When Gold Comes Back Into Favor?

Commodities / Gold and Silver 2015 Dec 21, 2015 - 05:44 PM GMTBy: Submissions

Sasafuturestrading writes: Stocks usually change direction before commodities.

There is one market that really shines when stocks and the dollar are in bear markets together, and that market is gold.

In other words, a climate of falling stock prices, a falling U.S. dollar, and historically low interest rates don’t leave investors with a lot of investment alternatives. This is the exact type of intermarket climate that drives money to gold.

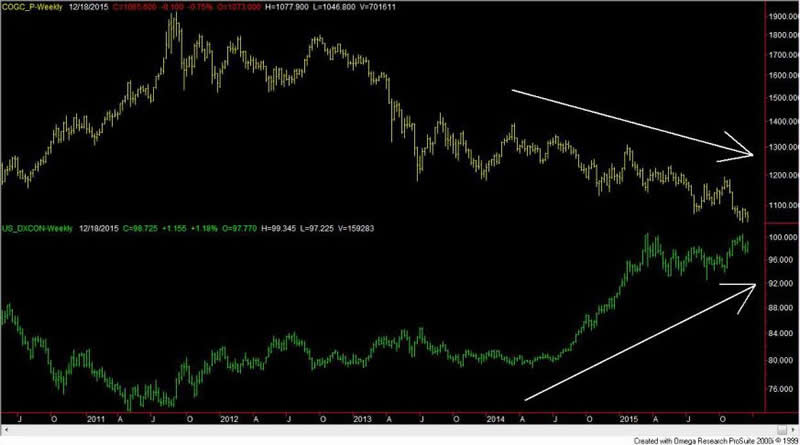

If gold is starting to rise, the first thing to do is to determine if the dollar is starting to drop. The next thing to do is to look at the separate charts of each market to determine the importance of their respective trend changes. A minor trend change is one may not justify a major trend change in the other. Their trend signals should be of similar magnitude.

When prices break the trendlines that have been in existence for several months or years, it is usually an indication that something important is happening.

GOLD AND DOLLAR INDEX WEEKLY CHARTS:

GOLD AND S&P500 WEEKLY CHARTS:

https://sasafuturestrading.wordpress.com/

Sasafuturestrading is a new blog independent a new blog.

The P.A.S. system is based on the following indicators:

- Fundamental

- Cyclical

- Technicians

The P.A.S. system find a market set up and only then establish a position once there has been a change in trend. Sasafuturestrading opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Sasafuturestrading receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss.

© 2015 Sasafuturestrading - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.