7 Bullish Gold Price Indicators

Commodities / Gold and Silver 2015 Sep 29, 2015 - 11:44 AM GMTBy: SecularInvestor

It is getting very exciting in the gold market! We have shown several bullish gold indicators in the last couple of weeks. Here is the thing: the number of bullish indicators keeps on growing.

It is getting very exciting in the gold market! We have shown several bullish gold indicators in the last couple of weeks. Here is the thing: the number of bullish indicators keeps on growing.

First, GLD ETF, the largest exchange-tradable gold ETF, has the lowest put-to-call ratio since 2012, right after the failed attempt of gold to break through its all-time high. Chart courtesy: Bloomberg.

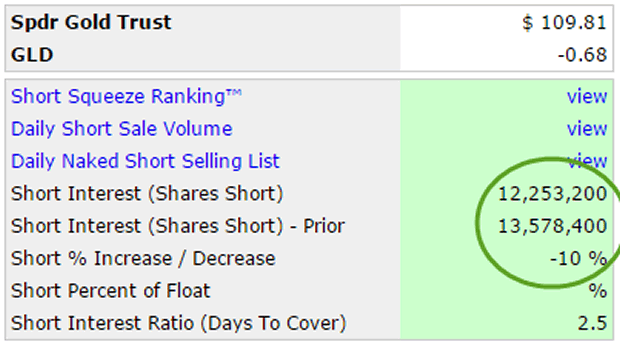

Second, the number of short positions in GLD ETF has reached long term lows. Although we are not able to show the long term chart, as it is protected material by shortsqueeze.com, we can pull up the following table. Note how the latest update from this week points to a 10% decrease of shorts compared to two weeks ago.

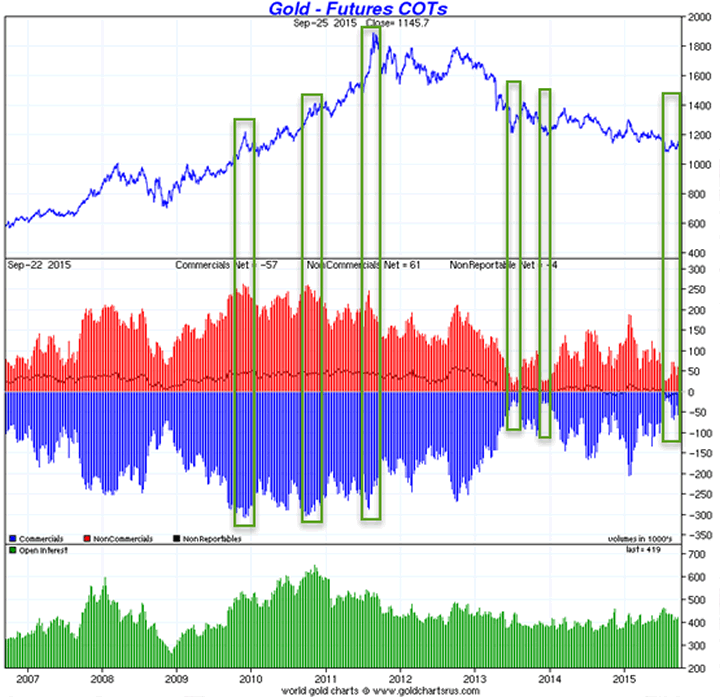

Next, the COMEX futures market shows historically low short positions by commercial traders. Readers know meantime that we attribute a high importance to this indicator, although we believe it is not a ‘stand-alone indicator.’ Next to that, mainly extreme positions carry a predictive value.

Earlier this week, we showed the 3-year COMEX chart. The 9-year shows an even clearer picture. Chart courtesy: Sharelynx.

Note how the dynamics in the COMEX market are ready for a trend change. During the uptrend, shorting power from commercial traders topped at a certain level, and increasingly less shorting power was required to turn prices lower.

During the downtrend, however, the opposite has taken place: each subsequent extreme position in commercial short positions has lead to marginally lower lows. This trend points to changing market dynamics.

At these low price levels, the number of bullish indicators keeps on growing, and that points to a trend change.

More proof is to be found in the gold miners. The mining sector is another leading indicator for the precious metals complex. Today, we are witnessing a bifurcated gold mining sector, with a couple of names outperforming in a truly explosive fasion.

Let’s summarize our 7 favorite BULLISH indicators in the gold market:

- Quality gold miners are strongly outperforming their peers, pointing to bifurcation in the gold mining sector.

- Shorts in GLD ETF have reached the lowest levels in years.

- The ratio of put-to-call options in GLD ETF is as low as in 2012, right after gold’s all-time high.

- Commercial traders in the COMEX gold futures market are at historically low levels, with marginally lower lows in the gold price.

- The gold to S&P 500 ratio is not declining anymore.

- Gold sentiment is so horrible that it reached truly contrarian levels.

- With stock and bond markets peaking, the alternatives for gold investments are becoming considerably less attractive.

Meantime, the gold miners in our Gold & Silver Report are largely outpeforming the general gold mining indices. Since July 24th, the HUI index has basically gone nowhere, with a 0% return, which is still 6% better than the S&P 500. Since July 24th, our selection of gold and silver miners from our Gold & Silver Report are up 13%.

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.

Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

© 2015 Copyright Secular Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.