Dovish ECB Disappoints – Gold Rises, Stocks and Bonds Fall Globally, Euro Surges

Commodities / Gold and Silver 2015 Dec 04, 2015 - 03:14 PM GMTBy: GoldCore

‘Super Mario’, the European Central Bank’s monetary magician, disappointed markets yesterday as continuing and unprecedented monetary easing failed to prevent a sharp sell-off in stock and bond markets which has continued today.

‘Super Mario’, the European Central Bank’s monetary magician, disappointed markets yesterday as continuing and unprecedented monetary easing failed to prevent a sharp sell-off in stock and bond markets which has continued today.

There are sharp losses on financial markets after the ECB’s President’s – nicknamed ‘Super Mario’ and more recently ‘Magic Mario’ – latest radical measures stopped well short of market expectations and traders desperation for more cheap money and deepening ultra loose monetary policies.

Draghi announced a deepening of probably the most radical monetary policies of any major central bank in history.

The ECB will extend its massive 60 billion euro ($63.5 billion) a month money printing, or debt monetisation, scheme to at least March 2017, an additional six months. Debt monetisation will now include both regional and local government debt and be reinvested upon maturity.

The ECB cut its deposit rate to a historic low and further into negative territory by 10 basis points to a fresh low of negative -0.3 percent, down from -0.2 percent. The cut means banks in effect must pay more for the ECB to hold their money. The ECB kept its main refinancing rate (or the price that banks pay to borrow funds from the ECB) unchanged at an unprecedented, essentially 0 percent – exactly 0.05 percent.

While stocks and bonds fell, gold rose and the euro surged 3% against the dollar. Disappointment rattled stock markets on both sides of the Atlantic, with many European indices suffering their worst day since the chaotic August 24 rout. The benchmark S&P 500 fell into negative territory for the year again.

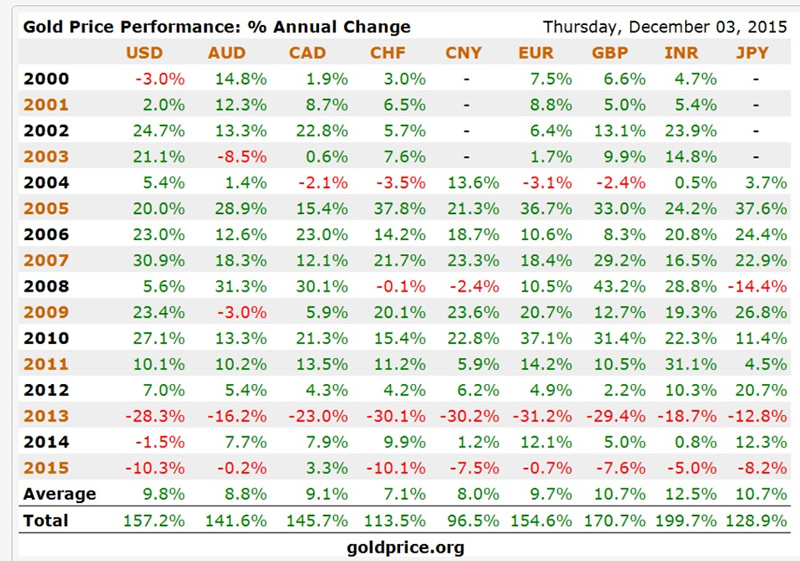

Gold bullion prices rose 0.8% in dollar terms – the biggest one day rise in two weeks – after the ECB announcement. Although gold is being oversold it was due a bounce. Gold in euro terms fell 2.3% and is now marginally lower for the year to date – down 0.7% year to date to €978 per ounce – see table.

Bond markets sold off very sharply yesterday. The benchmark 10-year bond yields of Germany, France, Italy, Spain, Portugal and the Netherlands all jumped by more than 20 basis points. Even the US Treasury market took a battering with the 10-year Treasury yield jumping 15 basis points to 2.38 percent — its biggest one-day rise in over two years.

“The value of the U.S. fixed-income market slid by $162.5 billion on Thursday while the euro area’s shrank by the equivalent of $107.5 billion” according to Bloomberg.

Many analysts noted that the stock and bond market routs reflected the fact that speculators had bet too heavily on a further aggressive expansion of QE and money printing by the ECB. Risk assets are now extremely dependent on the drug that is ultra loose monetary policies, which does not bode well for their outlook in 2016 and the coming years.

The ECB has made it clear that its ultra loose and extremely “accommodative” policies can be expected to continue for some time to come which will be supportive of gold in euro terms at these depressed levels.

The continuation of the ECB’s and other major central banks radical monetary experiment shows how vulnerable our economies are and how they remain very exposed to shocks in the Eurozone and indeed from outside shocks.

Significant global macroeconomic and geopolitical risks remain and may scupper the vulnerable Eurozone economy and indeed the global economy underlining the need for conservative asset allocation and safe haven assets.

DAILY PRICES

Today’s Gold Prices: USD 1063.00, EUR 977.56 and GBP 702.60 per ounce.

Yesterday’s Gold Prices: USD 1050.60, EUR 994.75 and GBP 703.13 per ounce.

(LBMA AM)

Gold in EUR – 1 Year

Gold made a significant jump yesterday, closing up $10.50 to close at $1063.20. Silver also gained slightly by $0.08 to $14.11 at the end of day. Platinum regained some of its recent losses to close up $16 to $844.

Gold in euro terms fell over 2% – see above. Silver, underperformed gold during yesterday’s bounce but was also higher and has eked out further gains today. Platinum, and palladium are marginally higher today.

Must-read guides to international bullion storage:

Download Essential Guide to Gold Storage in Singapore

Download Essential Guide To Storing Gold In Switzerland

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.