U.S. Recession 2016 has Arrived; Factory Orders Decline 2.9%, Inventories Rise

Economics / Recession 2016 Feb 05, 2016 - 12:38 PM GMTBy: Mike_Shedlock

Even though economists see a mere 20% chance of recession in 2016, I am increasingly confident a recession began in December 2015.

It was another disastrous factory orders report this month.

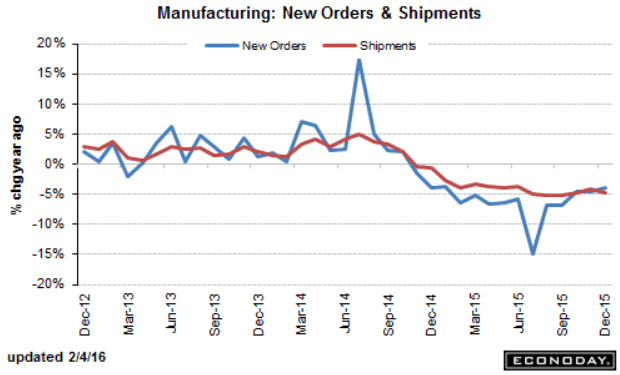

- December factory orders fell 2.9%

- Durable goods orders -5.0%, nondurable goods -0.8%

- November factory orders revised from -0.2% to -0.7%.

- Core capital goods orders fell steep 4.3%

- Inventories rose 0.2%

- The inventory-to-sales ratio rose again which portends weakness for future hiring and production.

- Shipments fell a steep 1.4%

The Econoday Consensus Estimate was -2.8%, nearly on the mark in a range of -3.7% to +0.2%. It's mind-boggling that an economist would predict a rise. Are they throwing darts?

New Orders and Shipments

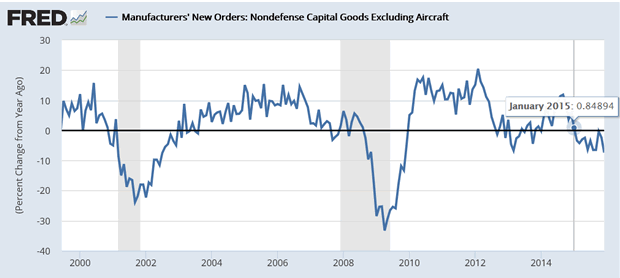

Core Capital Spending

Year-over-year core capital spending by manufacturers has been in negative territory for eleven months. Core capital spending is defined as nondefense capital goods, excluding aircraft.

The chart appears as if spending was positive last October, but that reading is -0.3%

Case for Recession Builds

- ISM Negative 4th Month, Employment Shows Significant Declines .

- Non-Manufacturing ISM Cracks Appear: 8 of 18 Industries in Contraction

- Portion of US Treasury Yield Curve Inverts .

- Like Lemmings Over a Cliff: Fed to Test Negative Interest Rates

Fantasyland Material

I repeat my claim Economists in Fantasyland: Economists See 20% Chance of Recession That's at Least 20% Likely Already Here .

With this disastrous report and a clear slowing of the service economy, a recession has arrived. Given NBER dating mechanisms, we may not know for another year!

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.