Gold and Silver COTs Feature Short Covering

Commodities / Gold and Silver 2015 Dec 29, 2015 - 01:37 PM GMTBy: Dan_Norcini

As suspected, the gains seen last week in both gold and silver ( and copper for that matter) were primarily the result of short covering. My view is that the bulk of this was tied to year-end book squaring ahead of Christmas and the New Year's holiday.

As suspected, the gains seen last week in both gold and silver ( and copper for that matter) were primarily the result of short covering. My view is that the bulk of this was tied to year-end book squaring ahead of Christmas and the New Year's holiday.

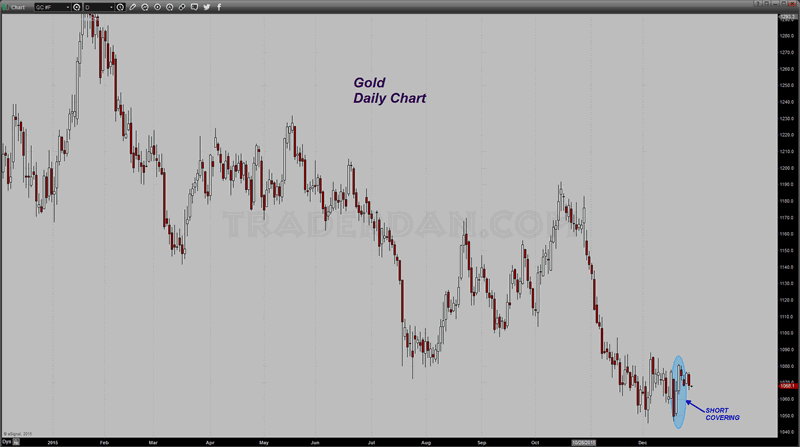

Starting with gold...

Daily Gold Chart

It should come as no secret to the readers of this site that the money to be made trading gold this year has come from the short side. With bears raking in the brunt of trading profits, it is only logical (and sensible) to expect them to book those gains and realize them.

As you can see from the chart, their buying was good for a $30+ move off the lows.

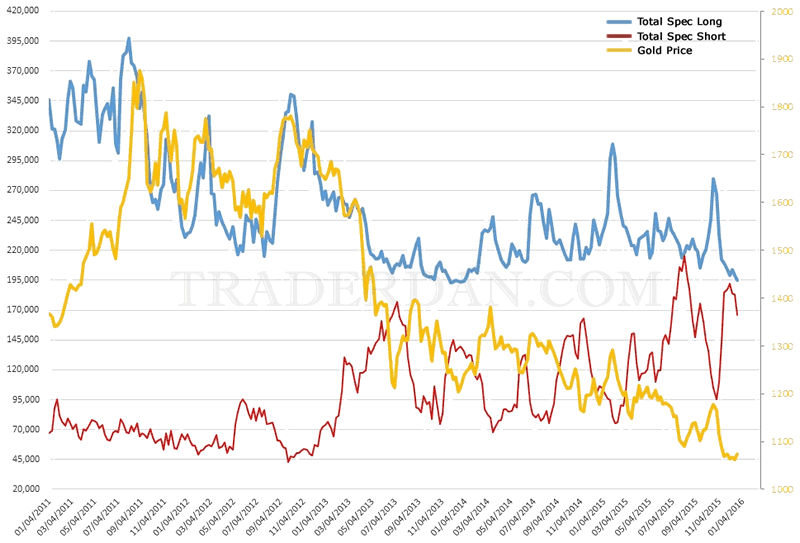

Here is the updated COT chart.

Daily Gold Chart

Gold CoT

You can see from looking at this chart that there was long liquidation that occurred over this past reporting period but most of that took place on December 17th when gold collapsed over $30 in a single day. That day was then followed by two consecutive days of short covering which was picked up on this reporting period and is observable on the chart.

