Refugee Crisis is a Far Bigger Risk to Your Money than the Fed or China

Stock-Markets / Refugee Crisis Sep 17, 2015 - 11:38 AM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes: Today we’re going to talk about the 800 pound gorilla in the room. No politician will touch it and no citizen wants to acknowledge it in an era where political correctness has run amok.

Keith Fitz-Gerald writes: Today we’re going to talk about the 800 pound gorilla in the room. No politician will touch it and no citizen wants to acknowledge it in an era where political correctness has run amok.

But we have to.

“It” is Europe’s desperate refugee crisis, and “it” is by far the single biggest threat to your money today. You’re not hearing about this at the moment but you will in the months ahead.

The situation is considerably more dangerous than a potential Fed rate hike and much more worrisome than China’s economic train wreck. As was the case in 2007 with the Financial Crisis when most viewed it as a localized $300 billion problem and I warned you otherwise, the refugee crisis is a truly global situation, the seriousness of which is unparalleled in modern times.

I have no doubt you have your feelings on the matter just as I have mine. Whether we agree or disagree is moot.

In my role as Chief Investment Strategist for Money Map Press, I do not have the luxury of taking one side or another. My job is to help you protect your money and profit no matter what events are at hand.

That’s what we’re going to talk about today. Then, of course, I’m going to give you my take on what this means for your money and a few specific investments you can make right now to help tame an otherwise unruly situation.

Here’s what no one understands about the refugee crisis… yet.

Put very simply, the refugee crisis is the largest single human movement in Europe since WWII and a religio-sociographic earthquake the likes of which the world hasn’t seen for centuries.

Ultimately, the situation can be a good one.

That’s because adept, intelligent politicians can turn social, political and economic risks into opportunity. Migrants, for example, can backfill an aging European labor pool, are ready to work, and can help by raising overall birth rates to shore up a shaky demographic pyramid.

Wharton University Professor Robert Meyer notes, for example, that refugee immigration can have long term positives. The highly skilled start businesses while the lower skilled or no-skilled take jobs locals don’t want. That’s what happened in the 1960s when Castro sent people packing for the United States. Today, Meyer observes, at least 40% of the start-ups in Silicon Valley have an immigrant as a founder.

Naturally, this is where things get tricky.

Like many people, I am hard pressed to use intelligent and politician in the same sentence these days. A positive outcome is dependent on positive people.

Right now, Europe is a stunted mess and its citizens, like our own, feel economically insecure. Many are still reeling from the global Financial Crisis of 2008-2009.

Citizen trust is at or near the bottom of the barrel when it comes to entrenched political leaders. If even a single Syrian refugee commits an act of terrorism, there’s going to be hell to pay politically. Not surprisingly, nationalist sentiment is building.

Over the short term, this will be played out as humanitarian concerns collide with austerity policies, housing needs and integration. Already strained public finances are going to get crushed. That’s not yet registered for most people.

If Europe is to survive, its self-interested officials have to involve business leaders and private finance in making rapid policy changes. That’s because business leaders are far more direct than political apparatchiks.

They will make decisions based on skills, benefits and training needs that by their very definition involve a level of segregation. Critics will call foul based on the apparent “discrimination” much the way they have lined up against Donald Trump’s position on Mexican immigration. They’re not the same thing.

One is an economic/humanitarian need while the other is a security risk. Countries that have refused to engage abroad are now going to bear the brunt of that failure. Germany and America, for example, still do not grasp that inaction has led to direct battlefield escalation.

There’s also a corresponding danger inside Europe itself from sleeper agents using millions of refugees as cover for hijrah or immigration jihad. ISIS has openly threatened to flood Europe with 500,000 fake refugees and unlike President Obama’s “red line” chances are they mean it.

I am not surprised that the Bulgarian State Agency for National Security, for example, is already investigating five men – refugees – caught at the Gyueshevo checkpoint with decapitation videos, jihadist prayers and ISIS propaganda on their phones. More will follow.

It’s worth noting that not a single Gulf States nation has taken in refugees citing that the risk of terrorism is too high even as Jordan, Lebanon and Turkey have accommodated an estimated 3 million people. Evidently they know something Europe doesn’t or simply doesn’t yet have the stomach to admit.

There is no concept of “burden sharing” notes Sara Leah Whitson, executive director of Human Rights Watch for the Middle East and Africa to CNBC. “The Saudi, Emirati and Qatari approach has been to sign a check and let everyone else deal with it,” she says. Even so, according to Breitbart, Britain has already donated more than Saudi Arabia, the UAE and Qatar combined throwing in more than £920 million versus a collective £589 million.

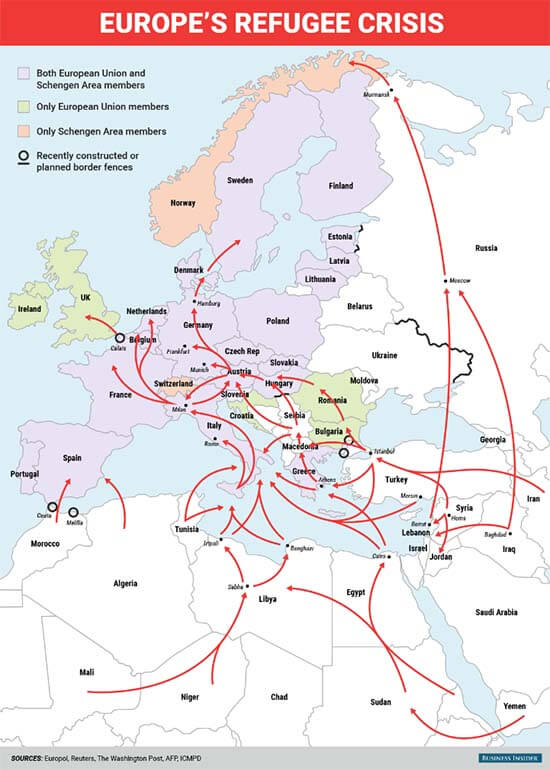

Meanwhile, Greece, Italy and France are merely acting as conduits and sending desperate people onward. Hungary, Austria and Germany have clamped down as I write this.

