Raising the Minimum Wage Is a Jobs Killing Move

Economics / Employment Mar 22, 2017 - 10:46 AM GMTBy: David_Galland

By Stephen McBride: In January, 19 US states raised their respective minimum wages. Washington was among the most generous, hiking by $1.53 (bringing it to $11 per hour). Arizona got an increase of $1.95—their “bottom rung” now sits at $10 per hour.

By Stephen McBride: In January, 19 US states raised their respective minimum wages. Washington was among the most generous, hiking by $1.53 (bringing it to $11 per hour). Arizona got an increase of $1.95—their “bottom rung” now sits at $10 per hour.

In all, 4.3 million workers are slated to receive a hike as they earn less than the new minimum wage in their respective states. Well, that’s what’s meant to happen. Judging by the fallout from recent hikes, it seems things aren’t going according to plan.

Minimum Wage Massacre

In February, Wendy’s CEO Bob Wright said the firm expects wages to rise at least 4% in 2017. Wendy’s has three options to offset the rising costs.

First, they could cut margins, but with an 8% margin, that’s unlikely. The second option is to raise prices. Given how price-sensitive consumers are these days, that too is a non-starter. Finally, the firm could reduce the amount of labor they use… and that’s exactly what they did. Wendy’s eliminated 31 hours of labor per location, per week.

However, their locations are just as busy. To keep output steady, they are planning to install automated kiosks in 16% of their locations by the end of 2017. David Trimm, Wendy’s CIO said the timeframe for payback on the machines would be less than two years, thanks to labor savings.

Market leader McDonald’s has also been automating. Last November, the firm said every one of its 14,000 US stores will be replacing cashiers with automated kiosks. McDonald’s has actually prioritized these changes in locations like Seattle and New York that have higher minimum wages.

The restaurant industry is the canary in the coal mine when it comes to raising the minimum wage. In 2015, two-thirds of workers earning minimum wage were employed in service occupations (mostly food preparation). Today, restaurants spend (on average) one-third of their revenue on labor.

Currently, rising labor costs are causing margins in the sector to plummet. Those with the ability to automate like McDonalds are doing so… and those who don’t are closing their doors. In September 2016, one-quarter of restaurant closures in the California Bay Area cited rising labor costs as one of the reasons for closing.

With the restaurant industry flashing warning signs, what do higher minimum wages mean for the rest of the economy?

Labor Lockout

In 2015, the percentage of hourly paid workers earning the prevailing minimum wage was 3.3%. While this may not seem like a lot, young people are disproportionately impacted. Around 68% of these workers are between ages 16 and 34.

A key point is that in 2016, 20.6 million workers (30% of all hourly, non-self-employed workers 18 and older) were ‘’near-minimum-wage workers.’’ This means they earned more than the prevailing minimum wage but less than $10.10 per hour. Some states have already surpassed this level, with many more on an incremental path toward it.

While wage increases put more money in the pocket of some, others are bearing the costs by having their hours reduced and being made part-time.

A recent example of this is in Seattle. In 2015, the Rainy City raised its minimum wage from $9.47 to $11 per hour. The effects? A study from the University of Washington in 2016 found that it decreased low-wage employment by 1%.

The study also found that while median wages rose, this was largely due to a strong economy. It’s important to note these increases don’t happen in isolation. The cost of wage hikes can be masked by a strong economy.

The study went on to say that working hours were reduced as a result of the hike. Interesting, many individuals actually moved their residence to take jobs outside of the city “at an elevated rate compared to historical patterns.’’

The 2015 bill included a provision in which firms with over 500 employees must pay a $15 per hour minimum wage starting January 2017. For companies with under 500 employees, it’s $13 per hour. Given this, Seattle is the closest thing there is to a controlled experiment on this topic.

With calls for further minimum wage increases likely to continue, what can we expect going forward?

Automation Annihilation

When signing a bill that will raise California’s minimum wage to $15 per hour by 2022, Governor Jerry Brown was very observant. Brown said, “Economically, minimum wages may not make sense. But morally, socially and politically they make every sense.”

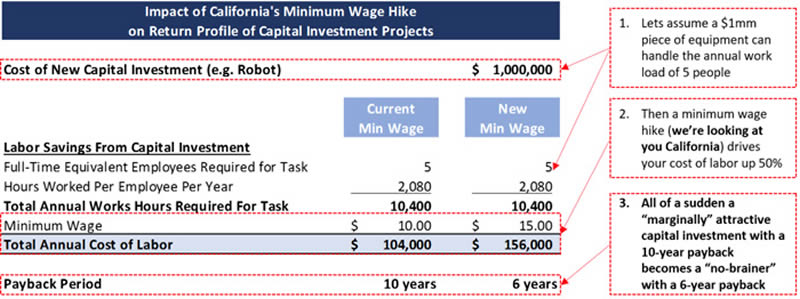

Brown is correct about the political part, but otherwise swings a miss. This hike will increase the cost of labor. Therefore, some jobs will be priced out of existence and some workers will be out of jobs. This table shows how the hike will incentivize capex projects (aka job automation).

Source: Zerohedge

Unfortunately, those who will suffer most are the young and low-skilled… the very people such laws are meant to help. In fact, Governor Brown knows this well. In 2014, he said that raising the wage would “put a lot of poor people out of work.”

There are also many studies that prove a rising minimum wage reduces low-skilled employment. This isn’t a US phenomenon either. Across Europe, there are higher unemployment rates in countries that have minimum wages.

Higher labor costs render low-skilled workers unemployable as it removes their key competitive advantage—cost. As a result, they are being replaced by machines. This is part of the wider issue of automation.

A 2013 study from the University of Oxford concluded that 47% of jobs in the US will likely be automated over the next two decades.

A 2017 report by McKinsey that looked at the ability of machines to replace human labor drew the same conclusion. The report found that 59% of all manufacturing tasks could be automated using current technology. The most exposed sector is food service, where 73% of tasks could be automated.

The inflation-adjusted minimum wage peaked back in 1968. However, it seems to be doing more harm than ever today. This is partly because of technological advancement, which has accounted for 88% of the 5 million manufacturing jobs lost since 2000.

Unless we stop seeing “political-sense” attempts to raise minimum wages, we are likely to see a lot more Flippy’s very soon.

Free report reveals: How to Eliminate Stock Market Risk with 3 Proven Investment Strategies

If you’re tired of being lied to by all those so-called “investment gurus” promising a sure-fire way to get 1,000% returns... but still need a system to safely get stock market returns…you need a copy of Garret/Galland Research's latest free special report.

Click here to learn more about this proven investing system that will change how you invest forever.

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2017 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.