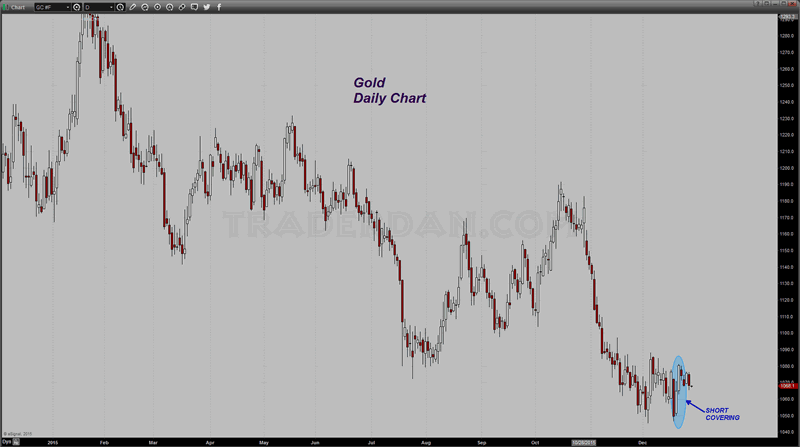

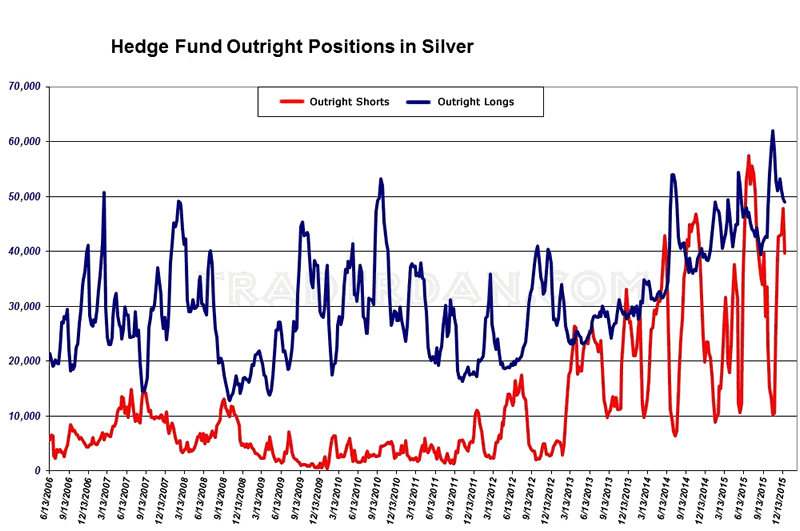

The same thing happened in silver. Here is a reposting of that same silver chart I loaded on the site earlier today.

You can see the sharp selloff on December 17th which was followed by the same two days of short covering that occurred in gold.

