Economic Recession, Could the Unthinkable Happen in 2016?

Economics / Recession 2016 Jan 11, 2016 - 05:28 PM GMTBy: Clif_Droke

The most important question investors should be asking at this point isn’t whether the secular bull market which began in 2009 is over, but whether continued equity market weakness in 2016 will lead to the unthinkable, namely an economic recession. A recession in 2016 has been deemed virtually impossible by most mainstream economists, so much so that all discussion of this possibility has evaporated. And while most U.S. economic data categories are still admittedly strong, the persistent weakness under the surface of the equity market over the last several months demands that the topic be reexamined.

The most important question investors should be asking at this point isn’t whether the secular bull market which began in 2009 is over, but whether continued equity market weakness in 2016 will lead to the unthinkable, namely an economic recession. A recession in 2016 has been deemed virtually impossible by most mainstream economists, so much so that all discussion of this possibility has evaporated. And while most U.S. economic data categories are still admittedly strong, the persistent weakness under the surface of the equity market over the last several months demands that the topic be reexamined.

One of the tenants of Charles Dow’s conception of the stock market is that the market’s primary trend is a precursor of U.S. business conditions in the aggregate. Dow maintained that a steady decline of the major indices typically precedes trouble in the business economy by at least 6-9 months. And while there are a few instances when the economy was able to withstand a bear market without entering recession, such cases are the exception instead of the rule.

The stock market’s problems can be traced primarily to weakness in commodities, particularly crude oil. Commodity weakness has been a result of diminished industrial demand in Asia and Europe as the leading industrial countries are still suffering the effects of the misguided tight money and austerity policies pursued by central banks and foreign governments in recent years. As predicted, those austerity chickens have come home to roost and they aren’t in any hurry to leave the chicken house. If our own experience in 2008 is any guide, it will likely take the better part of 2016 for the stimulus measures enacted by the People’s Bank and the ECB to have any measurable impact, and that’s assuming both entities remain committed to an aggressively loose money policy.

So the bigger question is whether the U.S. economy has enough forward momentum to withstand the impact of the global slowdown. The effects of this slowdown are clearly being felt by equity investors, and that should be a warning sign to economists that a consumer spending slowdown is a real possibility in 2016. Most economists consistently downplay Dow’s theory that the stock market is a leading indicator, however, so any slowdown in business this year will likely take most of them by surprise. Moreover, most economic statistics that most economists rely on for making forecasts are lagging indicators. This means these numbers won’t reveal a weakening domestic economy until it’s too late to take preventive measures.

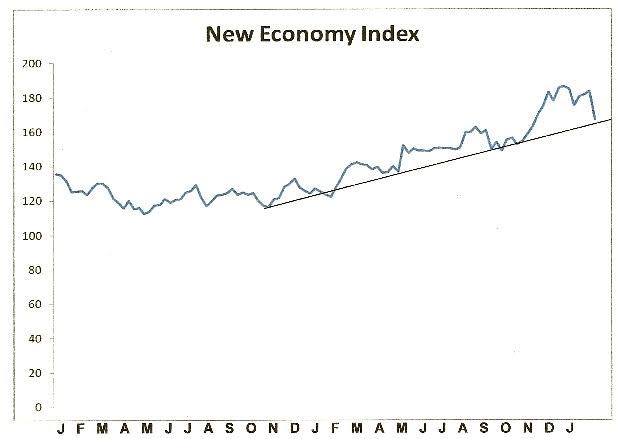

The key “statistic” for measuring the condition of the U.S. consumer should be the stock prices of the leading consumer retail, consumer discretionary and business service and transportation stocks. Examples would include FedEx (FDX), United Parcel Service (UPS), Amazon (AMZN), WalMart (WMT), and Starbucks (SBUX). These and other stocks are included in the New Economy Index (NEI), which I devised in 2007 to measure the underlying strength or weakness in the U.S. consumer economy. Here’s what the NEI looks like as of Jan. 8.

Remarkably, NEI has managed to stay above its intermediate-term uptrend line for months on end despite the continual erosion in the global economy. This can be attributed to the increasing willingness of consumers to make discretionary purchases, as well as their blithe unconcern at the possible domestic impact of the global slowdown. NEI is finally showing signs of weakening, however, and may be on the verge of finally breaking its intermediate-term uptrend. If this happens it will be the first indication in several years that the U.S. consumer is beginning to lose confidence. I should mention that the only consumer confidence that really counts is whether the consumer is actually spending money, not the opinions he expresses to some pollster on the state of the economy.

