Hillary: Deceit, Debt, Delusions (Part Two)

Politics / US Debt Oct 12, 2016 - 02:59 PM GMTBy: James_Quinn

In Part One of this article I addressed the deceit of Hillary Clinton and politicians of all stripes as they promise goodies they can never pay for, in order to buy votes and expand their power and control over our lives.

In Part One of this article I addressed the deceit of Hillary Clinton and politicians of all stripes as they promise goodies they can never pay for, in order to buy votes and expand their power and control over our lives.

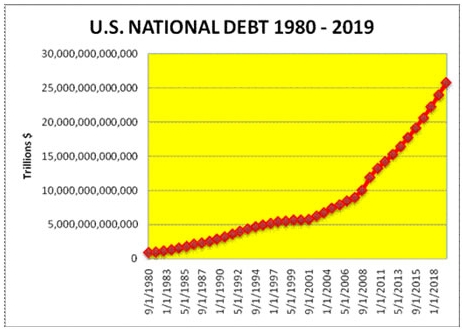

I created the chart below for an article I wrote in 2011 when the national debt stood at $14.8 trillion, with my projection of its growth over the next eight years. I predicted the national debt would reach $20 trillion in 2016 and was ridiculed by arrogant Keynesians who guaranteed their “stimulus” (aka pork) would supercharge the economy and result in huge tax inflows and drastically reduced deficits. As of today, the national debt stands at $19.7 trillion and is poised to reach $20 trillion by the time “The Hope & Change Savior” leaves office on January 20, 2017. I guess I wasn’t really a crazed pessimist after all. I guarantee the debt will reach $25 trillion by the end of the next presidential term, unless the Ponzi scheme collapses into financial depression and World War 3 (a strong probability).

The total disregard for the most perilous issue confronting the nation by politicians of all stripes is a national disgrace, proving beyond a doubt the elite ruling class has no conscience, no sense of morality, and no loyalty to the common people or future generations. The sociopaths who act as if they are in control addressed the 2008 global debt meltdown by adding tens of trillions in new debt to an already unsustainable system, setting the world on a course towards total financial collapse and world war.

There is no denying Wall Street, through the greatest control fraud in history, purposely generated trillions in bad mortgage products, bundled them in packages of indecipherable derivatives, bribed and threatened the rating agencies for fake AAA ratings, sold them to unsuspecting clients, while simultaneously shorting them, and proceeded to destroy the global financial system in the process.

The national debt at the outset of this crisis was $10 trillion, with total US credit market debt of $54.5 trillion. The debt was too damned high. A massive deleveraging needed to take place, wiping out the bad debt and those banks who gambled and lost. But, those who would have lost were establishment Wall Street bankers, billionaires and politically connected players. The establishment circled the wagons, instructed their puppets at the Federal Reserve to do whatever necessary to save Wall Street, rolled out trillions of Keynesian claptrap spending schemes, and threw Main Street and specifically senior citizens under the bus.

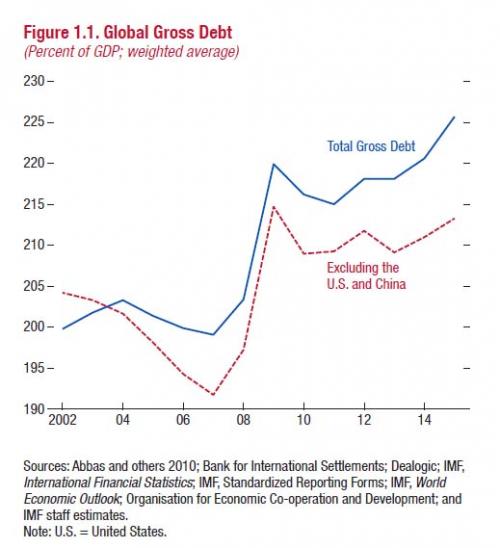

Eight years later the national debt stands at $19.7 trillion and total credit market debt has leaped to over $64 trillion. The Fed has conspired with other central banks around the world (specifically the ECB and JCB) to follow suite, driving global debt to an all-time high of $152 trillion – 225% of a rapidly slowing world GDP. And this doesn’t include the trillions of bad debt within the financial sector, as insolvent banks like Deutsche Bank, all Greek, Italian and Spanish banks, and Citigroup teeter on the edge. Rogoff and Reinhart proved when the debt to GDP ratio in countries exceeds 90%, financial catastrophe isn’t far behind. What does that say about our global economy?

