Trump Speech a Dollar Bust?

Stock-Markets / Financial Markets 2017 Feb 28, 2017 - 02:41 PM GMT Good Morning!

Good Morning!

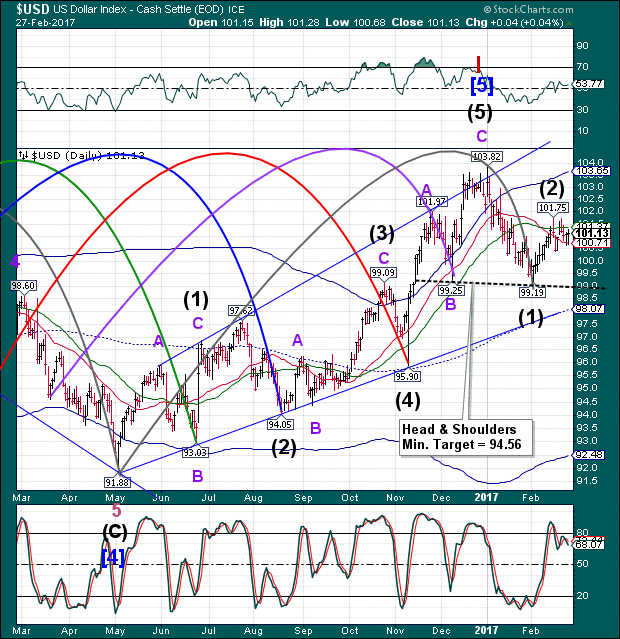

The USD is in the limelight again today. It has failed to better the February 15 high at 101.75, giving USD a sharp Wave 2 correction last week. Yesterday it bounced off Intermediate-term support at 100.73, but was unable to even match its 50-day Moving average at 101.37. This morning’s high was 101.22. The Cycles Model suggests the next Master Cycle low may be due on March 8, but could extend as much as another week beyond. A Pi date occurs on March 13, which matches up with a possible low in SPX as well.

ZeroHedge comments, “Trump Speech May Mark Turning Point for Dollar Trend

If Donald Trump’s speech Tuesday is long on hyperbole and short on details, it may be the end of the dollar’s reflation trade. Dollar-yen traders could be giving the clearest hint on the outcome.

The president’s speech will likely impact the Federal Reserve’s March decision and set the tone for the dollar for the next quarter. Despite the dollar’s slight gains during Monday’s trading, the trend since January is still down.”

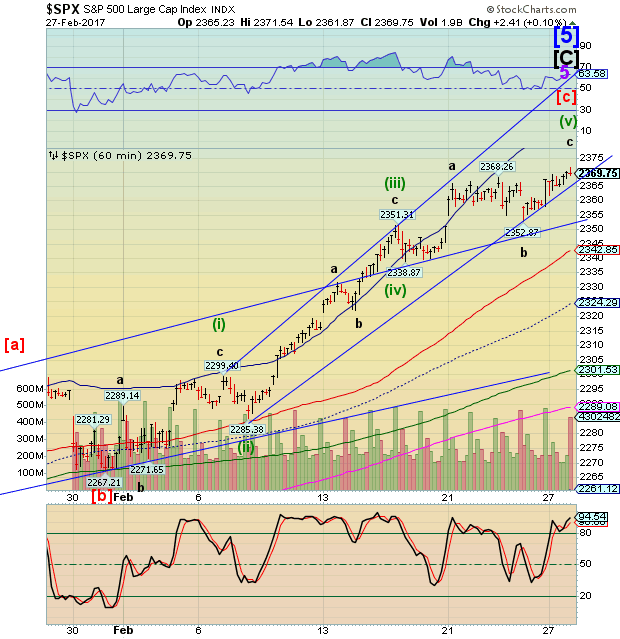

SPX futures have eased a bit, but are still above the trading channel trendline at 2365.00.

