Increased Fiscal Spending Could Spell Debt Trouble for 2017

Interest-Rates / US Debt Jan 04, 2017 - 11:58 AM GMTBy: John_Mauldin

Over the past 30 years, America’s economic growth and boom-bust market cycles have been fueled with abundant sources of cheap debt. Whether emerging markets or commodity-rich countries, there’s been no shortage of buyers of US debt.

Over the past 30 years, America’s economic growth and boom-bust market cycles have been fueled with abundant sources of cheap debt. Whether emerging markets or commodity-rich countries, there’s been no shortage of buyers of US debt.

This has allowed the US—and by extension its consumers—to borrow huge sums of capital to spend on fiscal items or for personal consumption. It was a rather symbiotic relationship from which both parties would benefit, even if longer term prosperity was being jeopardized.

Over the past 30 years, America’s economic growth and boom-bust market cycles have been fueled with abundant sources of cheap debt. Whether emerging markets or commodity-rich countries, there’s been no shortage of buyers of US debt.

This has allowed the US—and by extension its consumers—to borrow huge sums of capital to spend on fiscal items or for personal consumption. It was a rather symbiotic relationship from which both parties would benefit, even if longer term prosperity was being jeopardized.

The China Factor

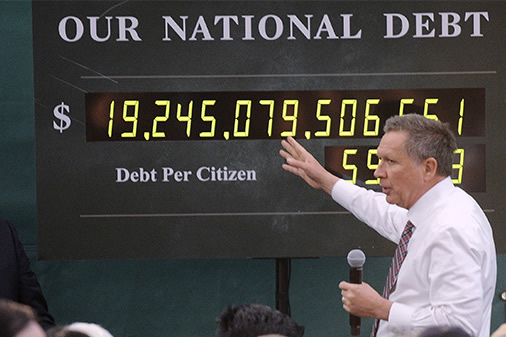

Between 2000 and 2015, foreign holdings of US securities (the bulk being government bonds) grew at 11% annually—from $3.6 trillion to $17.1 trillion. The transformation and maturity of the Chinese economy was a main driver behind the surge.

During this time, China’s holdings grew at 22% annually—from $92 billion to more than $1.8 trillion.

However, as China’s growth has moderated and its currency continues to depreciate, additional fiscal measures have taken place to meet economic growth targets. Over the past 15 months, China has spent $1 trillion of its $4 trillion foreign currency reserve stockpile, and in turn, has purchased much less US debt.

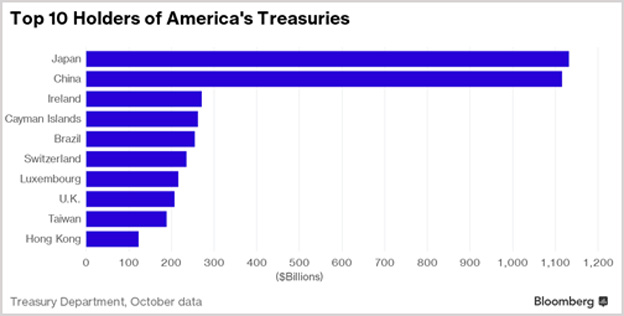

In fact, Japan has recently overtaken China as America’s top foreign creditor. Combined, the two nations account for more than 37% of America’s foreign debt holdings.

