3 Recent Danger Signs of a Looming Recession

Economics / Recession 2016 Aug 10, 2016 - 01:43 PM GMTBy: John_Mauldin

BY TONY SAGAMI : The world of investing is much riskier today than when I was growing up.

BY TONY SAGAMI : The world of investing is much riskier today than when I was growing up.

The biggest risk I see is an economy that is barely expanding beyond stall speed and threatening to fall into a recession.

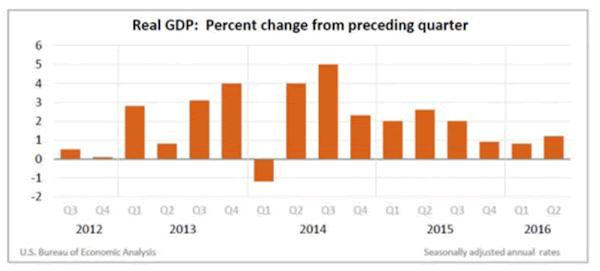

The Census Bureau recently reported that the US economy grew at a 1.2% annualized pace in Q2. Plus, they adjusted the Q1 GDP growth rate from 1.1% down to just 0.8%.

That means the US economy has grown at a rate of less than 2% for three straight quarters now.

Here are three more recent warning signs of a stalled economy.

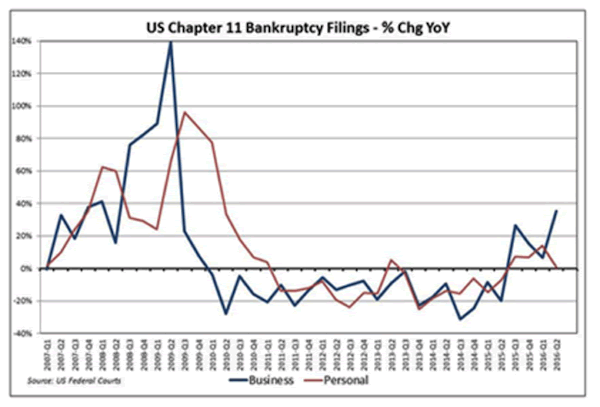

Sign #1: Business bankruptcies are accelerating

Business bankruptcies rose by 9% from Q1 to Q2… by 23% in the first six months of 2016… and by 25% over the same period last year.

“The domino effect is what the concern is,” said Mark Edwards of Creditsafe USA, “the fact that these bankruptcies could affect other businesses. This could get a lot worse.”

For example, athletic apparel manufacturer Under Armour cut its sales forecast due to the bankruptcy of The Sports Authority, a large national sporting goods retailer.

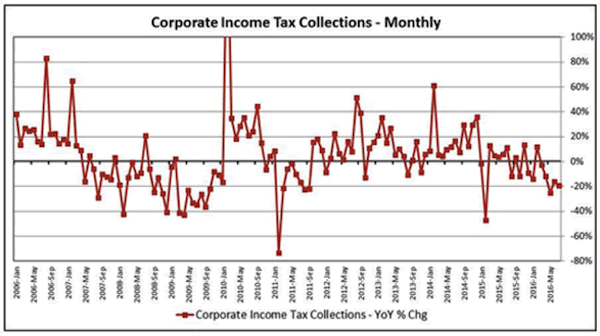

Sign #2: Tax collections are shrinking

Everybody hates paying taxes, but a big tax bill is a sign of success. Conversely, small tax bills show that you don’t make much money.

The US Treasury Department reported a 27% YOY increase in the US budget deficit to $401 billion.

The reason for the deficit jump is an 11% decline in corporate tax revenues for the first half of 2016.

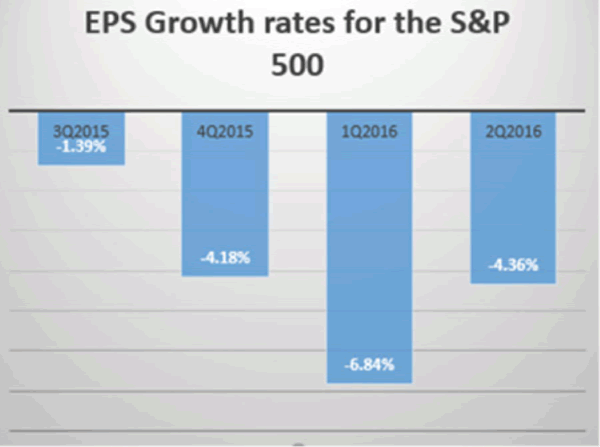

Sign #3: Rapidly evaporating corporate profits

We’re in the middle of earnings season. If Wall Street is right, corporate earnings have dropped by another 3.7% in Q2. That marks the sixth consecutive quarter of falling profits.

For example, Apple recently reported its quarterly results. Its YOY profits shrank to $7.8 billion, a whopping 27% fall from the $10.7 billion it earned in Q2 2015.

You’ve heard the argument that the stock market is a forward discounting mechanism? If that’s true—and I think it is—then we should be worried about the third quarter.

The consensus expectation for Q3 earnings is -0.1%.

I could go on with a long list of other dangers, but those three were just from the end of July.

With the stock market near its all-time high, you should have a clear strategy in place to protect your portfolio when things turn ugly .

That might be next week, next month, or next year—but don’t forget that it’s all fun and games until someone’s portfolio loses an eye. Don’t let it be yours.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.