The Big Nasty Deflation Word Is Here

Stock-Markets / Financial Markets 2015 Sep 24, 2015 - 12:22 PM GMTBy: Doug_Wakefield

Nomi Prins latest book, All the Presidents Bankers, allows the reader a glimpse into the comments and actions of those sitting at the highest levels of finance on Wall Street since the open of the 20th century. As I look at where America and the world markets stand today, coming off the top of the 29th financial bubble in history, I believe that a quick examination of two Wall Street bankers from two past market tops is a worthy place to start.

Nomi Prins latest book, All the Presidents Bankers, allows the reader a glimpse into the comments and actions of those sitting at the highest levels of finance on Wall Street since the open of the 20th century. As I look at where America and the world markets stand today, coming off the top of the 29th financial bubble in history, I believe that a quick examination of two Wall Street bankers from two past market tops is a worthy place to start.

The first individual was Albert Wiggin, President of one of the Big Six Banks in America at the time, Chase National Bank. Wiggins’ start in banking was most certainly a rise to the top at an early age. In 1892, at age 24 he was married; became the assistant cashier to the Third National Bank of Boston at age 26; at age 31 became the vice president of the New York National Park Bank, and by age 36, was the youngest vice president ever of the powerful Chase National Bank.

He has known in American history for stepping in to save the American financial system during the collapse of US markets in the Crash of 1929.

“On Black Thursday of the Wall Street Crash of 1929, Albert Wiggin joined with other senior Wall Street bankers in an attempt to save the collapsing stock market. On behalf of Chase National Bank, Wiggin, along with other bankers, committed substantial funds for an investment pool.” [Wikipedia, Albert H. Wiggin]

The Wikipedia post on Wiggins then attest to the fact that prior to the Crash of 1929, Wiggin’s shorted 42,000 shares of his own bank, netting him a tidy sum of $4 million. According to the US Inflation Calculator, based on the devaluation of the US dollar between 1929 and 2015, this would be equal to a sum of $55.7 million today.

Prins takes us even deeper into Wiggins’ actions in 1929.

“During the bull market, he had organized investment pools that bet on shares of Chase Securities and Chase National Bank to inflate their values. He also cut some of his friends in on the action, and made sure that everyone borrowed from Chase to pay for their holdings. His family extracted $8 million of loans from Chase, even though they could have afforded to buy stock without loans. They used those loans to purchase more stock to inflate its values further.”[pg 103 of 524 in Kindle Edition]

As Wiggins certainly showed by his own actions with his personal money, he clearly understood that timing was extremely valuable, when you are lending to speculators and sitting atop a boom before the bust.

“Wiggin knew he was covered no matter what happened. Shortly before the Crash, he shorted shares in his own bank by borrowing shares from various brokers at prices he anticipated would fall, at which time he would buy the shares in the market at lower prices and return them to the brokers, making money on the difference. When the Dow stood at 359 on September 23, 1929 (the market had topped out twenty days earlier at 381), he placed what would be a hugely profitable bet that Chase’s stock would fall…..” [ibid]

And thus Wiggins made over $10 million from using $200 million of his depositors’ money to speculate as Chase stock was inflating, and then made $4 million personally by shorting his own bank’s stock when it rapidly deflated during the crash that October.

Even though Wiggin’s presented ways to reduce taxes and tariffs as a means to stimulate the economy in the bank’s 1931 annual report (assisted by the bank’s economist Dr. Benjamin Anderson), policies that would go unheeded at the time; his personal actions of promoting his own stock at the detriment of his depositors and his own family while profiting personally from the blow off into the top, as well as profiting by short selling his own bank’s stock during the Crash, should be a reminder to us all of the deceptive side of the history of markets.

Ethics, honesty, and transparency are usually overlooked when the public is pleased with their investment returns. I mean hey, who wants to stop the party when the state is providing the punch bowl of cheap credit…even if this is what was taking place in the 1920s before the Crash of ‘29. And long term consequences? I know, they are always out there in the future….or are they?

From 1929 to 2007

While the events of 1929 was way before my time, and my father was only 4 at the time, I have many stories connected to the top in 2007, having released my research paper, Riders on The Storm: Short Selling in Contrary Winds in January 2006. So when Prins wrote of 2007, this was my history and yours as well.

