Gold And Silver - Ufa. Why It Matters But Does Not

Commodities / Gold and Silver 2015 Sep 19, 2015 - 01:51 PM GMTBy: Michael_Noonan

To almost all Americans mentioning Ufa will bring a blank response. What is Ufa? None would ask, "Where is it?" for there has been no mention of it anywhere in the mainstream media. Does Ufa matter? Yes, but in this country it does not.

To almost all Americans mentioning Ufa will bring a blank response. What is Ufa? None would ask, "Where is it?" for there has been no mention of it anywhere in the mainstream media. Does Ufa matter? Yes, but in this country it does not.

Here is a primer on understanding many acronyms the average American has no clue even of their existence. First of all, Ufa is not an acronym, it is the capital and administrative center of Bashkortostan Republic, Russia. It is one of the largest Russian cities with a population over one million people. It was founded in 1574. Now you know more than 99.9% of the average American, with just two sentences.

On to the acronyms: BRICS, Brazil, Russia, India, China, and South Africa, the core nations creating an alternative to Western [destructive] domination. SCO, Shanghai Cooperation Organization, originally organized as a military cooperative in Asia, akin to NATO, but has since taken on some additional economic importance, as well. EEU, the Eurasion Economic Union, akin to the EU, European Union. [This may begin to seem like a refrain from the East to the West: "Anything you can do, we can do better."] AIIB, Asian Infrastructure Investment Bank, and NDB, the BRICS' New Development Bank, counterparts to the IMF and World Bank, but without the required onerous debt burdens. Finally, CRA, Contingency Reserve Agreement, yet another layer of reducing the importance of Western financial domination.

It would not be an unfair comparison to state that next to world chess player, Vladimir Putin, Barack Obama is an ordinary checkers player with just moderate skills. In mid-July, while Obama was forcing an unnecessary nuclear restraint against Iran, a country with no nuclear capabilities, except according to the neocons in the United States, Putin convened a summit of the BRICS members, [while 5 nations, it has associate members in excess of 100, those tired of the American version of how the world should be run, or better said, ruled.], combined with the EEU members.

It marked the official launch of the NDB, providing a unified economic lending benefit outside of the Western banking stranglehold, bypassing and making irrelevant the fiat "dollar." The BRICS also established the Contingency Reserve Agreement [CRA], with an additional $100 billion available to member states and effectively renders the overly stringent requirements of the IMF and World Bank as superfluous and makes for new competition to Western dominance, which continues to weaken.

The combination of the NDB and CRA bolsters economic ties with BRICS members, making it easier to obtain loans to strengthen national reserves, if needed, all without using the Western International Monetary Fund [IMF] and World Bank. Perhaps more importantly, there is zero need for using the US fiat "dollar" as the now mostly Western world's reserve currency.

Why was none of this reported in the US press? "Keep them stupid," is probably the simplest response. What people do not know cannot hurt them, and it allows the elites to do everything and anything they want with little repercussion from a unknowing mass of ignorant citizens. Essentially, Western financial dominance is being displaced, and this will critically harm US interests, especially for the unsuspecting inhabitants who question nothing the [non-representative] US government does.

The summit at Ufa spells the eventual demise of the US fiat "dollar, " which, in turn, will produce major financial disruptions to all Americans [Wall Street bankers and immune politicians excluded], when the fiat Federal Reserve Note [blindly accepted as real "money" by Americans and others throughout the world], loses half of its value, or more. If the implications behind Ufa are still not clearly understood, the Eastern powers have already been doing business without the fiat "dollar," and Washington is helplessly beside itself as it loses control. [Expect more [smaller] wars, and do not rule out a big one.]

The world is fast changing, and while Ufa is not a dominate feature on the world stage, it is an important one of so many, unnoticed by so many American, so unaware. Those unaware are unaware of being unaware. So true.

As we approach the last Quarter of 2015, what changes failed to develop in 2013, 2014, and now 2015, [so far], could conceivably extend into, even beyond 2016. The US has sponsored numerous proxy wars, Ukraine being one, and the Middle East being the center hotbed for so many more, all diversions to keep people's minds preoccupied with minor [relatively speaking] skirmishes, [not to diminish the tragic loss of so may innocent lives].

