FTSE Stocks, Bonds and Sterling Calm Ahead of UK Election Result Storm?

ElectionOracle / Financial Markets 2017 Jun 08, 2017 - 05:24 PM GMTBy: Nadeem_Walayat

UK stocks, bonds and sterling were calm ahead of the result of the UK general election, where effectively the financial markets are discounting a Conservative election victory on an INCREASED majority in Theresa May's BrExit election, where the higher the number of seats gained by the Tories then the more positive the market response is likely to be. However should the markets also get it wrong this time as they had for the EU Referendum then all hell could once more break lose. But for the time being the markets are calm.

UK stocks, bonds and sterling were calm ahead of the result of the UK general election, where effectively the financial markets are discounting a Conservative election victory on an INCREASED majority in Theresa May's BrExit election, where the higher the number of seats gained by the Tories then the more positive the market response is likely to be. However should the markets also get it wrong this time as they had for the EU Referendum then all hell could once more break lose. But for the time being the markets are calm.

FTSE Stocks Index

After setting a new all time trading high at the end May, the FTSE has given up some of the gains as we counted down to the polling day in response to YouGov's insane seats forecasts of a hung parliament, though the reaction is much less than the chart implies i.e. only 2% which means the FTSE has basically been flat for the past month.

British Pound Sterling

Similarly the sterling short-term chart overly exaggerates the actual movement in sterling during the past couple of weeks, which has basically been in a trading range of between £/$ 1.03 and 1.275, with most recent action to the upside. However should the markets get this election badly wrong then that is likely to immediately wipe at least 10 cents off sterling by probably tumbling to between £/$ 1.14 to 1.16. That would likely be just the initial crash response with further selling to come in subsequent days and weeks to nudge sterling towards parity with the dollar.

UK Government Bonds

UK 10 Year bonds similar to sterling is discounting a Conservative increased majority election victory.

Whilst the interbank market clearly shows signs of Bank of England intervention, pumping extra liquidity into the UK banking system, hence the fall in the yield. And regardless of the election result we can expect the Bank of England to continue to keep the interbank market liquid.

As for what happened on the financial market at the time of the EU Referendum then see my following video of BrExit Trading FTSE & Sterling:

However, unlike for the EU Referendum AND Trump, I don't see a financial storm this time around, but I could be wrong! So this is definitely not the time to take ones eyes off the trading screens and to have game played scenarios of what to immediately do in case of an ALT Election Result which would be to SHORT STERLING! AND SHORT FTSE FUTURES!

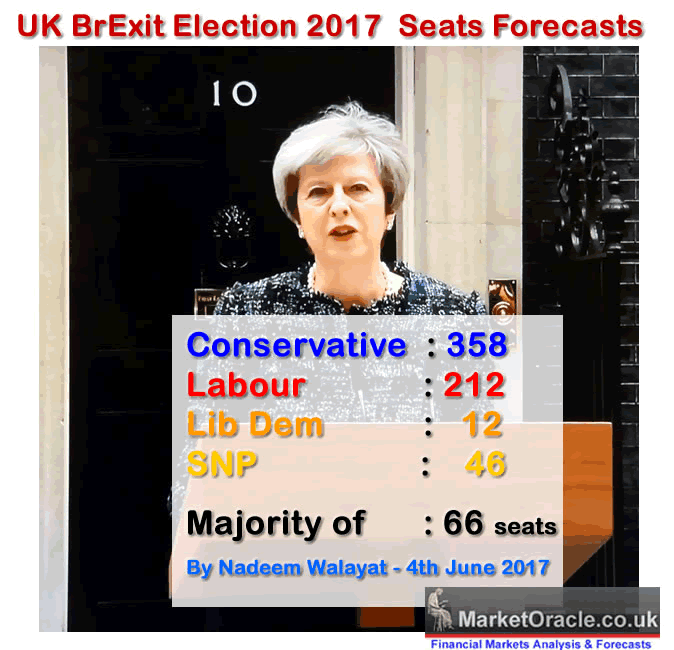

Election Forecasts

The 2017 General Election has proved to be one of the most volatile elections in terms of the polls for decades, which has seen the opinion polls based forecasters literally playing pin the tail on the donkey since Theresa May called the BrExit election. Virtually all of the pollsters started the campaign by forecasting a Tory landslide Conservative election victory of over 400 seats that mostly persisted until barely to 2 weeks ago as the following table illustrates:

UK General Election Forecasts - May 2017

| Forecasts | Date | Tory | Labour | Lib | SNP |

| YouGov | 16th May | 361 |

213 |

||

| Lord Ashcroft | 12th May | 412 |

|||

| Electoral Calculus .co.uk | 5th May | 404 |

171 |

8 |

45 |

| Election Forecast .co.uk | 10th May | 411 |

158 |

8 |

53 |

| Forecastuk.org.uk | 10th May | 383 |

183 |

8 |

52 |

| Spread Betting Markets (IG) | 12th May | 397 |

160 |

Whilst I repeatedly reminded that the pollsters had been consistently wrong for every major election since 2010 and that it was highly probable that they were wrong again as illustrated by my following video:

And where subsequently the pollsters have exhibited extreme volatility in their poll numbers that has translated into a forecast of seats range for the Tories from 302 to 420. Whilst here are the final seat forecasts just prior to today's vote, including my own based on the sum of my analysis of the past 6 weeks and separately based on my house prices based forecast which proved by far the most reliable forecaster for the outcome of the 2015 General Election.

UK General Election Final Forecasts

| Forecasts | Date | Tory | Labour | Lib | SNP |

| Nadeem Walayat - Forecast Conclusion | 4th June | 358 |

212 |

12 |

46 |

| Nadeem Walayat - House Prices | 3rd June | 342 |

|||

| YouGov | 7th June | 302 |

269 |

3 |

48 |

| Lord Ashcroft | 6th June | 357 |

|||

| Electoral Calculus .co.uk | 6th June | 361 |

216 |

3 |

48 |

| Election Forecast .co.uk | 6th June | 375 |

198 |

8 |

36 |

| Forecastuk.org.uk | 6th June | 350 |

225 |

8 |

44 |

| Spread Betting Markets (IG) | 7th June | 371 |

199 |

12 |

46 |

| BBC Exit Poll - 10pm | 8th June | ||||

| Actual Result - 3am | 9th June |

As is usually the case most of the pollsters tend to cluster around one another, and where the betting markets just tend to follow what the pollsters are implying in terms of polling percentages converted into seats. The only real outlier for this election is YouGov which has consistently been discounting the Tory seats total by about 50 to 60 seats compared to the other polls based seats forecasts.

But YouGov being YouGov always slip in a get out of jail card for apparently they have TWO forecasts posted on their site at the same time, one as stated above and another posted just a few hours before the polling stations opened stating that they expected the Tories would be be returned with an increased majority. Which once more illustrates the point that pollsters such as YouGov are bullshit artists! How can anyone make an informed decision based on the pollsters if they are forecasting two significantly different outcomes at the same time!

Whilst here is the analysis towards my forecast conclusion which unlike YouGov did actually correctly forecast the outcomes of the UK 2015 general election, EU referendum and Trump!

So in summary my UK General Election 2017 forecast conclusion is for the Conservatives to win the election with a 66 seat majority by increasing their seats total from 331 to 358. Whilst I expect Labour to drop 20 seats to 212 with the Lib Dems gaining 4 to 12, and I expect the SNP to lose 10 seats, dropping from 56 to 46.

And it won't be long before the BBC's exit poll gives an strong indication of what the result could be.

By Nadeem WalayatCopyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.