not be able to implement tax reform. This was the key component of their infrastructure spending proposals which should have been implemented within this year or early 2018.

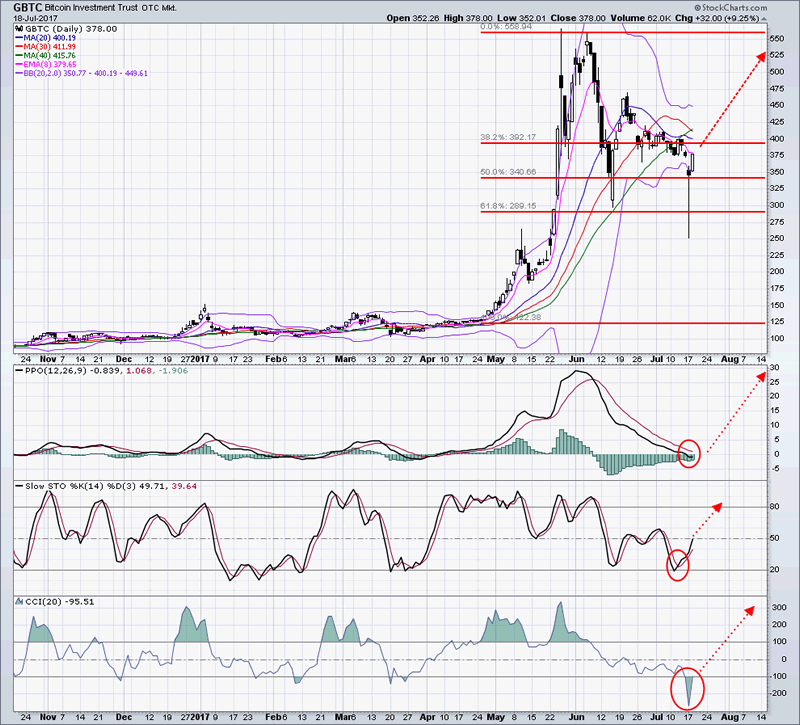

Bitcoin prices has been able to benefit from the “return in risk aversion” in the markets on fresh catalysts. Bitcoin prices, http://www.marketwatch.com/story/cybersecurity-legend-bets-his-manhood-that-bitcoin-reaches-500000-mark-with-three-years-2017-07-18?mod=MW_story_top_stories, plunged more than 25% over the last weekend of July 17th, 2017. Bitcoin, lost $10 billion, in market cap due to the crash. On Monday morning, July 17th, 2017, the markets recovered 30-40%. There is grave concern about the potential transition on the Bitcoin block chain platform. On August 1st, 2017, Bitcoin improvement, proposal, 148 (BIP148), is intended to allow the Bitcoin network to scale more efficiently is scheduled to be activated. The majority of developers do not agree on this new proposal. Currently, 43% of bitcoin’s mining power is seeking a new paradigm!

It is possible that Bitcoin could split into two or more separate cryptocurrencies. Miners are reporting progress in solving ‘hard fork issues’ which is shoring up confidence in the industry, in total.

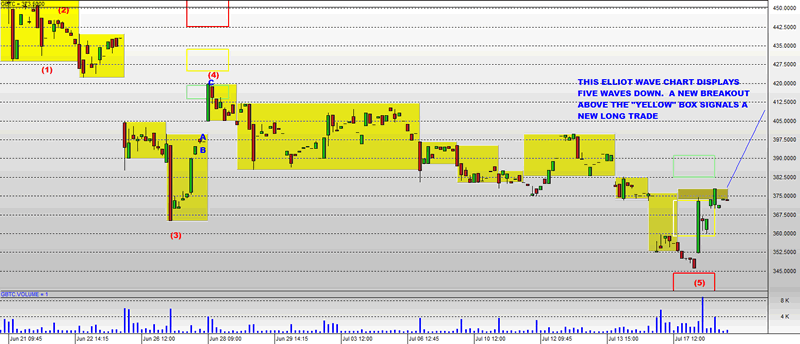

The Bitcoin Investment Trust Fund, GBTC is the instrument that is very active and tradable. I have put together three charts showing that it is currently at Fibonacci retracement level at 50% reflecting its’ next potential support area.

I has been involved in the cryptocurrency area since the very beginning and will now start covering new trade setups similar to last years long-term buy signal in Bitcoin I shared last July which, bit coin rallied over 350% since then. There is a great deal of BUZZ now emerging on Main Street and I will make you money in this ‘new asset class’ as well as keeping you regularly informed.

Know where the markets are headed and trade my signals at www.TheGoldAndOilGuy.com

Chris Vermeulen

www.TheGoldAndOilGuy.com – Daily Market Forecast Video & ETFs

www.ActiveTradingPartners.com – Stock & 3x ETFs

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.