Making matters worse, we are talking about potentially millions of people who, by their own admission, are not culturally compatible and who are showing very little if any desire to fit in to the millennia- old civilization Europe enjoys today.

To put this in perspective, Eurostat reports that the EU never settled more than 7,400 refugees a year between 2008 and 2014, despite having a population of 507 million. The United States with a population of 330 million settles only an average of 66,000 refugees a year.

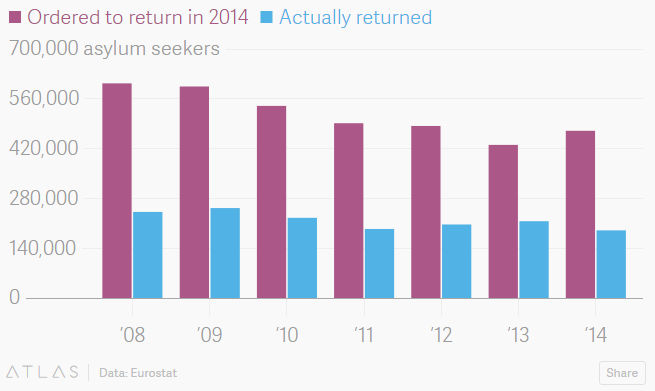

More poignantly, approximately 516,219 non-EU citizens are ordered to return home each year… and, not surprisingly, less than half do.

The staggering numbers involved here suggest that everything from women’s rights, to law, to intellectual freedom… concepts brought forth in the Age of Enlightenment dating from the 1620s to roughly the 1780s… is at risk.

Europe’s got about 60 days to figure things out before the markets do. I say that because it’ll take about that long for quarterly reporting to reflect what’s happening right now.

The short-term effects are already apparent.

Closed borders are causing traffic jams, delaying rail traffic, and overloading local distribution systems. There are huge backups everywhere from border crossings to the Chunnel. Grocers and pharmacies are particularly at risk with their emphasis on just-in-time delivery.

Medium and long-term effects potentially include an even faster decline in earnings than is underway now, a precipitous drop in cross-border business transactions, and a slowdown in manufacturing and purchasing that boomerangs back to China, one of the EU’s key trading partners.

We’re also going to see nations decrease benefits. You’d think that they’d be increasing them, but actually I think we’re going to see the Total Wealth Unstoppable Trend of Allocation surface rather quickly.

Denmark, for example, has already declared a new “immigration benefit” of 5,945 kroner for single adults with no children. That’s down 45% from the 10,849 kroner that used to be offered to asylum seekers. That nation also published ads in four Lebanese papers declaring the changes in an attempt to stop smuggling before it begins, or at least redirect it to other more generous countries.

Barring a massive policy change and a unified front from EU leaders and the business community, I see two distinct scenarios.

In the short term, U.S. Treasuries are going to remain strong and the dollar gets even stronger as part of a flight to safety. This will confound Yellen for obvious reasons. Funds like the PIMCO Strategic Income Fund (NYSE:RCS) with its yield of 12% are a great place to start, as is the PowerShares DB US Dollar Index Bullish (NYSEARCA:UUP), which will appreciate as the dollar strengthens.

You could short the euro with a choice like ProShares Ultra Short Euro (NYSE:EUO), but do so judiciously knowing that you’re going to be fighting the ECB every step of the way at a time when the euro has already weakened considerably. It’s a crowded trade.

Buy U.S. equities, which are going to absorb global funds. Right now, the logical choices are technology giants like Apple Inc. (NasdaqGS:AAPL) and defense players like Raytheon Co. (NYSE:RTN) because of their role in global growth and built-in defensiveness.

Gold, incidentally, is a non-starter. There’s simply too much manipulation and too much leverage to get a clean trade at the moment. Owning it as part of a properly constructed hedge against interest rates is still valid, though.

Longer term, the economic chaos associated with millions of refugees will result in a good number of bargains in everything from Greek olives to French wine, German cars and Italian leather. Consumers are going to have a field day.

Investors will, too. Rather than target individual companies, swooping in to grab a little of everything makes more sense.

The Fidelity Spartan International (FSIIX) is a solid start, with holdings like Nestle SA, Novartis AG, Bayer AG and Royal Dutch Shell. If ETFs are more your style, consider the Vanguard FTSE Europe ETF (NYSEArca:VGK), which holds a total of 514 stocks, including many of the same top-tier names I’ve just mentioned. Your goal is to pick up the best companies tied into global trends at a deep discount.

In closing, crisis investing is never fun, especially when the crisis in question is not yet fully understood.

But that doesn’t mean “it” has to be a disaster for your money.

There is always opportunity in chaos.

Until next time,

Keith

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.