We have the greatest debt bubble in world history and neither presidential candidate thinks it worthy of 30 seconds during two 90 minute debates. Instead they focus on the important stuff like *****, bimbo eruptions, emails, and mean talk. The proposals of both candidates would turbocharge already skyrocketing deficits. The people of this country should be scared shitless about the debt. But instead they are focused like a laser beam on Kim Kardashian’s latest escapade, twitter wars, facebook pictures of a distant cousin’s toe fungus, and the latest adventures of the Housewives of NY, NJ, OC, or Atlanta.

All honest borrowers know debt must be repaid. The U.S. government is not an honest borrower. With the national debt rising by $2.8 billion per day, one needs to question whether the U.S. government is an honest borrower. With annual deficits guaranteed to exceed $1 trillion per year for as far as the eye can see, how will the debt ever be repaid?

The Keynesian acolytes like Summers, Krugman, Bernanke and Zandi seem to forget Keynes promoted deficit spending during economic downturns, to be offset by surpluses during economic upturns. They are paid well by the establishment to forget. Hazlitt had to deal with superficial men of a similar ilk during his time. They care only for whatever cockamamie economic squandering idea they are paid to sell as the latest government salvation plan. The idiotic ideas never change, only the names of the foolhardy fanboys selling the idiocy to a disinterested and distracted populace.

“There are men regarded today as brilliant economists, who deprecate saving and recommend squandering on a national scale as the way of economic salvation; and when anyone points to what the consequences of these policies will be in the long run, they reply flippantly, as might the prodigal son of a warning father: “In the long run we are all dead.” And such shallow wisecracks pass as devastating epigrams and the ripest wisdom.” ― Henry Hazlitt, Economics in One Lesson

These pretentious so called economists always promote some scheme such as Cash for Clunkers, first time home buyer credits, national infrastructure rebuilding, war, and other broken window fallacy programs designed to get something for nothing. They declare haughtily the government can spend without limit and pile up trillions of debt because we owe it to ourselves. These are nothing but falsehoods built upon flawed logic and sold to a gullible public by media mouthpieces, crooked politicians, and dishonest bankers.

An honest man, not beholden to the establishment, like Ray Dalio, founder of Bridgewater Associates, who manages $150 billion, knows a debt bubble when he sees it. The world is approaching the limits of debt expansion. He also understands the issuers of the debt, holders of the debt and taxpayers cannot possibly all be satisfied in the long run. It’s the common working stiff who will be screwed again.

“Debt is fundamentally a liability even though it is treated as an asset by those who “own” it. As a result, holders of debt believe that they are holding an asset that they can sell for money to use to buy things, so they believe that they will have that spending power without having to work. Similarly, retirees expect that they will get the retirement and health care benefits that they were promised without working. So, all of these people expect to get a huge amount of spending power without producing anything. At the same time, workers expect to get spending power that is equal in value to what they are giving. They all can’t be satisfied.”

The Federal Reserve, in their frantic and illegal endeavor to prop up their insolvent benefactors on Wall Street and crooked politicians in Washington D.C., have destroyed the free market system based upon saving, investing, risk, failure and creative destruction. They have created a stagnant zombie economy dependent upon zero bound interest rates and rigged stock markets to maintain the appearance of normalcy.

Their zero interest rate policy has destroyed the lives of millions of senior citizens (with 3.6 million turning 65 every year for the next two decades), guaranteed the bankruptcy of pension plans across the country, and signaled to corporate CEOs that it is smarter to borrow billions and buyback their stock than to invest in capital, equipment or people. They have sapped the life out of the real economy, making it impossible to ever achieve 3% GDP growth again. The wave of Boomers retiring will be an anchor as former providers of taxes become users of healthcare and pension benefits.

The national debt is poised to reach $25 trillion by the end of the next presidential term. This would push the debt to GDP to 120%, up from 106% today. Remember, when this level has exceeded 90% throughout history stagnation and economic collapse was not far behind. This brings us back to the so called economic gurus of our time who condescendingly declare Japan’s debt to GDP ratio of 230% as proof deficits and debt don’t matter.

They fail to mention Japan has been in a three decade long recessionary death spiral with their stock market is still 57% below its 1990 peak. The predictable nonsense emanating from bloviating windbags for the establishment about the ever growing jenga tower of debt not being an issue is no different than their blather about the fraudulent housing bubble not being a problem in 2005 because it hadn’t burst yet.

The fact is the Fed has artificially suppressed interest rates for the last eight years in a failed attempt to make their warped academic theories work in the real world. Emergency level rates may have been necessary in 2008 and 2009, but keeping them at 0% for eight years reveals their complete capture by Wall Street and the establishment politicos. Now they are trapped. They can never allow free markets to regain control of our economy, as the slightest uptick in rates will now blow the global economy sky high.

