American Fracking Companies Keeping Their DUCs in a Row

Commodities / Articles Feb 02, 2017 - 04:12 PM GMTBy: Rodney_Johnson

OPEC producers are cutting production… or so they say.

OPEC producers are cutting production… or so they say.

And in addition, several non-OPEC producers, like Russia, are also cutting production. If history is any guide we could do away with the titles and simply call the Organization of the Petroleum Exporting Countries, and the all rest, the Energy Liars’ Club.

They often say one thing and then do another.

Even Saudi Arabia’s Oil Minister noted that OPEC members have a history of lying to each other. I don’t care how they treat each other. I’m only interested in how their actions – not their words – affect the money in my pocket.

For all their dramatic statements and grand pronouncements of deals that I don’t think will ever be honored, they’ve actually already provided the United States a great service.

In their quest to kill the American fracking industry, the Saudis have made the frackers stronger.

When the competition didn’t roll over and die, the OPEC members were forced to concede defeat and take a new line of attack (the recent production cuts). It won’t work, and that’s just fine for me, because it means cheap energy is here to stay.

In 2014, oil cost about $100 per barrel. At the time, frackers were riding high. More than 1,000 rigs were at work in the U.S., breaking apart rock with hydraulic might to tap new sources of oil. Energy employment was surging, and home prices in North Dakota were rising too. The Saudis, who are the largest OPEC producers, weren’t happy.

$100 oil was a good thing, but the insurgent American frackers had driven U.S. oil production above Saudi production, and the kings of oil weren’t interested in being displaced. So they ramped up production.

As OPEC members opened the taps, and demand growth remained steady but sluggish, the imbalance between supply and demand took its toll. Oil prices started to slide, and the trend picked up speed in the second half of 2015. By early 2016, we hit the bottom, just under $30 per barrel.

OPEC ministers must have been giddy. Their program caused widespread pain across the U.S. energy sector, resulting in massive layoffs by frackers, more than a few bankruptcies, and even falling land prices in energy-rich states.

But then something happened that the Saudi’s didn’t expect.

Frackers got better. More specifically, frackers increased efficiency… and survived.

In 2014, fracking companies broke even at $60 per barrel. The cost of recovering oil includes the exploration and drilling process, which is expensive, as well as pumping it once it’s located, which costs a lot less.

As oil prices dropped, frackers capped wells they hadn’t completed yet, which are called “drilled but uncompleted,” or DUCs. They focused on the more profitable wells that were already producing. They used the down time to work on efficiency, and eventually dropped their break-even price to $45.

Now American fracking companies have the best of both worlds – a bunch of DUCs already in hand (or, pardon the pun, in a row), located and ready for completion, and oil prices comfortably above their break-even price.

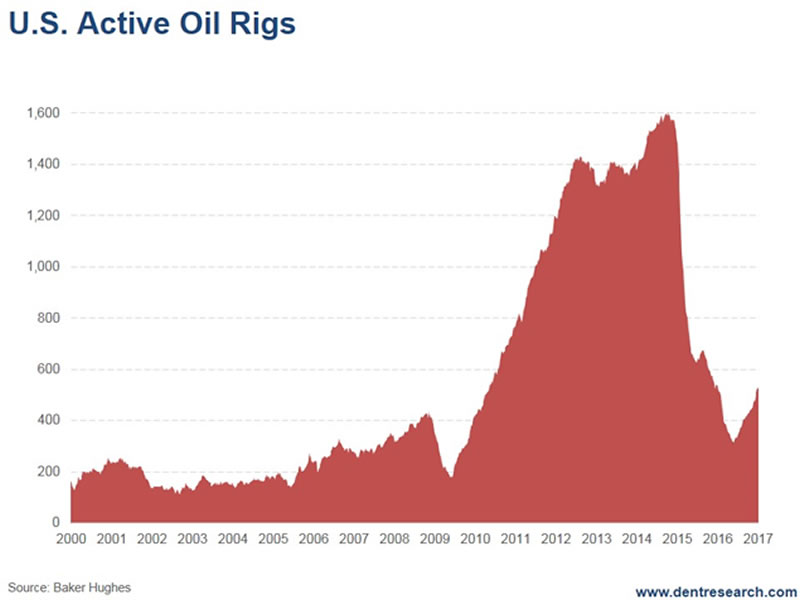

So, as the Energy Liars’ Club pushes up the price of oil, they’ll simply draw frackers back into production. In fact, this is already happening, as can be seen by the number of rigs in the U.S.

After dropping to a low of 316 rigs last summer, the U.S. rig count in operation on land has rebounded to 529, or 13 more than there were this time last year. This is a long way from the top in 2014, when just over 1,600 rigs operated. But, hey, that just means we have a long way to go.

Right now, U.S. energy producers have a problem bigger than the price of oil, but one that’s solvable.

When oil prices plummeted, companies had to idle production, put equipment in storage, and lay off their employees. Getting equipment back is easy, but getting people back is hard.

Skilled workers found other jobs, and are probably hesitant to go back to an industry that fired them the last time around. So frackers will have to entice back previous employees with higher pay, train new workers, or some combination of the two. This will take time.

It’s possible oil prices will creep up a bit more as frackers slowly expand their operations, but eventually U.S. production will ramp up, and I expect oil prices will come down.

Members of the Energy Liars’ Club will break their production commitments to each other, adding even more supply to the system.

And frackers will get even more efficient… putting a lower lid on prices for years to come. That’s at least one cost that should remain low for consumer’s businesses, making those higher medical care and education costs just a bit easier to stomach.

Rodney

Follow me on Twitter ;@RJHSDent

By Rodney Johnson, Senior Editor of Economy & Markets

Copyright © 2017 Rodney Johnson - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.