Time to Invest in Gold? Consider These Four Factors First

Commodities / Gold and Silver 2015 Sep 18, 2015 - 06:35 AM GMTBy: Investment_U

Sean Brodrick writes: The market expects gold to go lower as the Fed raises interest rates. That’s because gold pays no interest, unlike bonds. In fact, more than $2.6 billion was wiped from the value of gold exchange-traded products (ETPs) in just three weeks as investors awaited the Federal Reserve’s meeting. Ouch!

Sean Brodrick writes: The market expects gold to go lower as the Fed raises interest rates. That’s because gold pays no interest, unlike bonds. In fact, more than $2.6 billion was wiped from the value of gold exchange-traded products (ETPs) in just three weeks as investors awaited the Federal Reserve’s meeting. Ouch!

And in all, since gold entered a bear market in April 2013, a whopping $54 billion in value has bled out of gold ETPs. Holdings in bullion products fell to 1,508.2 metric tons on August 11.

That’s the lowest since 2009.

As the saying goes, trying to catch a falling knife is a good way to end up with bloody fingers.

But I don’t think that’s the case here. In spite of low prices and the threat of a looming interest rate hike, I’ll give you four good reasons why gold and miners are ready to blast off.

Gold Bullion Inventories Are Very Tight

Recent weeks have seen the cost of borrowing gold in London head sharply higher. Why would someone need to borrow gold in London? That’s a fair question.

What I’m referring to are the dealers who need to make good on contracts to deliver the yellow metal to refineries in Switzerland. There, the gold will be melted down and sent to Asia, where it tends to vanish. (For more on that story, check out this piece from April.)

The Swiss bankers used to be able to count on buying metal from the big gold ETPs. But with inventories in those funds scraping bottom, gold may be harder to come by, which, in turn, should up the price.

India’s Gold Imports Are Surging

India’s imports of gold jumped to more than 120 metric tons in August. That’s the highest level so far this year. In August 2014, the figure was a mere 50 metric tons. This despite the fact that India still has a 10% import duty on gold.

But India’s gold-crazy festival season is coming up. And so far, with prices at a month-long low, gold is looking like a bargain.

India’s government hates that its people have such a love for this “barbarous relic.” Recently, it approved two plans to lower physical demand for gold: sovereign gold bonds and gold monetization.

The sovereign gold bonds are aimed at curbing domestic demand for physical gold among investors. People can turn in gold and get bonds against them, paying an interest rate of around 3%. The bonds are for five to seven years, and for five, 10, 50 and 100 grams of gold. However, the depositor earns an interest rate below regular Indian government bonds (recently 7.75%). And that won’t compensate him for various risks.

In gold monetization, people turn in bullion or jewelry at a bank. While it’s being held, the owner will earn 2% to 3% in interest, tax-free. The aim here is enhancing the domestic supply of physical gold for jewelers. India is doing this because it wants to get the masses of idle gold lying dormant in vaults and households throughout the country out into the open. It’s especially meant to appeal to temples rumored to be sitting on vaults of gold.

So how well are these schemes working? Well, Indian gold imports are surging. That tells me these grand plans aren’t working at all.

Chinese Gold Demand Is Strong, Too

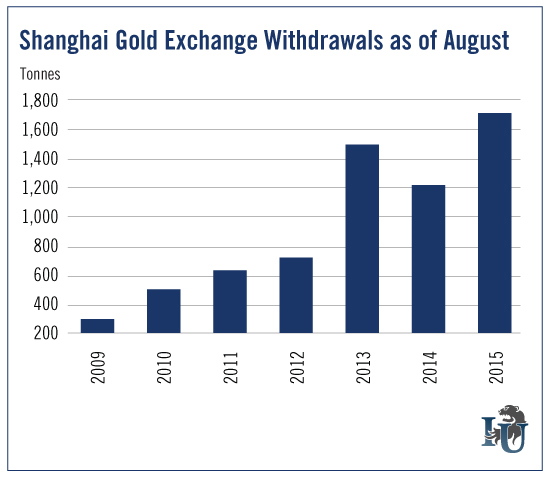

China’s gold demand as tracked by deliveries out of the Shanghai Gold Exchange (SGE) is very strong over the summer months - a time when demand is usually weak.

In fact, the flow of gold through the SGE is already 36% higher than last year and 13.5% higher than the level of 2013. And 2013 was a record year.

So, if you’ve been hearing in the media that Chinese gold demand is down this year, well, not if the deliveries out of the SGE are any indicator.

Sure, second-quarter demand was way down. But it’s coming back in a big way. In fact, a recent eight-week period saw 512 metric tons of gold withdrawn from the SGE. That’s higher than global mine production, which would be around 492 tons over the same time frame.

