Fed, Central Banks Trapped – Gold Bullion Will Protect

Commodities / Gold and Silver 2015 Sep 23, 2015 - 03:17 PM GMTBy: GoldCore

By David Bryan

By David Bryan

The future direction of the planet is between the central bank’s counter-party paper Ponzi currency or the independence of real money.

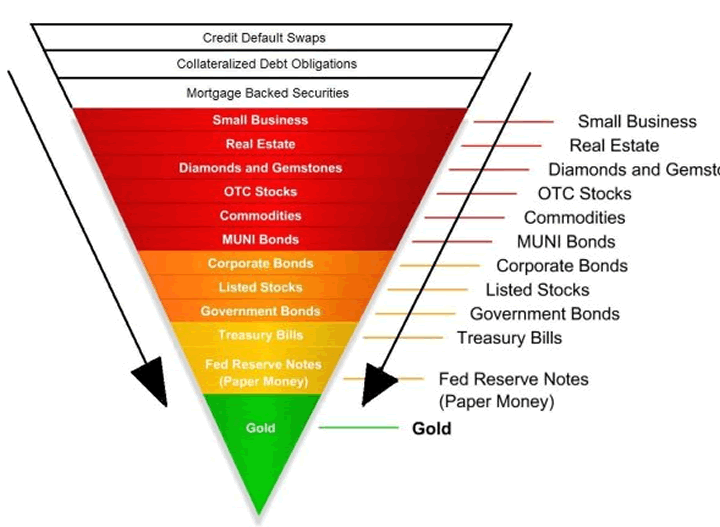

Foresighted central banker John Exter is famous for his classification of risk assets. Using Exter’s Golden Pyramid the riskiest assets are those at the bottom of the pyramid and situated at the top of the apex is gold bullion – independent from the counter-party risk of central bank’s paper and electronic currency.

Exter’s Inverted Risk Asset Pyramid (via ZeroHedge)

At the bottom of the wealth asset pyramid are over leveraged paper derivatives estimated to be a magnitude of up to six times the world’s wealth. An example of this is in Germany today where it was recently estimated that Deutsche Bank has a massive 70 trillion dollars worth of exposure to derivatives. Meanwhile, annual GDP in Germany is just 4 trillion dollars.

Warren Buffett warned of these “financial weapons of mass destruction.”

This staggering giant paper Ponzi of unpayable leveraged finance means there are multiple counter-party paper claims within complex risk structures that will bankrupt the entire counter-party paper and electronic global financial system in a derivative collapse.

The downward arrows on the Inverted Pyramid point to wealth fleeing from the perceived risk of unpayable counter-party paper to the ultimate assured protection of gold as independent money that offers the security of having a physical asset that will retain liquid disposable wealth.

Gold is the mortal enemy of the central bank counter-party paper system, to prevent the flight of capital away from the Ponzi of paper finance markets and into independent wealth, the price of gold is tightly suppressed by the central planners as documented by GATA, especially during times where there is market uncertainty or periods of geopolitical stress.

Losses from deleverage and deflation since the 2008 paper crash have been so immense that central banks counterfeit of quantitative easing has been necessary to prevent a collapse of the derivative complex.

At the same time re-inflated worldwide stock markets have become totally dependent on managed central bank intervention for life support, while gold and gold mining shares have been monkey hammered even though the physical demand for gold greatly exceeds world mining supply.

From trying to meet insatiable world demand, the Western gold pool has reached a critical level of available supply that could finally end the ability of central banks to maintain their gold price suppression.

Within the structure of a central bank counter-party paper Ponzi, central banks are trapped into a future of negative interest rates and the end of capitalism.

For capitalism to work there must be a return on capital and no amount of counterfeited money or easing can re-engineer the tragic collapse of a financial house of cards built on a pyramid of unpayable leverage or prevent gold from being independent money!

The smartest money on the planet has logically anticipated in advance the tragic end of the central bank paper Ponzi and has positioned in secure physical gold that is held in storage free from the risk of counter-party failure.

The eventual staggering monetary value of one ounce of physical gold, will be the amount of quantitative easing that is required to try and save the derivative complex which is thought to be in excess of one quadrillion dollars, plus attempts to rescue the bond markets, worldwide stock markets and the Ponzi of unallocated gold instruments where upwards of 200 claims exist for every ounce of gold sold, divided by the ounces of gold in the world.

Money

Money is defined as any good that can be used in exchange for other goods and services and as payment of debt. It has to be a tangible asset to be a sound unit of measure to value other goods and services, to act as a stable unit of exchange and to provide a lasting store of value that can protect wealth.

Counter-party money is someone else’s liability, it is the liability owed to the issuing central bank and it has no value apart from a legal stipulation that prevents real money from being used in competition.

Gold

Gold has natural physical wealth and real value. Gold does not have a national currency or a state boundary and serves people equally every place in the world. Gold, when used as independent money, prevents the central banks from their destructive false counter-party claim to exclusively control and centrally plan the nation’s’ economy. Gold cannot be printed into existence so it does not have the artificial risks that come from using the central bank’s Ponzi of counterparty paper finance. Gold is the peoples’ real wealth that protects them from corrupt government and financial institutions. Gold is the money that cannot go broke. For several thousands of years every country in the world has used gold or silver to guarantee the independence and value of their currencies.

The gold held in the nation’s treasury belongs exclusively to its citizens. When used as the backing for their currency it has the physics of real wealth to properly fund their enterprise, it is a reliable physical unit of value to be used in the exchange of their goods and services, it has an indestructible lasting store of real value that safely protects their wealth for generations to come and ensures the stable progressive economic health of their nation.

See Einstein, Physics, Gold and The Formula To End Economic Decay.

Enterprise

Enterprise is the energy behind all productivity and creates all prosperity. There is no substitute for enterprise and yet banks and socialist politicians would have us believe that enterprise is not necessary to create wealth. These same banks and socialist politicians would have us believe that we should use only fake money and lose independence to their central planning and control.

Alignment

Money should be measured in terms of gold. Nations aligned by gold safely interact with each other without the fluctuation risks of exchange rates or from the central bank counterfeiting theft that is quantitative easing.

Acquiescence

Counterparty is accepting someone else’s liability. When that institution acts criminally such as counterfeiting the money we use, then by acquiescence we are counterparty to the fraud.

Independence

Independence is when money has value, when we do not acquiesce to become counterparty to central banks and government fraud.

Freedom

Freedom and prosperity begins with the use of independent money to fund our enterprise. Our freedom and prosperity ends when we adopt the counter-party theft of central bank’s monopoly money.

“Trapped Central Banking and Gold” is adapted from The Astounding Brilliance of The Ancients Perpetuated – www.thetibetansecretblogspot.com by David Bryan, based on factual knowledge of the natural physics of energy and matter, six senses and the Wheel of Life.

DAILY PRICES

Today’s Gold Prices: USD 1124.60, EUR 1010.97 and GBP 734.77 per ounce.

Yesterday’s Gold Prices: USD 1129.30, EUR 1009.11 and GBP 729.66 per ounce.

(LBMA AM)

Gold in GBP – 1 Week

Gold ended with a loss of 0.7% and fell $7.80 to $1.125.40 per ounce yesterday while silver fell 38 cents to $14.81 per ounce. Gold in sterling is testing recent resistance at the £740 per ounce level and has reached its highest price since the end of August today.

In Singapore, gold bullion ticked a little higher and maintained those gains in London, hovering just below the $1,130 per ounce level. Silver prices are 0.3% higher to $14.90 today, while platinum is 0.5% higher and palladium has surged 2.3%.

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.