Silver: Until Paper Currencies Stop Losing Value

Commodities / Gold and Silver 2015 Dec 15, 2015 - 05:36 PM GMTBy: DeviantInvestor

Alasdair McLeod wrote an excellent article in which he said,

Alasdair McLeod wrote an excellent article in which he said,

“So if anyone asks you when you might take your profits in gold and silver, smile sweetly and just say, ‘When paper money stops losing its value.’”

When will paper money stop losing its value? I submit that unbacked fiat paper money will, based on history, never stop losing value – as long as it is backed by dodgy sovereign debt issued by governments descending deeper into debt ever year. A viable alternative is currency backed by gold and silver, but even though precious metals have been used successfully as money for centuries, there is far more profit for TPTB when they use the paper stuff. Consequently paper and digital currencies will not disappear anytime soon.

But given that we are stuck with the paper stuff… and given that we erroneously believe that the paper stuff is an adequate measuring tool… and given that we live our daily lives within the universe of paper currencies … and given that we need silver (and gold) to compensate for the loss of value in paper currencies … THEN:

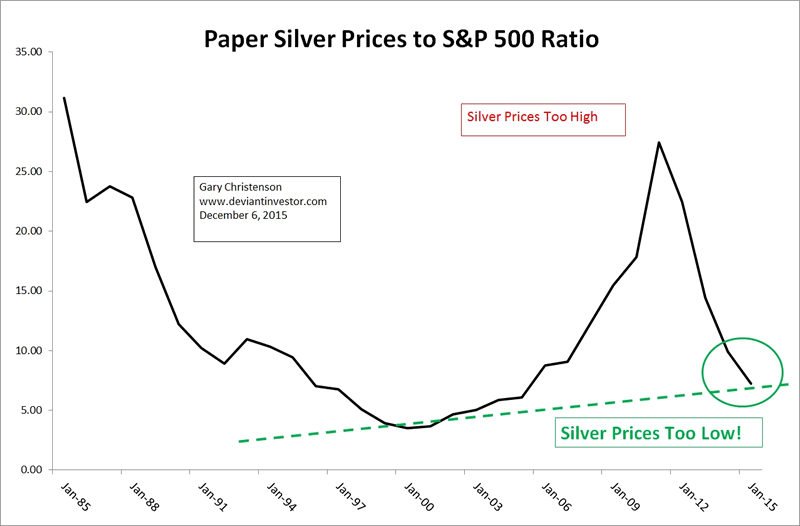

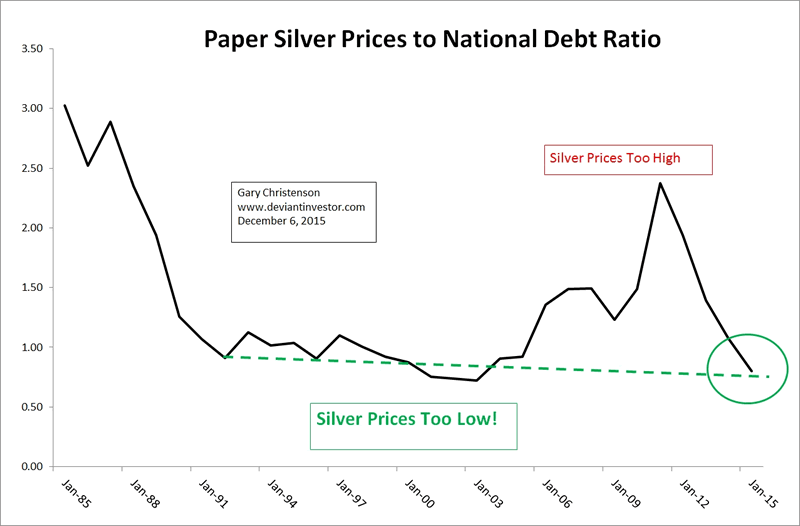

The critical question is: Is silver inexpensive now? Consider silver ratios to the S&P 500 Index, the official US national debt, and others.

Examine the following ratio of (1000 times paper COMEX) silver to the S&P 500 Index. Silver is at the low end of its long-term range indicating that the S&P has been levitated by QE and central bank policies while paper silver prices have been crushed. Massive profits came from levitating the S&P so this is sensible, but the ratio indicates that silver is likely to substantially increase in price over the next several years.

Examine the following ratio of (1 trillion times paper COMEX) silver to official US national debt. Silver is at the low end of its long-term range indicating that silver prices are low compared to the national debt, which has increased consistently for a century. The ratio indicates that silver is likely to substantially increase in price over the next several years.