Prins discussion of events in 2007 reveal why an understanding of what we are NOT learning from history becomes even more critical at market tops than what we have recently experienced from the deluge of cheap credit.

“There were massive problems plaguing Wall Street. Yet in a July 9, 2007, Financial Times interview, Prince (CEO of Citigroup) talked up Citigroup’s strength. Reminiscent of Charles Mitchell (President of National City Bank, which later became Citibank in 1976) nearly eighty years earlier, he said, “When the music stops, in terms of liquidity, things will get complicated. But as long as the music stops, you’ve got to get up and dance. We’re still dancing”[405 of 524 in Kindle Edition]

Well, it wasn’t but a few months later that the music stopped. Prins points out the on November 4, 2007, there was an emergency board meeting because of various rising losses in Citigroup’s positions, Prince resigned. He stated at the time, “Given the size and nature of the recent losses in our mortgage-backed securities business, the only honorable course for me to take as chief executive officer is to step down.”

When he resigned in 2007, his salary and bonuses from the previous 4 years totaled $53.1 million, and to assist him during this transition phase, a $99 million golden parachute. [Ibid, pg 406]

When the music stopped in 2008, massive losses continued to mount.

For the millions of investors in buy and never sell strategies today who look at the values on their statements today, trusting that the Federal Reserve will always cut rates and always flood the system with more cheap debt as though this were some sacred rite of passage for the American investor, I can only say two words. Wake up!

Lessons for 2015 from 1929 and 2007

Prince made the comment in the summer of 2007, “When the music stops, in terms of liquidity, things will get complicated.” He should have said, “When the music stops, in terms of liquidity, investors are going to lose big.”

Every investor expects that there will be plenty of liquidity, or in laymen’s terms, plenty of buyers for their investment or plenty of cash to exit into when they get ready to cash out a portion of their investments and go spend the money. Yet, the problem Prince certainly must have known about in July 2007 was the collapse of two Bear Stearns hedge funds in June, wiping out $1.8 billion of investors’ capital. Before the public would see headlines celebrating the Dow’s close above 14,000 for the first time on July 19th, trouble with liquidity had already started.

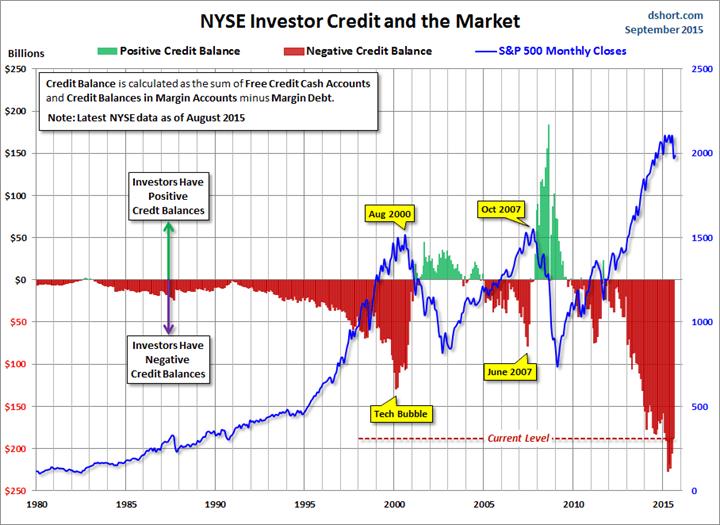

[Chart pulled from March 6, 2015 issue of The Investor’s Mind: The Great Liquidity Ruse]

Now we leap to this spring. How much longer can the public expect interest rates to fall when looking back at where we have already come since Volcker was the Chairman of the Fed in the early 80s, and US Treasury yields reached their highest in American history?

Right now, in the short term, this decision may come down to the choice of holding assets in markets that hit their highest levels ever this spring or summer, or in holding US Treasuries, the largest bond market in the world and still today considered as only 1 of 3 assets ranked as Tier 1, the safest level, by the BIS.

We know today that Prince’s comments in 2007 about a lack of liquidity making things complicating was a prescient warning. So why not look for comments on liquidity from another banking powerhouse?

