Global Stock Markets Plunge on Soaring Crude Oil Price

Stock-Markets / Global Stock Markets Jun 27, 2008 - 07:17 PM GMT

Eyes wide open - How could Wall Street brokers tell their clients that auction-rate securities were “…very safe and liquid as possible,” Yet underwriters from the same company telling issuers that demand was softening and demanded higher interest rates. At least 24 proposed class-action lawsuits have been filed against brokerages since March, and a nine-state task force is examining how the firms marketed the securities. Those burned in the meltdown see it as a case of Wall Street hiding known risks from investors, much like the dot-com scandal over former Merrill Lynch & Co. analyst Henry Blodget , who once advised buying a stock while privately calling it ``junk.''

Eyes wide open - How could Wall Street brokers tell their clients that auction-rate securities were “…very safe and liquid as possible,” Yet underwriters from the same company telling issuers that demand was softening and demanded higher interest rates. At least 24 proposed class-action lawsuits have been filed against brokerages since March, and a nine-state task force is examining how the firms marketed the securities. Those burned in the meltdown see it as a case of Wall Street hiding known risks from investors, much like the dot-com scandal over former Merrill Lynch & Co. analyst Henry Blodget , who once advised buying a stock while privately calling it ``junk.''

This is typical of the goings-on at Wall Street firms. Because of conflicts of interest, that ensue from underwriting stocks and bonds in which they derive large fees, Wall Street has no desire to stop the gravy train. At the other end of the spectrum there are brokers who have no desire to lose a commission by disclosing all the risks of any particular investment, all under the same roof. Certainly, you will hear, as we did recently from a Merrill Lynch analyst, that investor have “ thrown in the towel ” on bank stocks. But that is after banks stocks, as a group, have already declined 50%. Some advice.

How can you tell whether your broker is withholding material information? The first line of defense is to inquire whether the broker's firm also underwrites the security. One example is Citigroup's issue of $4.5 billion in new shares on April 30. The new shares were enthusias-tically offered at $25.27, a 5% discount from the offer price two days before. Sounds like a good deal, doesn't it? Today, Citigroup shares closed at $17.25, 32% less than the offering share price just six weeks ago. Do you think there might have been some serious omissions about Citigroup's financial health to those investors?

Personal Incomes get a jolt.

Personal incomes rose 1.9% in May, the largest gain since September 2005, when insurance payments from hurricane damage flooded into bank accounts. The increase was close to the 1.5% gain expected by economists surveyed by MarketWatch . Notice that the government is taking credit for the last jolt in personal incomes as well. But Consumers are still in a funk.

Seatbelts on?

Stocks continued to fall on Friday, unable to bounce back a day after the market plunged on renewed concerns about financials, credit conditions and oil topping $140 for the first time.

Stocks continued to fall on Friday, unable to bounce back a day after the market plunged on renewed concerns about financials, credit conditions and oil topping $140 for the first time.

Thursday's 358 point drop in the Dow Jones Industrials is seen as the worst drop in nearly six years. In addition, this month the market seems to be enduring its worst June so far since 1930, and plunging to its lowest daily finish since Sept. 11, 2006, after getting slammed hard as crude soared to new highs and Goldman Sachs disparaged U.S. brokers and advised selling General Motors Corp.

Treasury Bonds a safe haven or a trap for the unwary?

Higher T-bond prices mean lower yields. The fact that investors have been rotating over to t-bonds may be a knee-jerk reaction based on past experiences, where bonds did well in market declines. But this time the situation calls for higher food and energy prices. Can bonds withstand a heavy whiff of inflation and not keel over?

Higher T-bond prices mean lower yields. The fact that investors have been rotating over to t-bonds may be a knee-jerk reaction based on past experiences, where bonds did well in market declines. But this time the situation calls for higher food and energy prices. Can bonds withstand a heavy whiff of inflation and not keel over?

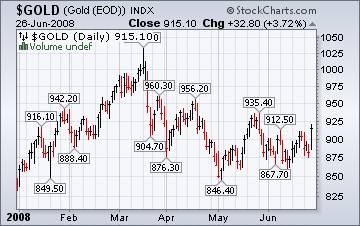

Gold is making a surprise move up.

Gold futures climbed above $925 an ounce Friday as a new record high in crude oil, persistent weakness in the U.S. dollar and a recent plunge in the U.S. stock market encouraged investment demand for the precious metal, setting prices up for a weekly gain of almost 3%.

Normally this pattern would be considered bearish. However, today's move puts us on the alert for a breakout above 935.40. Both bulls and bears should be dancing near the door in gold.

The Nikkei is beginning its next descent.

( Bloomberg ) -- Japanese stocks fell , sending the Nikkei 225 Stock Average to its worst losing streak in seven months, as oil surged, the dollar weakened and analysts predicted more losses at U.S. financial institutions.

According to the Financial Times, investors have administered old-style beatings to money lenders in Japan . There were more than 45,000 money lending firms in Japan in 1992. Today there are less than 10,000.

How low will Shanghai go?

