Gold Buying Surges At U.S. Mint In November – China Buys 21 Tonnes In November Alone

Commodities / Gold and Silver 2015 Dec 08, 2015 - 02:26 PM GMTBy: GoldCore

Despite gold at near 6 year lows, global demand for physical bullion remains very high. This is clearly seen in the recent demand data from the U.S. Mint and other mints. It is also seen in demand data from GFMS and the World Gold Council which shows very robust demand from Germany, India and of course, China.

Despite gold at near 6 year lows, global demand for physical bullion remains very high. This is clearly seen in the recent demand data from the U.S. Mint and other mints. It is also seen in demand data from GFMS and the World Gold Council which shows very robust demand from Germany, India and of course, China.

There is also the very high official demand from central banks and, in particular, the Russian central bank and the People’s Bank of China (PBOC). Today came news that China’s gold reserves rose by another 21 tonnes in November, the biggest bout of gold buying since China began disclosing monthly data on China’s gold reserves in June – see Gold News.

Last week data showed that sales of American Eagle gold coins at the U.S. Mint surged in November, with gold demand nearly tripling month-over-month as bullion prices fell to multi-year lows.

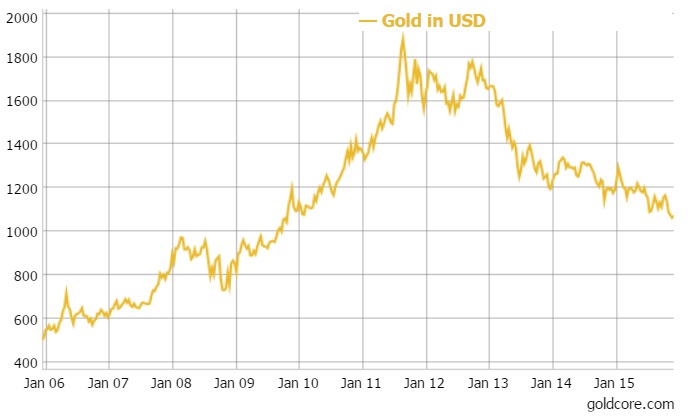

Despite these very high levels of demand, gold prices fell sharply in November – from $1,141/oz to $1,070/oz or 6.6%.

Gold prices continue to be determined by traders and speculators in the futures market as evidenced by the Commitment of Traders (COT) data, showing that hedge funds now have record short positions. This typically occurs close to market bottoms and – along with the supply demand fundamentals – would suggest gold is close to bottoming.

Futures participants are eagerly awaiting the Fed’s interest rate decision next Wednesday, December 16th. Should the much heralded and anticipated 25 basis point rise materialise as is expected, then we expect gold could show further weakness.

Weakness into year end seems quite possible given the poor technical position, poor sentiment in western markets and momentum which can be a powerful thing. $1,000/oz gold seems increasingly likely and it appears to be gravitating to this big round number.

Chinese New Year looms and demand from China should provide support at these levels and should spur gains in January.

Dr Constantin Gurdgiev covered the surge in demand for gold coins from the U.S. Mint on his blog:

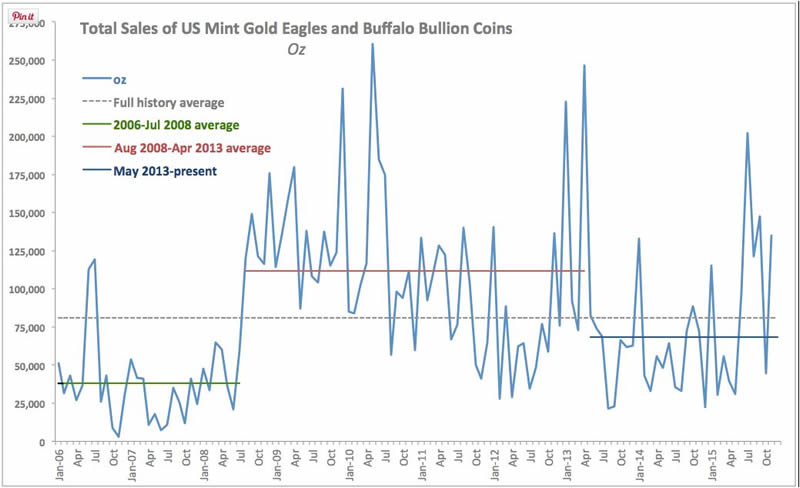

Following October fall-off, sales of U.S. Mint gold coins rose strongly in November to 135,000 oz by weight (+86.2% y/y) and 237,500 units (+95.5% y/y).

These figures include sales of both Eagles and Buffalo coins. Average weight of coin sold also rose strongly to 0.5684 oz compared to 0.4709 oz in October and close to 0.5967 oz/coin in November 2014.As noted in my note covering October sales, October decline was a correction reflective of volatile demand and also significant uplift in sales in previous months.

As chart above shows, sales by weight are now well above period average and above peak period average. In 11 months of 2014, US Mint sold 679,500 oz of gold coins; over the same period of 2015 sales totalled 1,020,000 oz.

November 2015 also marked 20th consecutive month of gold sales/price correlations (12mo running) being negative, suggesting strong and entrenched demand from buyers pursuing long hold strategy and taking advantage of improving cost of holding gold.

Continue reading Dr Constantin Gurdgiev blog on U.S. Mint gold coin demand

DAILY PRICES

Today’s Gold Prices: USD 1071.75, EUR 988.43 and GBP 714.79 per ounce.

Yesterday’s Gold Prices: USD 1082.70, EUR 1001.80 and GBP 718.26 per ounce.

(LBMA AM)

Gold in USD – 10 Years

Gold fell back yesterday after Friday’s gain, closing down $12.30 to $1072.90. Silver also fell by $0.27 to close at $14.28. Platinum lost $29 to closes at $849.

Must-read guides to international bullion storage:

Download Essential Guide to Gold Storage in Singapore

Download Essential Guide To Storing Gold In Switzerland

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.