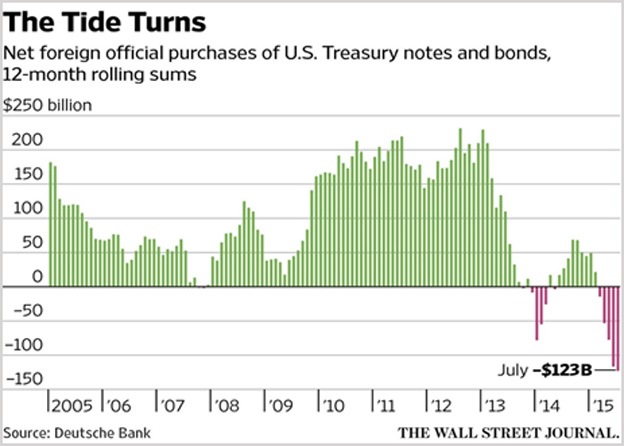

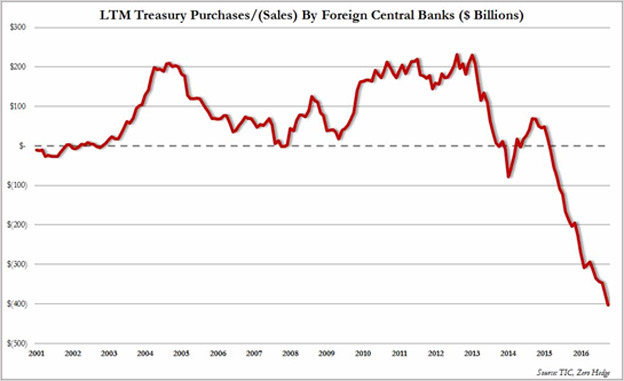

While still significant, both countries’ purchases have been in decline since peaking in 2013, along with several other key central banks around the world that are now more focused on investing domestically.

A Changing Debt Market

In addition to stemming slow economic growth through government spending, China is also attempting to curb excessive leverage in the debt markets.

“Bank wealth products,” made possible by a plethora of cheap credit, are heavily marketed to Chinese investors as an alternative to low-money market rates. The bond holdings of wealth management products more than doubled over the 18-month period ending in June 2016.

But the products are often sold with little disclosure about the securities responsible for producing income to investors. And the People’s Bank of China began tightening lending standards this past August in response to the risks the products pose to its broader economic agenda.

Combined with expectations for more aggressive tightening of monetary conditions in the US, the $9 trillion Chinese bond market has declined precipitously.

The yield on ten-year Chinese government bonds has risen 30% to 3.4 percent, compared with 2.6 percent less than a month ago. Yields go up when bond prices go down, and a higher yield makes it more expensive to issued debt.

A Declining Currency

The Chinese yuan is also sinking along with bond prices and has posted its biggest annual decline in more than 20 years. Goldman Sachs estimates currency is leaving the country to the tune of $70 billion per month, up from a monthly pace of about $50 billion since mid-year.

As the second largest economy and major supplier of capital to the US, these developments and implications for financial markets should not be overlooked.

If the US plans to continue tapping debt markets to ramp up fiscal spending, it may be met with much more challenging conditions.

It’s not a question of if the money will be available, but at what cost?

The Calm Before the Storm?

At 26X current earnings and 17X forward earnings, the S&P 500 is richly valued.

The Dow Jones Industrial Average is up 13% in 2016, oil has gained 25% since the presidential election. Volatility is at a 52-week low.

The gold and bond markets haven’t been so lucky; investors have experienced sharp losses in recent trading. Bears in both markets are out with a vengeance amid a more hawkish Federal Reserve and optimism for reinvigorated economic growth next year. This is driven in part by promises of added fiscal stimulus, deregulation, and rising interest rates.

So, while all may be calm in US equity markets this holiday season, we recommend taking into consideration the larger forces at play and rigging for stormy waters in 2017.

Gold has declined close to 20% since post-Brexit highs, and yields are surging to levels last seen in 2014. For those not already positioned, this is a smart time to diversify into precious metals or add to an existing allocation.

When volatility heightens in the coming months, you’ll be prepared no matter where the market lands.

Only time will tell if Trump’s economic plan and policies will come to fruition or if investors will be met by disappointment. But the changing debt market could be a key factor affecting the outcome.

Free Ebook: Investing in Precious Metals 101: How to buy and store physical gold and silver

Download Investing in Precious Metals 101 for everything you need to know before buying gold and silver. Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t. It’s the definitive guide for investors new to the precious metals market. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.