The feeble minded politicians that pass for leaders believe the $10 trillion increase in debt since 2008 is no problem because interest on the debt is less today than it was in 2008. For the fiscal year just ended the interest on the debt was a mere $433 billion. That is based on an average interest rate of about 2.3%. The average rate in 2008 was about 4.5%. Ray Dalio, our smart hedge fund manager, points out an inconvenient fact for the mathematically challenged dimwits running this shitshow.

“It would only take a 100 basis point rise in Treasury bond yields to trigger the worst price decline in bonds since the 1981 bond market crash. And since those interest rates are embedded in the pricing of all investment assets that would send them all much lower.”

What the politicians ignoring the 20 trillion pound elephant in the room fail to tell the American public is a 1% increase in the average interest rate would cause interest on the debt to soar to $660 billion, a 52% increase over the FY16 level. A similar increase around the globe would blow a $1.5 trillion hole in governmental budgets. At the end of the next presidential term when the national debt will be $25 trillion or more, a 3.3% average rate across all bond durations would yield annual interest expense of $825 billion, almost double the current level.

Only a brain dead Keynesian, Ivy League educated economist, mainstream media spokesmodel, or bought off political flunky cannot see the inevitable financial Armageddon approaching unless we reverse course now. But there is absolutely no one within the deep state establishment with the moral fiber or courage to stand up and do the right thing. The plan seems to be to pretend the debt is not a problem, increase taxes and use the most vicious form of taxation – hidden inflation on those least able to pay – to make the unpayable debt less burdensome and screw the bondholders with guaranteed losses. Hazlitt had their number 70 years ago.

“Here we shall have to say simply that all government expenditures must eventually be paid out of the proceeds of taxation; that inflation itself is merely a form, and a particularly vicious form, of taxation. It is perhaps the worst possible form, which usually bears hardest on those least able to pay.” ― Henry Hazlitt, Economics in One Lesson

Politicians and central bankers play both sides of the fence when lying about inflation. Bernanke and Yellen have set a magical level of 2% inflation, which is somehow supposed to promote full employment and stable prices. Why 2%? Why not 1.8956723%? It’s just as outlandish in its conception. Over the last eight years we’ve listened to these highly educated boobs lie about raising rates as soon as inflation hit 2% or when unemployment dropped to 6.5%.

Inflation has been over 2% during these eight years and according to the BLS bullshit spreaders, unemployment is currently 5% – still no rate increase. We are lost in a blizzard of Fed lies. They are now trapped by their own lies. Normalization of interest rates will never ever happen. Negative real rates have been in effect and negative nominal rates are in our future. How Yellen and her fellow banker cronies sleep at night knowing they have destroyed and continue to destroy the lives of senior citizens, the middle class and the millennial generation is beyond me.

Here’s the game being played behind the curtain, never to be revealed by Hillary, Yellen, the captured dying legacy media, or anyone beholden to the establishment for their paycheck or bribe: (1) You keep the lower classes trapped in ghettos, dependent upon welfare scraps provided by the state for their sustenance. (2) You keep the masses dumbed down and socially stunted through government indoctrination in public schools. (3) You tax the working class heavily while convincing them piling up consumer debt is the path to happiness. (4) You bastardize, manipulate and fraudulently reduce the reported level of inflation in order to screw senior citizens out of their Social Security benefits. (5) You run up the national debt to astronomical levels while making $200 trillion of unfunded welfare promises to future generations. (6) Since the debt is unpayable, you generate man made real inflation exceeding 5% per year in order to inflate away the debt. (7) You never speak of this plan while paying your media mouthpieces to distract the populace with electronic bread & circuses. (8) As a last resort you start World War III to divert attention away from your traitorous actions.

As we come down the home stretch of this election, the stakes have never been higher. The future of the country is at stake. Do we believe in liberty? Do we believe in the truth? Do we care whether this country survives the next decade? Do we care about future generations? Then it’s time to stand up and be heard. It’s time to fight. It’s time for the putrid, corrupt, evil establishment to be eradicated like filthy roaches in your basement. Hazlitt sums it up nicely:

“The times call for courage. The times call for hard work. But if the demands are high, it is because the stakes are even higher. They are nothing less than the future of liberty, which means the future of civilization.”

In Part Three of this article I will dismantle Hillary Clinton’s pie in the sky delusional economic proposals with facts, logic, and a cold dose of reality. Feeble minded mathematically deficient ideologues need not read it. Their heads would explode.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2016 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.