We turn now to the annual shareholders report of JP Morgan bank that was released this spring. While the mainstream idea of, “They print money, market goes up” has brought about the misleading idea that the Federal Reserve can always print more debt and stocks will always start climbing again, nothing could be more polar opposite from the truth and the lessons on financial bubbles.

QEI, II, and III have closed since the 2008 crisis, and yet we find that we have LESS liquidity today than in 2007. Notice I said less liquidity, not less debt or Treasuries that represent that debt.

Consider Morgan’s description of the extreme importance of having enough liquidity across the system:

“Liquidity in the marketplace is of value to both issuers or securities and investors in securities. Liquidity can be even more important in a stressed time because investors need to sell quickly, and without liquidity, prices can gap, fear can grow and illiquidity can quickly spread – even in supposedly the most liquid markets.” [pg 31 in stockholders report]

The report goes on to explain to its stockholders, and frankly, anyone seeking to learn what has taken place since 2008, that the inventories of the market markers for US Treasuries has declined to $1.7 trillion in 10 year Treasuries today from its peak of $2.7 trillion in 2007. During the same period, with the flood of debt being created to inflate lending for speculation on higher and higher asset values, the US Treasury market globally has grown to $12.5 trillion from $4.4 trillion.

The more debt that was created, the more big banks, sovereign wealth funds, and large investors were buying up US Treasuries, even directly from the US Treasury. This was taking place while market makers, or dealers in our capital markets, were watching their supplies shrink.

Why did these big institutions and central banks stash away even more than the amount of US Treasuries created since 2008? Did big money understand that this was merely another boom that would eventually lead to a painful bust one more time? Were they preparing for the time when cash would be hard to find, and buyers panic not to get in, but to get out of “all time high” markets?

The other lesson that investors need to learn very quickly is the one Albert Wiggins leaves us with today. When you tell your clients and family to go out and borrow $8 million to bet on your stock going higher, that borrowed money is mostly coming from margin loans. Works great on the way up but becomes deflating collateral against a constant debt on the way down. Since margin loans are backed by securities that can change value quickly, the lender can literally demand overnight you start shrinking your asset position to meet certain ratios of asset/debt as prices start falling across an investment or market.

[Chart from Lance Roberts of STA Wealth Management in NYSE Margin Debt Declines Again, Sept 17, 2015]

As Lance Roberts recent chart above makes clear, the massive amount of debt from QE allowed the massive growth of margin loans underneath stock prices.

So as we look at the history unfolding in front of us, may we return to the history behind us, and learn from it as fast as we can. Now the lessons from history become more than some dry academic subject, but the deflationary realities of bear markets of the past.

Cheap credit fueled bubbles seduce the public that investing is easy, especially if the state, ie the central bank, is constantly touting that it will do whatever it takes to stop the deflating of the every bubble its cheap credit polices have inflated!

“Why such a big difference in the response to the initial sharp drop in Chinese equity prices in June and the subsequent shocks?… The initial equity drop was probably largely seen as a natural, to some extent intended, market-specific correction from blatantly overstretched valuations.”[Underlined text my own, Comments by Claudia Borio, Head of the Monetary and Economics Department at the Bank of International Settlements, at the media briefing to the release of the Sept 2015 Quarterly Review on Sept 13th]

"So the Fed kept filling up the punch bowl [referring to the period between 2002 and 2005]. And as opposed to going into inflation of goods prices, it went into an inflation of asset prices.

That's inflation in the same way, but its not called inflation. So if the stock market goes up we don't say, 'Oh my god, there has been inflation', or if housing prices double we don't say 'oh my god, there has been this enormous inflation', we say, 'How much richer we are!' But the problem is that we are not richer, it is simply an illusion of richness." Dave Colander - Professor of Economics at Middlebury College (minute 59:00)

Be a Contrarian, Remember Your History

The big shift from longs to shorts and shorts to longs is underway around the globe, as every major equity market is now under its 200-day moving average, and the global deflationary slowdown sets in. Don’t be mislead by hope in the “unlimited OZ”. Trade on the lessons from history.

Click here to start the next six months reading the newsletters, reports, and group emails as the bust phase grows stronger.

On a Personal Note

Check out Living2024. It is my personal blog. I wanted to have a place to write stories about where this entire drama seems to be taking us all. Check out my latest post, Please “Assist” My Investments.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.