Trump Making Deficits and Public Debt Great Again

Interest-Rates / US Debt Dec 16, 2016 - 12:36 PM GMTBy: Arkadiusz_Sieron

Trump’s economic agenda consists of foreign policy, fiscal policy and regulatory policy. We have already commented a bit about Trump’s imprint on geopolitics and uncertainty in the context of the gold market. Now, let’s focus on the domestic policies.

Trump’s economic agenda consists of foreign policy, fiscal policy and regulatory policy. We have already commented a bit about Trump’s imprint on geopolitics and uncertainty in the context of the gold market. Now, let’s focus on the domestic policies.

First, Trump wants to reduce regulations hampering business. During the campaign he called for a moratorium on new financial regulations and for a 70 percent reduction in regulations. Importantly, in his 100-day action plan, the president-elect proposed that for every new federal regulation, two existing regulations must be eliminated. Deregulation should stimulate economic growth and the stock market, which is not good for the yellow metal.

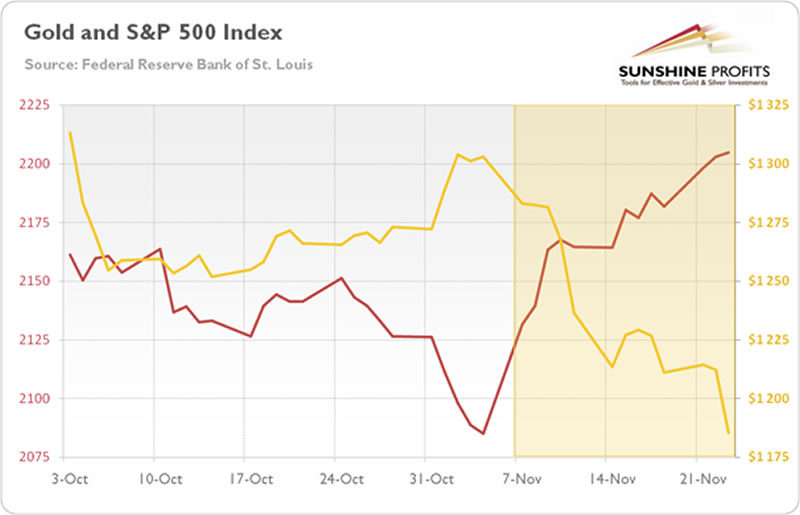

In particular, Trump may dismantle the Dodd-Frank act, replace and repeal Obamacare, as well as ease restrictions on fossil fuel and their extraction. Although the new president would probably adopt a tougher immigration policy, he would generally relax tight regulation. It should be positive for the risky assets, particularly energy and financial stocks (health-care stocks also surged after Trump’s victory) and negative for safe havens, such as gold. The chart below shows the developments in the gold price and S&P 500 Index after the elections.

Chart 1: The price of gold (yellow line, right axis, London P.M. Fix) and the S&P 500 Index (red line, left axis) from October 3, 2016 to November 23, 2016.

Second, Trump promised tax cuts to encourage more consumer spending and business investment. His tax plan assumes several changes, but the most important is a proposition to replace the current seven personal income tax brackets with rates on ordinary income of 12 percent, 25 percent, and 33 percent. Trump would also lower the corporate income tax rate from 35 percent to 15 percent, as well as simplify the tax code, and eliminate federal estate and gift taxes. The tax cuts could stimulate economy, but most of the cuts would go to the richest, which may limit pro-growth effects for the consumer spending (instead, people with the highest income could save more or purchase financial assets). Perhaps even more importantly, tax cuts would likely reduce revenues and widen the fiscal deficit. According to the Tax Foundation (which is rather conservative-leaning), the tax plan would diminish federal revenue by between $4.4 trillion and $5.9 trillion on a static basis or by between $2.6 trillion and $3.9 trillion, after accounting for the larger economy and the broader tax base.

Third, Trump is likely to increase government spending. In particular, the next president proposed more spending on veterans’ healthcare, military, immigration policy (including removing undocumented immigrants or building a wall) and infrastructure. Lower tax revenues combined with higher spending imply ballooned fiscal deficits. According to Moody’s analysis, in the worst scenario, Trump’s policies would increase the deficit from the current 3.5 percent of GDP to more than 10 percent by the end of the presidential term.

In the long run, making deficits and public debt great again should be negative for the economy. As a reminder, the deteriorated fiscal position during the George W. Bush’s presidency erased investors’ confidence in the American economy and was positive for the price of gold. And we should not forget about reduced benefits from trade (due to the higher tariffs) and reduced size of the labor force (due to deportation of illegal immigrants). These negative effects should be supportive for the gold market, especially if the recession occurs during Trump’s presidency.

However, the fiscal stimulus proposed by Trump could support economic growth in the short-term, before the negative effects occur. This is perhaps what the market is anticipating right now, at least at the beginning of Trump’s presidency. Investors are focusing on reflation and they hope that a fiscal stimulus will arrive and replace the ineffective monetary policy. Call it strange, but markets welcomed Trump’s accommodative proposals, expecting higher inflation and higher corporate profits. Such sentiment, which was reflected in higher bond yields, is negative for the gold market. The yellow metal usually shines during economic slowdowns or recessions, while it suffers in an accelerating or overheating economy (as a reminder, the U.S. economy is close to full employment, according to the Fed).

Summing up, the details of Trump’s economic plan are not yet known. Generally speaking, it consists of tax cuts, higher government spending, deregulation and more protectionist policies. His policy mix should be negative on balance, however, it will give the U.S. economy a boost in the short term. This is bad news for the gold market. Moreover, investors have so far shrugged off negative effects of a higher debt load, focusing on pro-growth and inflationary consequences. We see some parallels with Ronald Reagan who cut taxes and deregulated, but increased the American debt. Although we do not believe that “Trump’s honeymoon” will last for the whole presidency (which has not started yet), investors should remember that despite the rise in public debt under Reagan’s presidency, gold entered a bear market.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.