( Bloomberg ) -- China's stocks tumbled, (not shown in the chart) putting the benchmark index on course for its worst month on record, as investors speculated the government will increase interest rates this weekend to help tame inflation.

( Bloomberg ) -- China's stocks tumbled, (not shown in the chart) putting the benchmark index on course for its worst month on record, as investors speculated the government will increase interest rates this weekend to help tame inflation.

There is speculation among investors that the People's Bank of China may raise rates again over the weekend in order to curb inflation. The Shanghai Composite Index fell another 5.3% last night.

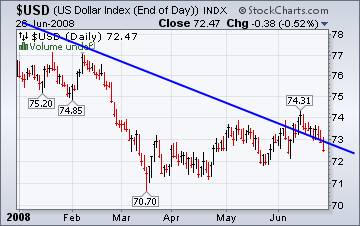

The dollar's woes are not over yet.

( Reuters ) - The U.S. dollar slumped on Thursday, hitting its lowest level against the euro in nearly three weeks, as investors reduced their expectations for a Federal Reserve interest rate rise this year, and as U.S. stocks slid.

( Reuters ) - The U.S. dollar slumped on Thursday, hitting its lowest level against the euro in nearly three weeks, as investors reduced their expectations for a Federal Reserve interest rate rise this year, and as U.S. stocks slid.

The trendline didn't hold, throwing the Dollar back into its funk. Let's see whether it climbs back above the trendline or not. The pattern leaves room for that possibility.

Will someone with clean hands look at our problem?

Congress hopes to pass a bill soon that aims to rescue enough at-risk homeowners to put a price floor under a collapsing housing market. In theory, everyone benefits. In practice, well, the rescue plan itself might end up needing a rescue, at taxpayers' expense.

The problem is, the type of people who are crafting this legislation don't have clean hands. They are using their legislative powers to benefit themselves at taxpayer expense. Are we laughing or crying about this? Senator Dodd, move over!

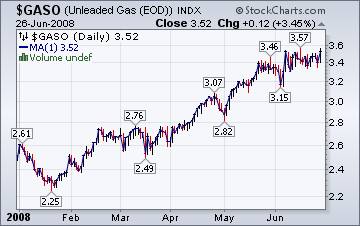

Ouch! $5.00 gasoline is around the corner.

The Energy Information Administration's This Week In Petroleum tells us that; “Frugal drivers these days scour the roads for gasoline under $4.00 per gallon in the hopes of getting the most from their fill-up dollar. But it's not just the amount of gasoline per dollar that matters anymore. Attention has increasingly turned to the miles a driver can get from each gallon. More and more people are purchasing fuel-efficient vehicles, while websites are popping up offering tips for increasing miles per gallon in any vehicle: keep the tires properly inflated, drive at or just below the speed limit, drive gently (rapid acceleration or deceleration wastes fuel), keep fuel and air filters clean, etc. But not only does the type of car you drive – and how you drive it – affect miles per gallon, so does the fuel you put in that car.”

Elevated prices related to growing “financial investment” in natural gas.

The Energy Information Agency's Natural Gas Weekly Update avers that natural gas prices far surpasses historical prices for this time of the year. “Increases in demand from electric generators meeting air-conditioning demand have already occurred in the Southwest and part of the East Coast earlier this month and are expected to expand as the summer proceeds. In addition to the increasing demand from hot temperatures around the country, the elevated price level for natural gas currently appears related to growing financial investment in many commodities, including metals, agricultural products and crude oil, resulting in steep prices increases. Since the beginning of 2008, the spot price at the Henry Hub has increased $4.93 per MMBtu, or 63 percent, to yesterday's average of $12.76.”

The Energy Information Agency's Natural Gas Weekly Update avers that natural gas prices far surpasses historical prices for this time of the year. “Increases in demand from electric generators meeting air-conditioning demand have already occurred in the Southwest and part of the East Coast earlier this month and are expected to expand as the summer proceeds. In addition to the increasing demand from hot temperatures around the country, the elevated price level for natural gas currently appears related to growing financial investment in many commodities, including metals, agricultural products and crude oil, resulting in steep prices increases. Since the beginning of 2008, the spot price at the Henry Hub has increased $4.93 per MMBtu, or 63 percent, to yesterday's average of $12.76.”

Don't fall for the blame game.

U.S. sales of newly constructed single-family homes fell 2.5 percent in May to a 512,000 annual rate and were down over 40 percent from a year ago, government data on Wednesday showed. The fact is, folks, new home sales have fallen two years in a row.

Professor Michael Lehmann writes in the San Francisco Chronicle that the growth in home sales rose by 50% from 2000 to 2005. That was the equivalent of the 100-year flood. Now we have to clean up the aftermath. The article is entitled: “Root Cause”

Federal Reserve policy lies at the heart of the crisis. In response to a high-tech bust, the Fed lowered interest rates to stimulate a housing sector that already enjoyed boom conditions. That mismatch of diagnosis and treatment built the foundation of all that followed, including the Fed's current difficulty in resuscitating residential real estate.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.