Behind the weakness is a drop in the dollar value of commodity prices, which reflects the deflationary undercurrent still present in several European and Asian nations. While deflation is no longer a major threat to the U.S., the residual effects of the weak global economy are beginning to erode corporate profits. This is one reason for the internal weakness in the NYSE broad market in the last few months. A critical precursor to an improvement in the equity market then will be a reversal of the overseas economic weakness.

To that end, the European Central Bank (ECB) announced a year ago its first round of quantitative easing (QE) with monthly purchases of EUR 60 billion worth of public bonds. The European QE is expected to last until September 2016, with any extension dependent on the exigencies of the euro zone economy. The goal of this stimulus measure on the part off the ECB is to reverse the deflationary trend and hopefully replace it with some inflation.

In the March 2015 issue of Business Credit, economists for the euro zone economics team Euler Hermes S.A. forecast a “positive but limited impact” for Europe’s QE of 0.5 percentage points of GDP growth and 0.3 percentage points on inflation through July 2016. That forecast, which many economists shared, looks to have been a tad optimistic in light of recent developments. Although the ECB stepped up its stimulus program in December, the latest data show consumer prices have remained unchanged at an annual 0.2 percent, below consensus expectations.

Euler Hermes rightly observed that the ECB lags far behind the U.S. Federal Reserve and the Bank of England when it comes to rapidly responding to deflationary threats. The Euler Hermes team also pointed out that the “transmission mechanism of QE is less clear in the euro zone because the private sector is less intertwined with financial markets than the United States or the United Kingdom.” Moreover, non-financial corporations in Europe tend to finance between only 10-20 percent of their debt in the market. Euro zone households have less equity market holdings, preferring savings deposits or bonds; real estate holdings also have less impact on consumption than in the U.S. With these fundamental differences between the euro zone and the U.S., it’s easy to see that the success of Europe’s QE program faces many obstacles.

The biggest hope or success of euro zone QE is, as Euler Hermes observed, the “policy signaling effect” which would theoretically help to increase business confidence and therefore raise inflation expectations and loan demand. Unfortunately, however, the ECB was late “coming to the QE party” which will make it more difficult to reverse the effects of deflation. In Euler Hermes’ words, “If the ECB was a credible deflation-fighter, it would not need to print humongous amounts of money; the mere announcement of a credible target would trigger a virtuous circle leading to that target.”

Perhaps the old saying “better late than never” applies to the ECB’s attempts at staving off deflation. But given the central bank’s poor track record, investors shouldn’t get their hopes up too high that success will be met anytime soon.

So if European QE won’t be a major factor in reversing the global economic malaise in 2016, what could possibly bring about an improvement? Confidence is the keystone of a thriving economy, as any economist will testify. When consumers, investors and business owners are confident in the strength and stability of business conditions they express this confidence by spending money, either to consume or to invest and expand business. The lack of confidence in the long-term strength of the recovery is what has held back U.S. economic growth in recent years. Every time it looked as if the economy was ready to take off it was hindered from doing so by some foreign threat or another. In 2015, uncertainty over the global outlook led to cost-cutting and a complete lack of capital expenditures among S&P 500 companies. Revenue growth and net income were also down for the year due to the strong dollar and hard-hit oil sector. Thus confidence in the long-term outlook has been sorely lacking.

Without confidence, the next best thing is outright fear. The type of profound fear that was common in the years immediately after the credit crisis hasn’t been seen since the recovery gained traction in 2013 and beyond. While confidence is far preferable to fear, at least fear can generate the kind of action needed to stimulate the economy – much as was the case with the Fed’s QE program after the crisis. So without a return of confidence in 2016, perhaps it will come down to how much fear is needed to generate concerted and aggressive action by governments and central banks in the coming months.

The U.S. Congress abdicated much of its authority to the Fed in the wake of the credit crisis; Congress must reassert its authority in the nation’s fiscal affairs, however. Businesses and investors would find renewed confidence in the economic outlook if taxes were lowered and regulatory burdens were lifted. The current administration has done much damage to the economy by way of increasing both, which has added to the uncertainty among investors and has hindered capital investment.

Of the two major factors – confidence and fear – it would appear the safer bet that fear, rather than confidence, will be the dominant force behind efforts at reversing the damage caused by the global economic slowdown in 2016.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.