These distractions are meant to detract from the Globalist's stripping the wealth of the Western world, QE-Forever, ZIRP, negative rates, banning of cash, and the biggest and least acknowledged war on gold and silver, anathema to printing infinite amounts of fiat to finance the theft of people's wealth.

The National Security Administration [NSA], [the larger and true-to-life-version of George Owell's "1984"], the ongoing militarization of police around the country, confiscation of all wealth via fiat-issue, the destruction of the middle class and elderly, actually, the American way of life, are visible [but often unseen by the public] signs of the end of this country as the US, as a nation, continues its unabated slide into Third World status.

Will gold and silver accumulation save you? That has been the conventional wisdom. Is it still valid? Yes and no. Yes, in that one will be far worse off without either, and being prepared is more than half the battle, and make no mistake, people are in a battle against the corporate federal government [for many, unknowingly and inconceivably].

What about the "No" part? No one knows the extent to which the government will clamp down on the citizens over which it rules. Banning cash becomes more vocal, to wit, the Rothschild's Bank of England just made such an announcement. It will be the end of financial freedom and make owning/dealing in/with gold and silver more problematic.

In banning cash, and while not a done deal [the US survives on the narcotics trade which uses only cash, so that has to be solved, first], the government will be able to monitor every single transaction by citizens who must rely solely upon digital currency. Buying gold or silver may well be viewed as a "terrorist" act to subvert the "legal" digitalized "currency system."

With relatively few American owning either gold or silver, with whom will you be able to interact buying/trading/bartering in exchange for your gold/silver. Plus, you run the very real risk of being "ratted out" by someone who would be more than willing to do his or her [un]"patriotic" duty to inform authorities, maybe even receiving some kind of reward for doing so. It will not be easy to transact or trade in PMs.

That said, black markets have always existed, and oppressed people will always find a way.

To be without gold or silver is an invitation to be fully shorn by whatever existing powers that be. The fact that PMs have been so artificially suppressed; the fact that the elites demand payment in gold/silver first and foremost is another message of the importance of owning same. Do what they do, not what they say.

The end game is at hand. It can and will go on for much longer than most people expect, as the passing of 2013, 2014, and most of 2015 have amply demonstrated. Do not allow yourself to be distracted, not by events, not by suppression, and not by the passing of time.

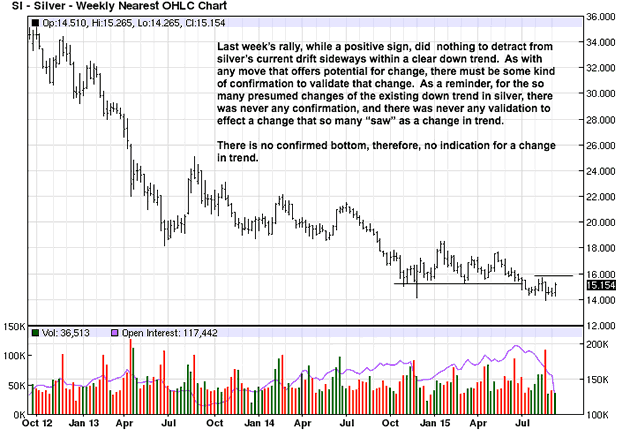

Stay focused and continue the accumulation of both gold and silver. We reiterate that the gold/silver ratio favors accumulating silver over gold, at this point.

A look a the charts...