Here’s the thing: Chinese demand is usually stronger at the end of the calendar year as the Chinese New Year approaches. That’s when domestic gold consumption normally is at its highest.

This year isn’t set in stone. But it sure looks like it could set a new record.

Gold Miners Are “Absurdly Cheap.”

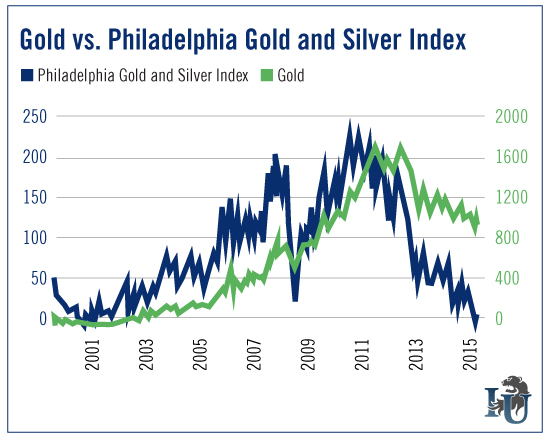

The Philadelphia Gold & Silver Index (XAU), the oldest of the gold miner indexes, has broken the low it made back in November 2000, when the gold bullion price was only $265 per ounce.

Gold stocks aren’t just cheap right now. They’re stupid cheap. Many of them are turnaround stories, just waiting to head higher.

Here are some facts I recently told my $10 Trigger Alert subscribers about mega-miner Barrick Gold (NYSE: ABX)...

- It expects all-in sustaining costs of $840 to $880 per ounce in 2015. The company has made slashing costs one of its top priorities.

- It’s poised to ride a gold rally. Barrick should receive an extra $330 million in incremental EBITDA for every $100 rise in the price of an ounce of gold.

- It’s slashing debt. Barrick is on track to reduce $3 billion in debt by 2016. On top of that, the company has $4 billion in an undrawn credit facility. So it can ride out the bad times.

- Barrick is cheap! The stock is trading at 0.79 times sales and 0.74 times book value.

With fundamentals like this, you know it won’t take much to send Barrick and other quality miners blasting higher. And the really interesting thing is that gold miners look like they might be bottoming right now.

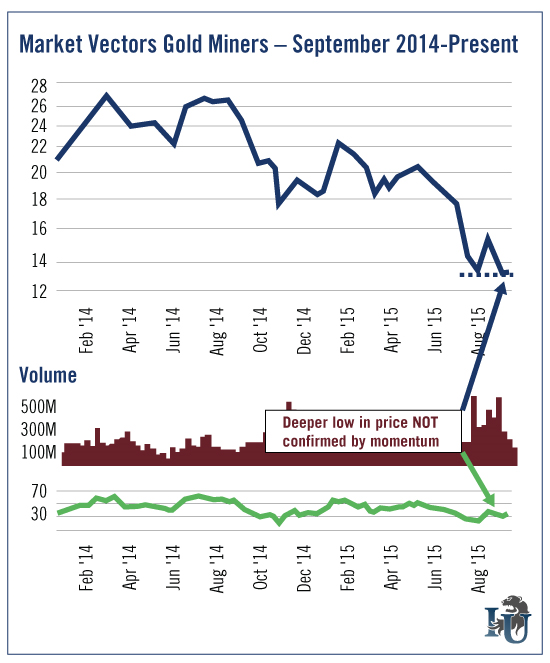

Check out this chart for the biggest gold miner ETF, Market Vectors Gold Miners (NYSE: GDX).

By any measure, that is an ugly-looking chart. But this is where bottoms are formed. And you can see that a deeper low in price was not confirmed by the momentum indicator on the bottom of the chart.

In short: It looks like the bears are running out of steam.

Now, combine this with the extreme undervaluation in miners, the fact that the best miners are cutting costs sharply, the surge in demand out of China and India, and the strange rise in gold lease rates in London. It’s a recipe for a red-hot rally.

When it comes, you won’t want to miss out.

Good investing,

Sean

Editorial Note: In recent years, resources and resource stocks have taken a beating. There’s no question about it. But as we near the bottom, now is the time when opportunistic investors should be licking their chops. The question is: How can you tell the difference between an undervalued yet quality miner... and a company that could be toxic to your portfolio? To help you answer that question, Sean created the Resources to Riches Alliance.

This easy-to-follow course - broken into eight parts - will teach you everything you need to know about investing in the energy and natural resource markets. Even better, we’re currently offering a $50 discount to new members. Simply click this link and enter the code RICH50 at checkout.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.