Now is the Time to Short Gold and Silver

Commodities / Gold and Silver 2015 Oct 18, 2015 - 03:33 PM GMTBy: Submissions

Tony Mermer writes: Gold's recent rally has convinced many investors and traders that the precious metals bear market is over. I disagree. Since I believe that the gold and silver bear markets are not over, the recent rally is merely a rally within this bear market. This rally is probably over, so here's why now is the time to short gold and silver.

Tony Mermer writes: Gold's recent rally has convinced many investors and traders that the precious metals bear market is over. I disagree. Since I believe that the gold and silver bear markets are not over, the recent rally is merely a rally within this bear market. This rally is probably over, so here's why now is the time to short gold and silver.

This rally is becoming old

Gold has rallied since the middle of July 2015 when it reached $1070. This means that the rally has already lasted more than 3 months. Historically speaking, gold's bear market rallies do not last more than 3 months.- Gold's rally from early November 2014 to mid January 2015 lasted 2.5 months.

- Gold's rally from January 2014 to mid-March 2015 lasted 2.5 months.

- Gold's rally from late June 2013 to late August 2013 lasted 2 months.

- Gold's rally from May 2012 to October 2012 lasted 5 months.

- Gold's rally from December 2011 to February 2012 lasted 2 months.

- Gold's rally from September 2011 to November 2011 lasted 1.5 months.

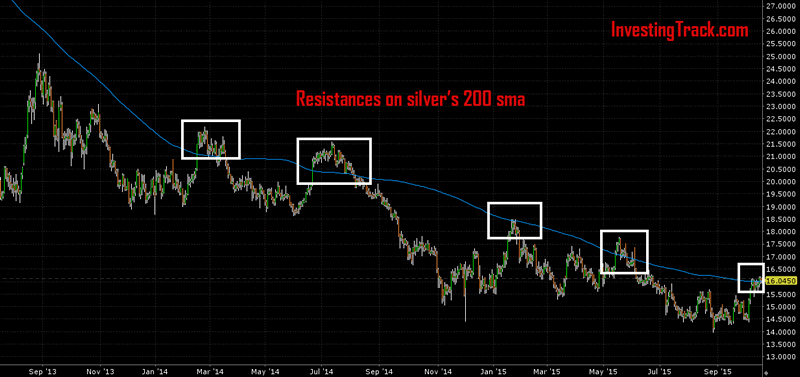

Gold and silver are up against a ton of resistances

Gold and silver are rallying up against a bunch of resistances. Any breakout above these resistances is likely to be a false breakout. Silver is running up against it's 200 sma. As you can see, the 200 sma has been admirable resistance over the past 2 years.

Gold is also running up against its 200 sma resistance. Is it making a false breakout? Perhaps.

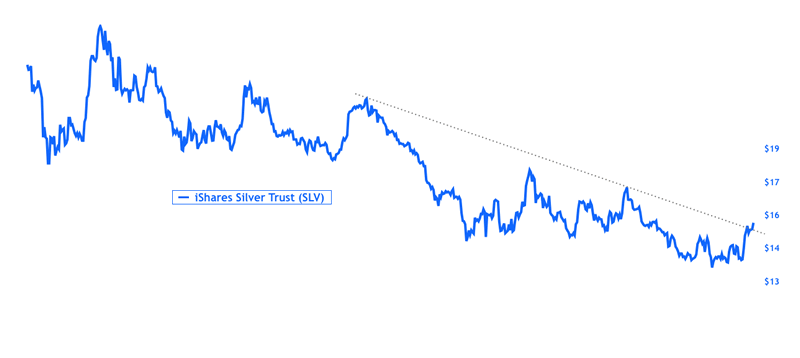

In addition to the moving average resistances, precious metals related assets are running up against some long term resistances. Silver is facing resistance from its long term trendline. This trendline has capped silver throughout this entire bear market.

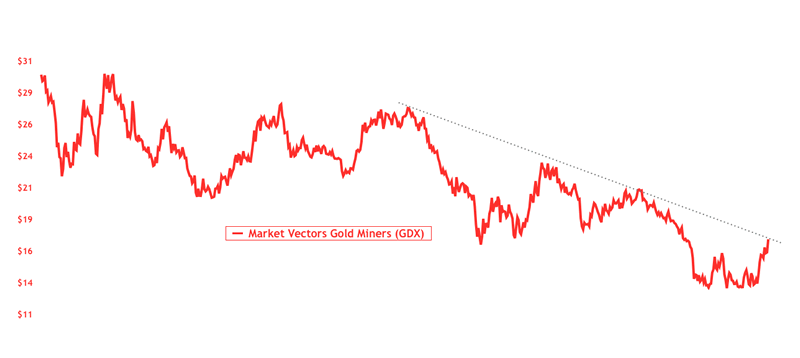

Likewise, the gold miners ETF GDX is facing resistance from its long term trendline. This trendline has capped GDX throughout this entire bear market.

The U.S. dollar is ready to rally

The U.S. dollar's bull market is not over. All bull markets have at least 2 rallies, and the USD's rally from mid-2014 to early 2015 was only the first rally in this bull market. Thus, the U.S. dollar's bull market has at least one more rally. The U.S. dollar has been in a long correction since March 2015. In other words, this 7 month correction is about as long as corrections get. The U.S. dollar is ready to rally to new highs any day now. In addition, the Euro is very close to retesting its August 2015 high of $1.17. Should this resistance hold, the U.S. dollar's bottom will be in. A bullish U.S. dollar is bearish for gold, silver and gold mining stocks. After all, it's the U.S. dollar's rally that caused precious metals related assets to decline from the middle of 2014 to the end of 2014.By Tony Mermer

I'm Tony Mermer, founder and CEO of Investing Track (investingtrack.com). We are a privately held quantitative investment firm.

© 2015 Copyright Tony Mermer - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.