One of America’s Largest Online Retailers Is Stockpiling Gold and Silver Coins to Pay Employees In Coming Crisis

Commodities / Gold and Silver 2015 Nov 10, 2015 - 12:38 PM GMTBy: GoldCore

One of America’s largest companies is preparing for problems in the banking and financial system and another financial crisis.

One of America’s largest companies is preparing for problems in the banking and financial system and another financial crisis.

Online retail giant Overstock.com (OSTK), publicly stated that the company has stockpiled gold and silver coins in preparation for another U.S. financial crisis. Patrick Byrne, its founder and chief executive, is a libertarian who champions crypto currencies, bitcoin and gold and silver bullion as financial insurance against risk in the financial and monetary system.

Overstock Chairman, Jonathan Johnson recently told an audience at the United Precious Metals Association (via Casey Research):

“We are not big fans of Wall Street and we don’t trust them. We foresaw the financial crisis, we fought against the financial crisis that happened in 2008; we don’t trust the banks still and we foresee that with QE3, and QE4 and QE n that at some point there is going to be another significant financial crisis.”

Quantitative easing (QE) is when central banks create billions and trillions worth of fiat currency out of thin air and inject it into the financial system rising currency debasement and inflation in the long term.

Johnson went on to explain the company’s preparations:

“So what do we do as a business so that we would be prepared when that happens? One thing that we do that is fairly unique: we have about $10 million in gold, mostly the small button-sized coins, that we keep outside of the banking system. We expect that when there is a financial crisis there will be a banking holiday. I don’t know if it will be two days, or two weeks, or two months. We have $10 million in gold and silver in denominations small enough that we can use for payroll. We want to be able to keep our employees paid, safe, and our site up and running during a financial crisis.

We also happen to have three months of food supply for every employee that we can live on.”

A further insight into the company’s preparations for a crisis can be seen in the company’s latest 10-Q filed with the SEC:

“Our precious metals consisted of $6.3 million in gold and $4.6 million in silver at June 30, 2015 and December 31, 2014. We store our precious metals at an off-site secure facility. Because these assets consist of actual precious metals, rather than financial instruments, we account for them as a cost method investment initially recorded at cost (including transaction fees) and then adjusted to the lower of cost or market based on an average unit cost”.

Johnson, Overstock’s anti-establishment chairman, told the Financial Times it holds the bullion coins outside the banking system so the company could pay employees even if banks close for a period of time in a crisis – as was seen in Cyprus and Greece in recent months:

“We thought there’s a decent chance that there could be a banking holiday at some point caused by a crisis and it could last for two days or two weeks or who knows how long, and we wanted to be in a position where we could continue to operate during any such crisis,” he said.

GoldCore is advising companies internationally to allocate capital to gold and silver bullion as a way to diversify their assets. This is prudent given the risks of today and need for financial insurance to protect against bank bail-ins, capital controls, “bank holidays”, currency debasement and other risks posed by another financial crisis.

DAILY PRICES

Yesterday’s Gold Prices: USD 1095.60 , EUR 1015.90 and GBP 725.95 per ounce.

(LBMA AM)

Gold closed higher yesterday up $3.10 to $1091.10. Silver lost $0.18 to close at $14.56. Platinum lost $28 to $910.

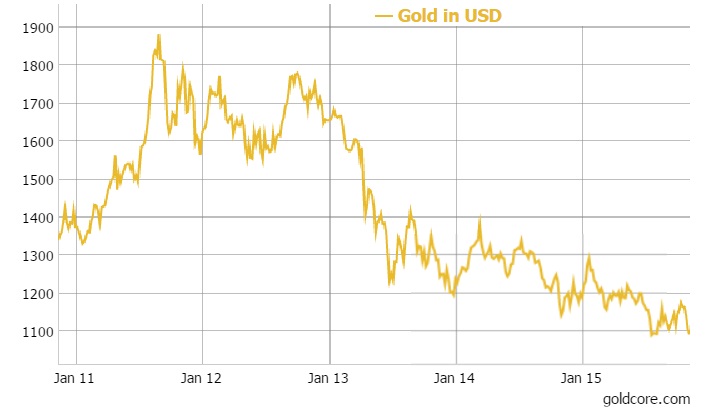

Gold in USD – 5 Years

Gold has eked out small gains and appears to be stabilising at just above five-year lows reached in July, after last week’s nearly 5% plunge.

Less than two weeks ago – on October 28th – gold was trading at $1180 per ounce and has declined a sharp 8 per cent in just two weeks. Value buyers and those dollar cost averaging into position are taking advantage of the price weakness.

Indian demand for gold and silver remains robust as we had into the Indian festival season. Gold and silver coins saw good demand on Dhanteras in India today instead of jewellery. It was noted that consumers were on a buying spree due to lower prices.

According to jewellers and bullion dealers MMTC-PAMP India, the buying activity remained robust in the first half of the day at most places. But more sales are expected later in the day, with office-goers coming in for buying late in the evening.

Dhanteras is considered to be an auspicious day for buying gold and silver and is largely celebrated in North and West India.

Must-read guides to international bullion storage:

Download Essential Guide To Storing Gold In Switzerland

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.