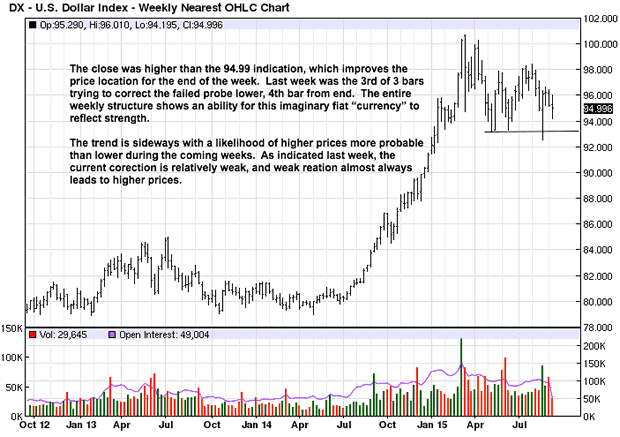

We include the fiat "dollar" due to its perceived importance and stating it is the enemy of the enemy, in that gold and silver give lie to the lies of the central bankers who use fiat to confiscate your wealth as well as of nations. The undeniable and observable fact is that the "dollar" is acting relatively well. If you note how little the current trading range has retraced gains from the 2014 lows, it speaks to how the probability of the "dollar" prices going higher remains high.

For as long as this controlling fiat stays strong [for how much longer?], it is hard to see how gold and silver will be able to recover from current levels, even slightly higher levels.

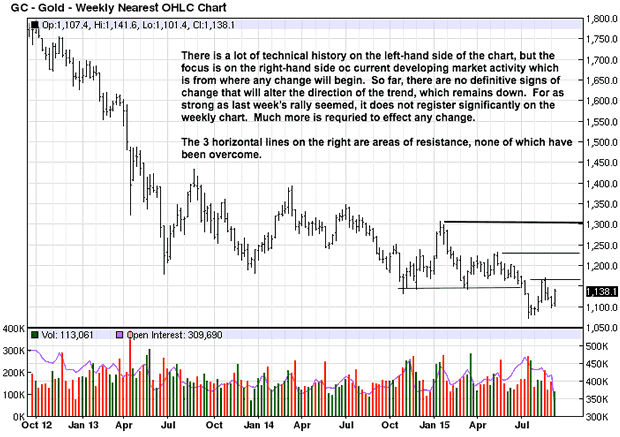

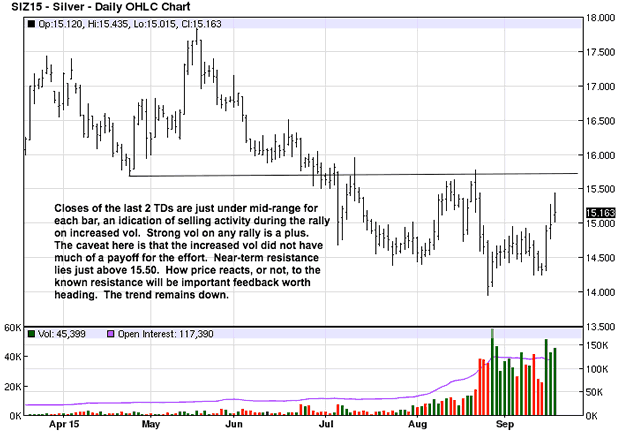

Where "pictures" say a lot, there is little reason to add more, and the chart comments are on point.

Do not be taken in by the rally of last week. There have been larger ones, January comes to mind, that have failed, over the past 5 years. Markets take time to bottom, and we do not see a bottom in place. Patience remains the watchword, as if there were a choice.

You can see how slight progress has been, even to the downside, since October '14.

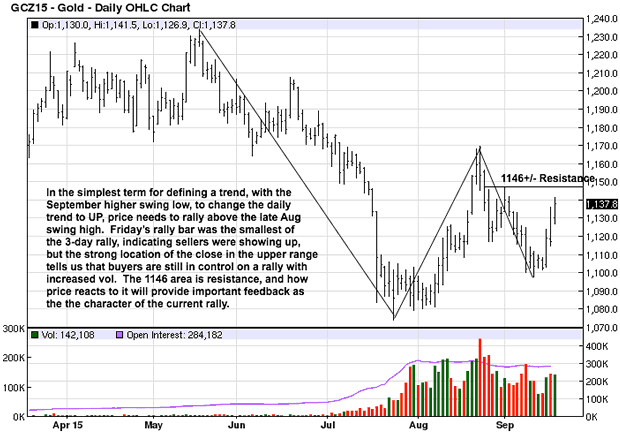

Until there is a conclusive washout, lower, or a more substantial rally on volume and with demonstrated staying power, expect more of the same.

If more could be said than that which already has, we would say it. Nothing more can be added, at this point, for more needs to happen.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.