Oil Price Collapse U.S. Recession Odds 2016

Economics / Recession 2016 Feb 09, 2016 - 10:29 AM GMTBy: Mike_Shedlock

David Rosenberg, chief economist at money-management firm Gluskin Sheff & Associates, went way out on a limb today.

David Rosenberg, chief economist at money-management firm Gluskin Sheff & Associates, went way out on a limb today.

Even though oil broke $30 to the downside again today, bond yields have crashed, and the price of many commodities is below the cost of production, Rosenberg made this statement today as quoted by the Wall Street Journal :

"I put the odds of a U.S. recession in the next year as close to zero as anything could be close to zero."

A spike -- not a fall -- in oil prices preceded or accompanied every recession since the 1970s. "This is the first time I've ever heard the economic intelligentsia talk about how lower oil prices are going to trigger a recession in the United States," said Mr. Rosenberg.

Many initially viewed these forces as transitory, but cratering global demand raises the risk the U.S. can't forever outrun them. The culprit: an oversupply of labor and capital in emerging markets that amassed big debts to build new production facilities over the past five years.

This oversupply abroad helps explain why U.S. wage growth has been so weak despite a headline unemployment rate that has reached 5%, said Daniel Alpert, managing director at Westwood Capital, an investment-banking firm. Higher wages in the U.S. simply drive jobs to lower-cost countries that have an oversupply of workers.

Economic gauges already indicate an industrial recession. The Federal Reserve reported this month that its index of industrial production had fallen 1.8% over the year ended December, a drop that has always been accompanied by a recession since the 1970s.

Economic forecasters have played down worries about a contracting manufacturing sector or a trade slowdown because each accounts for a relatively small slice of overall growth, which allowed the U.S. to motor past similar slumps in the past.

Small Slice Myth

The Wall Street journal repeats the myth manufacturing does not matter because consumer spending drives the economy.

I dispute that notion in Debunking the Myth "Consumer Spending is 67% of GDP" .

My article is based on the work of economist Mark Skousen.

His article, Linking Austrian and Keynesian Economics: A Variation on a Theme explains why a Gross Output model that takes into consideration business-to-business transactions works better than the widely used GDP model that doesn't.

The consumer spending model ignores valued added in business-to-business transactions in every stage of production. The GDP and GO models differ widely in percentages assigned to the consumer and manufacturing in the economy.

For more from Skousen, please see his excellent report Third Quarter Gross Output and B2B Iindex Reports Sharp Slowdown in US Economy .

Slowing Service Economy

Moreover, Rosenberg missed the slowing service economy as well. Please consider Non-Manufacturing ISM Cracks Appear: 8 of 18 Industries in Contraction .

Check out what's contracting and what's not.

Growing Industries

- Finance & Insurance

- Real Estate, Rental & Leasing

- Utilities

- Retail Trade

- Information

- Construction

- Agriculture, Forestry, Fishing & Hunting

- Health Care & Social Assistance

- Management of Companies & Support Services

- Public Administration

Contracting Industries

- Mining

- Educational Services

- Wholesale Trade

- Other Services

- Arts, Entertainment & Recreation

- Accommodation & Food Services

- Transportation & Warehousing

- Professional, Scientific & Technical Services

Entertainment, as well as accommodation and food services are now in contraction. Food service has been a key provider of jobs.

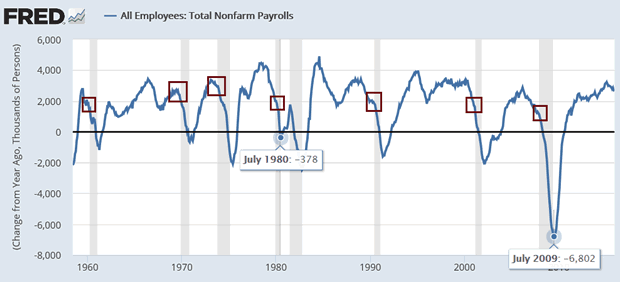

Jobs are a hugely lagging indicator. Here's a chart from my February 4th article Currency Wars and a Job Gain Recession?

If a lending slowdown "were to broaden out beyond just energy and mining, that would be a concern," Mr. Rosenberg said.

Rosenberg should ignore strength in jobs and take a look at what the service economy is saying. It's not just mining in a slowdown.

I believe a Recession has Arrived . Even if not, the odds of one this year are surely not zero.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.