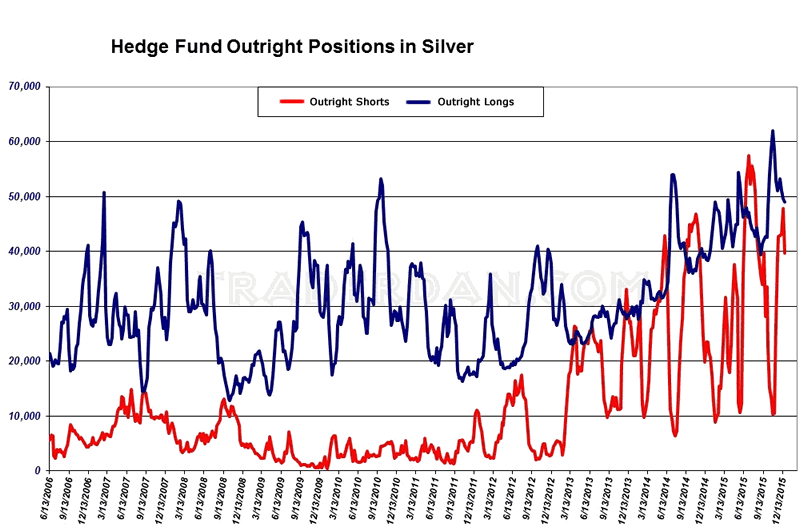

Hedge Fund Outright Positions in Silver

Daily Silver Chart

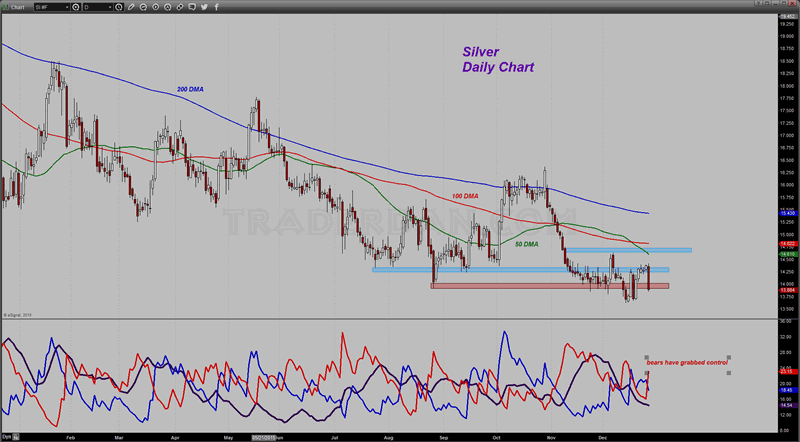

As you can see, as was the case with gold, both long liquidation took place over this reporting period that ended Tuesday of last week as well as short covering. The brunt of the long liquidation occurred on the 30 cent price plunge on December 17th that dropped the price below $13.75. The next two days were when the short covering occurred as price then retraced the entire loss of the 17th and then some.

Today, we are right back below $14 once more.

As noted many times now over the past two weeks, both gold and silver remain mired in range trades. Maybe they will go somewhere next year but if the yield curve is any indication, the gold bulls may not be including that in their New Year's wish list.

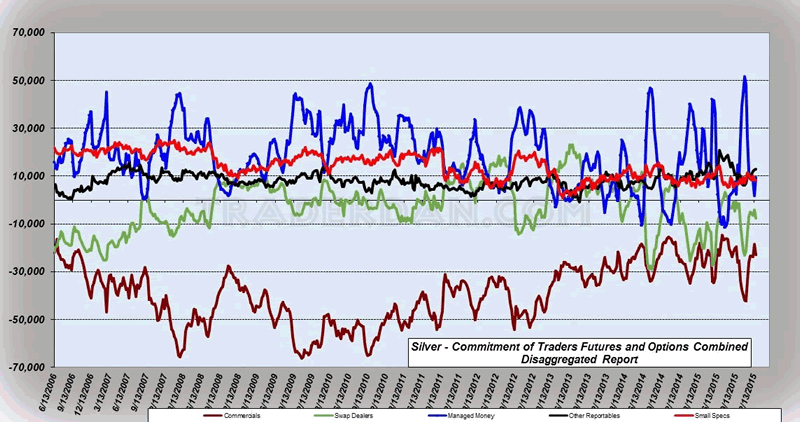

I should note here, that the speculators continue shooting themselves in the foot as they remain NET LONG silver in a brutal bear market.

Silver CoT

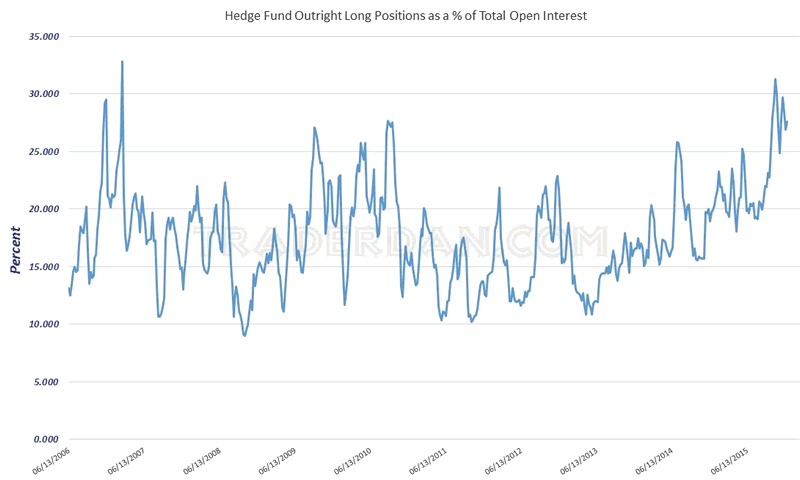

As a matter of fact, the hedge funds continue to hold not far off the all time record high for outright long positions. They are approximately 13,000 longs off their October peak scored a couple of months ago. Clearly, these guys have not had any fun this year in the silver market!

Hedge Fund Outright Positions in Silver

Lastly, here is the same data plotted in a percentage term.

Hedge Fund Outright Long Positions as a % of Total Open Interest

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.