Beware of March Non Farm Payrolls. They Have the Worst Record than any Other Month

Economics / Employment Mar 31, 2016 - 05:37 PM GMTBy: Ashraf_Laidi

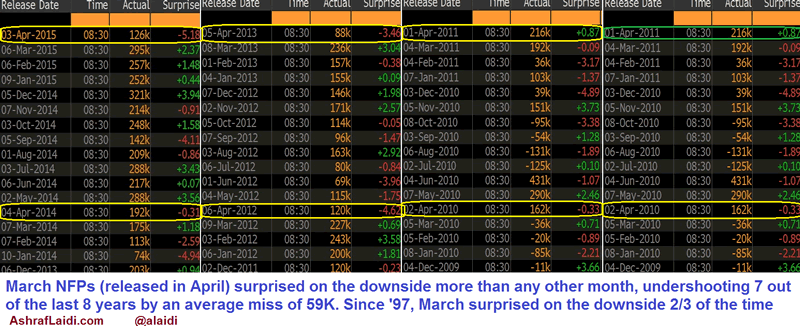

The table below shows the consistency of misses (actual figure below consensus forecasts) in March NFPs over the last three years. In fact, NFP figures for the month of March have come in below forecasts in 7 out of the last 8 March reports with an average miss of -59k.

Most strikingly & recently, last year's March report showed a 126K reading, well below consensus of 245K. Interestingly, that 129K reading was revised down to 88K one month later.

Since 1997, March NFPs have come in below expectations at 2/3 of the time for an average miss of -81k. With Friday's NFP release expected at 205K from February's 242K, any disappointment alongside historical proportions would suggest a figure below 170K, which would be far from a shocker, but would fall alongside the definition of slowing pace of jobs creation.

If that is the case, especially alongside weak average hourly earnings, then USD weakness will extend primarily against commodity FX and high yielders (AUD, NZD and CAD), while not ruling out EURUSD at 1.1500. Any downside risk for the single currency has been ruled out as not only Eurozone flash CPI edged higher, but most Eurozone business surveys have emerged stable.

Finally, the fact that cycle low in EURUSD occurred on the week of the unveiling of ECB QE (March 2015), reinforces the forward looking nature of currency markets in that the Fed is more likely to remain on hold than the ECB cutting rates further form here.

Back in August 2008, I mentioned that the US dollar has already topped out. Indeed, EURUSD bottomed in March and USDJPY peaked in June of last year. More USD downside to come, when market forecasting energy shifts from rate hike speculation to the duration of rate hike inaction.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2016 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.