Ready or Not the Recession May Have Already Arrived

Economics / Recession 2016 Jul 05, 2016 - 03:04 PM GMTBy: Michael_Pento

While investors have been focused on the perennial failed hope for a second half economic recovery, they have been missing the most salient point: the U.S. most likely entered into a recession at the end of last quarter.

While investors have been focused on the perennial failed hope for a second half economic recovery, they have been missing the most salient point: the U.S. most likely entered into a recession at the end of last quarter.

That’s right, when adjusting nominal GDP growth for Core Consumer Price Inflation for the average of the past two-quarters the recession is already here. But before we look deeper into this, let’s first look at the following five charts that illustrate the economy has been steadily deteriorating for the past few years and that the pace of decline has recently picked up steam.

There is no better indicator of global growth than copper. Affectionately referred to as “Dr. Copper”, this base metal has traditionally been a great barometer of economic health. Unfortunately, as you can see from the chart below, copper has been in a bear market for the past five years and shows no sign of a recovery from its 55% plunge.

Next, we have the Baltic Dry Index. This index measures the demand to transport dry commodities overseas. An advancement of this index would represent an increase in global growth. But as you can see, this index has been in a down-trend since the end of 2013 and fallen 75% from that point.

Baltic Exchange: Baltic Dry Index (BADI: Exchange)

Source: CNBC

With both of these vital indicators pointing south, it should come as no surprise that Reuters recently reported that the Organization for Economic Co-operation and Development (OECD) said that global trade would only grow by, “2 percent this year, a level it has fallen to only five times in the past five decades and that coincided with downturns: 1975, 1982-83, 2001 and 2009.”

There is little debate that the worldwide economy is stagnating, and despite what some would like to argue, the United States has not been immune from this slowdown at all.

To prove this we can first look at the spread between the Two and Ten-year Treasury Notes. When this spread is contracting there is increased pressure on banks’ profits, which leads to falling loan growth and less economic activity. The 2-10 Year yield spread has been narrowing since July 2015 and is now the tightest since November 2007.

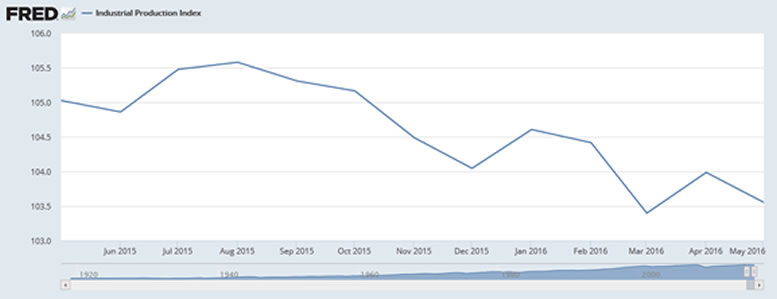

Then we have Industrial Production that measures the output of factories, mines and utilities in the U.S. economy. According to the Wall Street Journal, industrial production is faltering:

“Overall industrial production peaked in November 2014 but has failed to regain that level amid a mining sector collapse and leveling off at factories. Overall industrial production was down 1.4% in the 12 months through May. Utility output is down 0.8% and mining output has plunged 11.5%.”

And the once crowned jewel of the post-Great Recession economy, the lagging economic indicator known as the Non-farm Payroll Report, is also rolling over fast. Last month’s disappointing 38k net new jobs created was written off by some as an anomaly, but the chart below shows that this was actually part of a declining trend that has been in place since October 2015.

The falling copper price, tumbling global trade, a flattening yield curve, weakening industrial production and the rolling over of monthly job creation all point to an economy headed into contraction.

But as mentioned earlier, to confirm that this recession may have already arrived, we need to look no further than the data published by the Bureau of Economic Analysis (BEA) and the Bureau of Labor Statistics (BLS).

The official designator of a recession is the BEA, which defines the situation as two consecutive quarters of negative real GDP growth. During Q4 2015 and Q1 2016, real GDP posted 1.4 and 0.8% respectively—so officially we’re not in one yet. However, when deflating nominal GDP by the core rate of Consumer Price Inflation (CPI) published by the BLS, you get real GDP of just 0.3% in Q4, and negative 0.8% during Q1. Therefore, the economy is dangerously close to a contractionary phase; and is already in one when averaging the prior two quarters (at minus 0.25% when adjusted by core inflation).

It took 1.5 years to bring the economy out of the Great Recession that began in December 2007. And it took a $3.7 trillion increase in the Fed’s balance sheet, plus 525 basis points of interest rates cuts to pull us out. The major problem is that stock market is now pricing in a strong recovery from the four quarters in a row that the S&P 500 has posted negative earnings growth. Another year, or more, of falling earnings for equities would result in a devastating bear market.

The Fed already has a bloated balance sheet in relation to GDP and only a few basis points to reduce borrowing costs before short-term rates hit zero percent. Therefore, there just isn’t much the Fed can do this time around. Therefore, this next recession could last even longer than the previous one.

The stock market is pricing in perfection and is ill prepared for a protracted recession that may already be underway. Prudent investors should hedge their portfolios now from such an unwelcomed event.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.