Payrolls Underwhelm Markets, While China Boils Over

Stock-Markets / Financial Markets 2017 Jan 06, 2017 - 04:32 PM GMT Short-term support helped to keep the SPX aloft yesterday. The futures markets have been waiting for the monthly payrolls report. Now that it is out, it appears to be less than satisfactory. The question is, will there be a new high, or do the equities markets sell off from here?

Short-term support helped to keep the SPX aloft yesterday. The futures markets have been waiting for the monthly payrolls report. Now that it is out, it appears to be less than satisfactory. The question is, will there be a new high, or do the equities markets sell off from here?

Bloomberg reports, “The U.S. labor market turned in a solid performance at the end of 2016, sending job gains above 2 million for a sixth year as paychecks rose by the most during the current expansion.

The 156,000 increase in December payrolls followed a 204,000 rise in November that was bigger than previously estimated, a Labor Department report showed Friday in Washington. The median forecast in a Bloomberg survey of economists called for a 175,000 advance. The jobless rate ticked up to 4.7 percent as the labor force grew, and wages rose 2.9 percent from December 2015.”

ZeroHedge digs a little deeper, “With Wall Street expecting a 178K payrolls print for president Obama's final full monthly December jobs report, the headline December nonfarm payrolls increase of just 156K is likely to disappoint. However, the poor December number will likely be offset by a revision to the November print from 178K to 204K, even as October was revised downward from 142K to 135K, for a net revision of the past two months to 19K higher.”

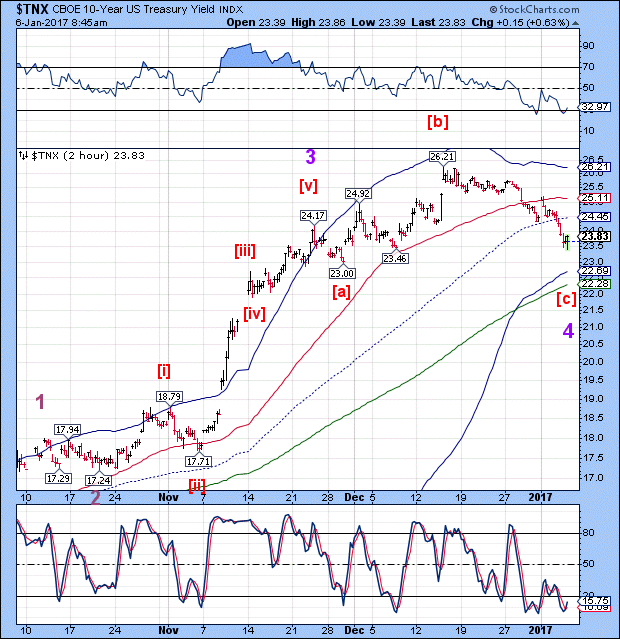

Bond investors apparently did not like the news, as yields jumped higher. It appears that Wave 4 of (3) may be complete. The target for Wave 5 of (3) is 27.00.

USD futures have bounced to challenge Intermediate-term resistance at 101.80. Chances are good that it may retrace to challenge its Cycle Top at 102.35, which is an approximate 42% retracement of the decline. That area would be an opportune time for a a short position on USD.

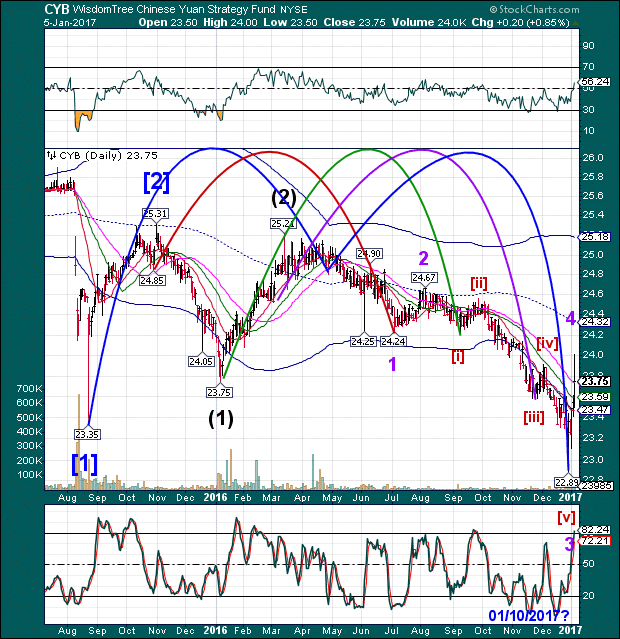

The Chinese Yuan is tumbling again after a short-lived short squeeze.

ZeroHedge reports, “While China's unprecedented currency moves have quickly become the main talking point across global markets which otherwise have started off 2017 in an eerily calm fashion, it is the sudden surge in two-way volatility that has emerged a major threat to global market stability.

Case in point, the offshore Yuan fell as much as 1.1% to 6.8623 a dollar in Hong Kong, the most in exactly one year, after a record 2.5% surge over the past two sessions. This took place as a result of conflicting signals, as on one hand China continued to drain liquidity and sent overnight deposit rates into all time high territory, yet on the other the PBOC raised its fixing less than projected, but still the most since 2005, and Goldman Sachs advised its clients that the best time to short the yuan are just after interventions - like the recent one - which flush out bearish positions, or when China concerns were off traders’ radar screens.”

The instability of the Chinese currency is going off the charts. There appears to be more instability to come. Will it spread to other markets?

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.