ZeroHedge reports, “With traders focused on President Trump's address to Congress tonight where he is expected to outline his economic priorities and provide plan details, European stocks are little changed for a second day and Asian stocks decline modestly as U.S. futures trade around the flatline. Oil declines, trading just under $54, while the dollar is little changed. Before the open, the US reports the second reading of 4Q GDP, with attention also on the Chicago PMI print as well as the Conference Board consumer confidence index. Salesforce and Ross Stores are among companies reporting.”

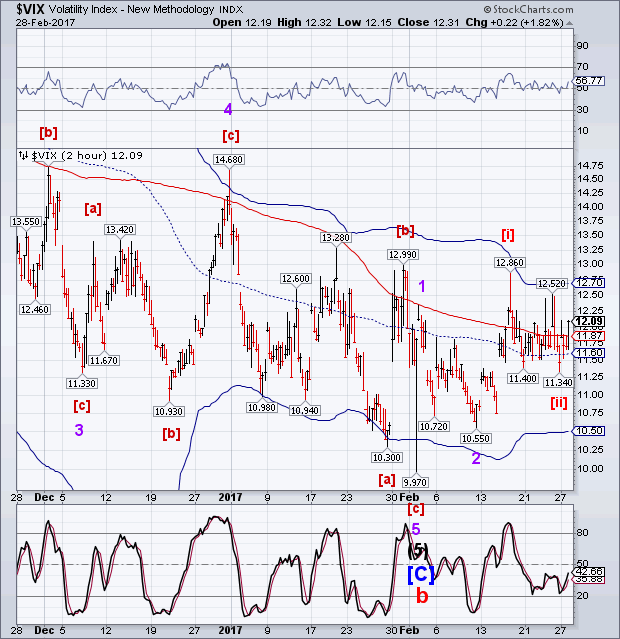

VIX closed above its 50-day Moving Average, but has be hovering in that area for the past two weeks. It appears that a breakout above 12.52-12.86 may be necessary to produce an aggressive buy (SPX sell) signal. There is a good reason for that. You can see that the Moving Averages have all declined from a higher range in the past three months, due to the decade-long Cycle Bottom. The daily mid-cycle resistance is at 13.73. Even that support/resistance line has declined.

Many traders use a fixed number in the VIX to denote rising risk. The fixed numbers usually vary between 15 and 25. However, the 50-day Moving Average in SPX is only 3.5% from the top (2189.55), so waiting for a fixed number may cause an unnecessary delay in a sell signal. Remember, the VIX is meant to be an early indicator of a change in trend.

It’s the Hi-Lo Index that gives us the delayed and final confirmation.

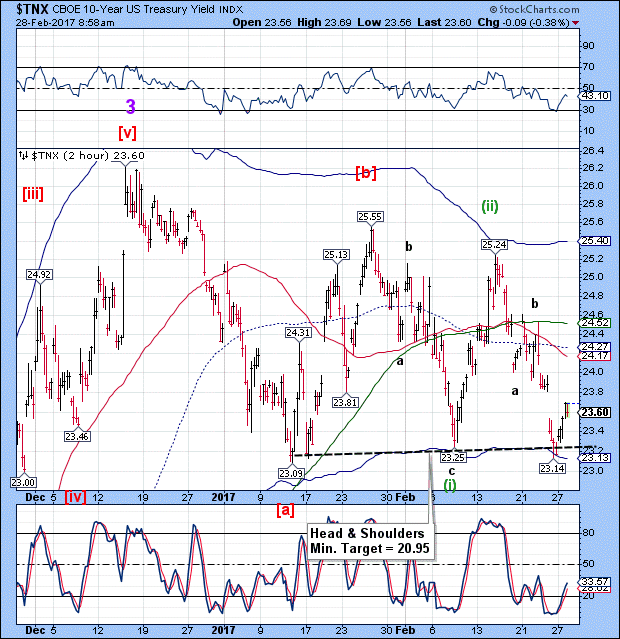

TNX may have reversed into its final decline of Wave (iii), which may be the largest in this series of Waves. The next Master Cycle low is due in the week of March 13, the same as SPX and a week later than USD.

Conclusion: Unless the cycles Model is wrong, the Trump speech appears to be a big bust.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.