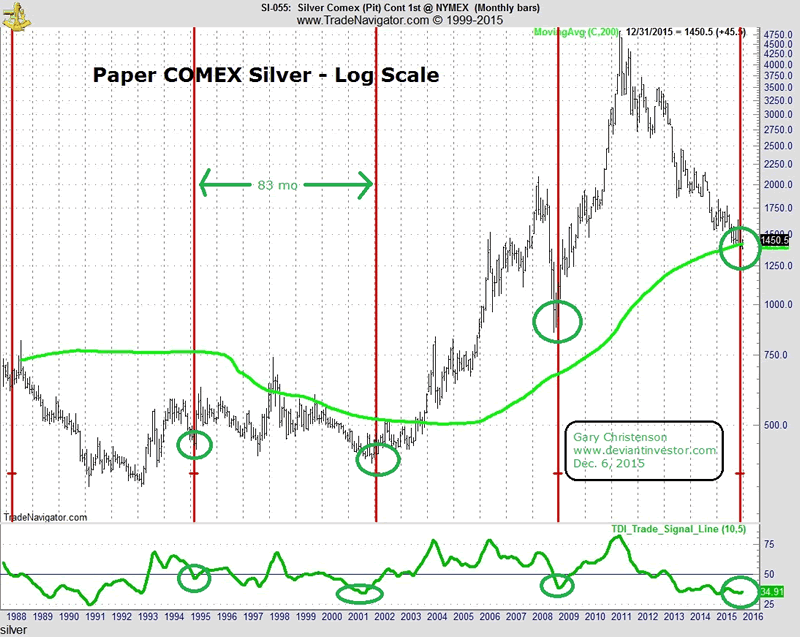

Examine the following graph of monthly paper COMEX silver prices on a log scale back to 1988. Note the following:

- The red vertical lines are spaced 83 months apart. I have circled major lows (1995, 2001, 2008, and 2015) in green. Paper silver prices have currently descended into a seven year cycle low.

- Note that silver has fallen hard in the past 4.5 years and has returned to its 200 month moving average – the green line – which is a severe correction.

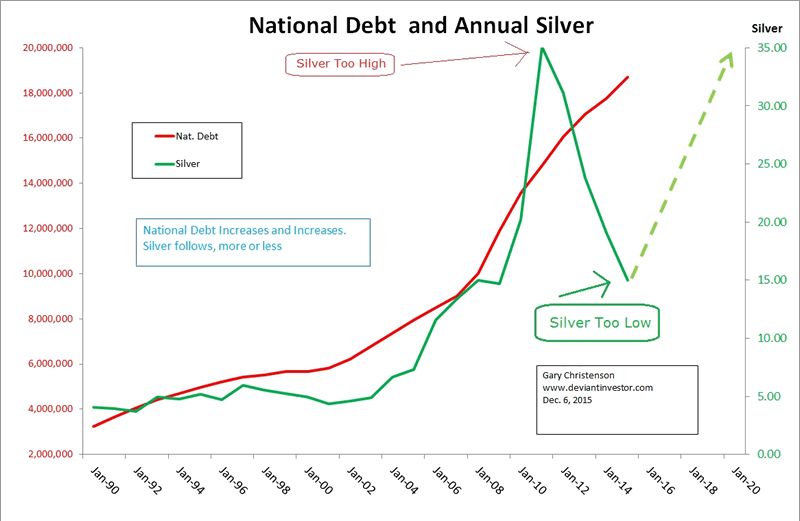

- Silver prices are erratic but on average they rise along with national debt, government spending, and currency in circulation.

- It is difficult to quantify but I think we can safely assume that silver prices will also rise based on increasing warfare in the Middle-East, increasing fiscal and monetary insanity, and increasing foreign policy stupidity.

CONCLUSIONS:

- Silver price ratios (paper COMEX) are near historical lows compared to both the S&P 500 Index and the official US national debt.

- Central banks are aggressively devaluing their currencies and trying to inflate consumer prices. They will probably succeed since they own the legal “printing presses” and consequently we should expect erratically higher gold and silver prices in the relatively near future.

- Politicians will continue spending and descending further into a devastating pit of debt, and central banks will not voluntarily reduce debt and currency in circulation. A deflationary accident may occur but we should assume central banks will fight it with a flood of global “printing press” currencies. Think Japan, “helicopter drops,” a war on cash, negative interest rates, more QE, and “bail-ins.”

- It is relatively easy to increase debt, increase currency in circulation, devalue currencies, and spend more on warfare and welfare. It is difficult to increase silver and gold reserves. The prices for silver and gold will eventually reflect their scarcity, their high demand, and the ease with which central banks can devalue their currencies.

- Read Steve St. Angelo’s article on silver coin demand.

- Paper Dies, Silver Thrives!

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.