America We Are Already In A Recession 2016

Economics / Recession 2016 Feb 25, 2016 - 02:26 PM GMTBy: Harry_Dent

So the S&P 500 is out of correction for now and the coast is clear. NOT! This is exactly what we’ve been predicting would happen – after reaching new lows, stocks would have to bounce before they inevitably resume their longer-term trend, which is down.

So the S&P 500 is out of correction for now and the coast is clear. NOT! This is exactly what we’ve been predicting would happen – after reaching new lows, stocks would have to bounce before they inevitably resume their longer-term trend, which is down.

But stocks haven’t been the only victims of late. Just a couple weeks ago the January nonfarm payroll report came in at 151,000 jobs. So much for the expected 190,000! And of the ones reported, they were mostly low-wage jobs.

Pile that on top of the disappointing Christmas and retail sales in December. Not to mention falling stock earnings and sales growth, the worst December-to-January stock performance to date, and another banking crisis looming in Europe, especially Italy. There’s economic weakness everywhere you look!

All of this is leading me to believe that the next recession – which will lead into an even greater DEPRESSION – is not a few months away. I think it’s already begun.

Think back to the Great Recession in 2008. By the time we figured out it had started, it was months after the fact. It officially started in January 2008, three months after the stock market peaked in early October. And jobs didn’t peak and start to decline until four months later that May. Only then did the stock market see its sharp and deep crash between June and early November.

Well, of course it did! The jobs report is a lagging indicator! It doesn’t tell us anything about where we are now, which is probably why the Fed and markets-on-crack love it. Yet they think it’s the most important report that comes out. Go figure. (By the way, real estate is another lagging indicator, and Lance will have more on that for you tomorrow to tell you where we’ve been, and to give you an idea of where we’re going.)

David Stockman recently pointed out a better indicator for jobs that his colleague Lee Adler tracks.

Unlike the nonfarm payrolls report, where there’s a lot of room to fudge the numbers, this other indicator is in real time and goes right to the source: payroll! Specifically, payroll taxes that the IRS withholds from businesses.

It’s pretty obvious that if the IRS is withholding fewer payroll taxes, then there aren’t as many people on payroll. As it turns out, the trend in monthly data has been clearly downward since 2011. And the last two months are worse. Lee Adler’s daily data shows that jobs flattened in December and declined 5% in January.

Given that this is in real time, sounds like we’re already in a recession!

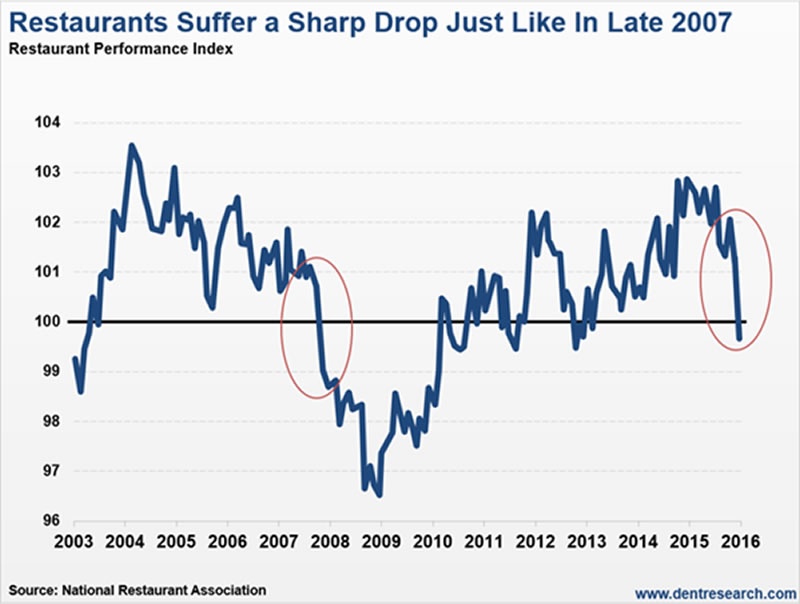

But let’s take a look at another indicator that shows we’re already there. This one most surprised me: the Restaurant Performance Index. What sector would you expect to benefit more from freed-up spending thanks to lower oil prices? But look where it is today:

By falling below the 100-level line, restaurants are officially in a period of contraction. The index fell to a negative reading of 99.7 in December from 101.3 in November. That’s a 1.6% drop in a month! We haven’t seen a drop this steep since late 2007!

It gets really ugly when you start digging into the index. Among the eight indicators that make it up, the December decline occurred in all of them.

For example, 73% of restaurants reported higher same-store sales in July. As of December, only 42% of them do. Ouch.

And whereas only 13% of restaurants were reporting lower same-store sales in April, now it’s 43% – more than the 42% on higher same-store sales I just mentioned. Sure, it’s higher by just a percent, but still, that’s a pivotal shift in momentum!

Digging deeper, 33% of restaurants reported higher customer traffic, but 51% reported a decline. And a quarter of them see worsening economic conditions in the next six months. Only 12% see better.

That likely points to a key tipping point in December. All of which suggests that a recession either started in that month or January.

Of course, most of the economists or analysts in bubble land aren’t seeing this. I can’t say none of them because a few are finally starting to wake up!

After stocks broke below the support level at 1,820 on the S&P 500, we were bound to get another bounce. But a much sharper and larger crash is growing very likely between sometime next month and July – and that won’t be the end of it.

We are not out of the woods yet. And we’re in for a lot of volatility ahead, so don’t expect things to settle down anytime soon.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.