Why the Japanese Yen's Bull Run REALLY Ended

Currencies / Japanese Yen Sep 12, 2015 - 04:32 PM GMTBy: EWI

Monetary "Yentervention" did not cause the currency's depreciation -- it only COINCIDED with it

Monetary "Yentervention" did not cause the currency's depreciation -- it only COINCIDED with it

Talk about "star" wars.

"Asia's biggest action star" Donnie Yen was just cast in the next installment of the never-ending Star Wars movie franchise. Mr. Yen, in case you aren't aware, is known as "the strongest man in the entire universe." (Huffington Post)

It wasn't that long ago you could say a similar thing about the Japanese yen. Count three years back, to 2012, and the yen looked like the strongest monetary unit in the financial universe, standing at an all-time record high against the mighty U.S. dollar, the world's "reserve" currency.

Flash ahead to now (circa September 2015), and the yen is down 30% whilst clinging to its lowest level against the dollar in 12 years.

So, what changed?

Well, that depends on whom you ask. According to the mainstream pundits, one main "force" has drained the yen of its superstar status: the almighty "Light S-ABE-R." Or, in non-geek terms, Japan's Prime Minister Shinzo Abe, who's been shaping the country's monetary policy. See:

"Abenomics Propels Yen's Weakness" (Financial Times)

And: "Japan Bulls Rest Hopes for Yen Weakening on Abenomics" (Bloomberg)

There's just one flaw in that logic:

The yen's record-shattering bull run ended in late 2011 -- more than a year before Abe took office in January 2013!

What's more, Abe did not implement his "three arrows of fiscal stimulus, quantitative easing, and deregulation" -- the factors widely held "responsible" for the yen's weakness -- until later in his term as Japan's Prime Minister.

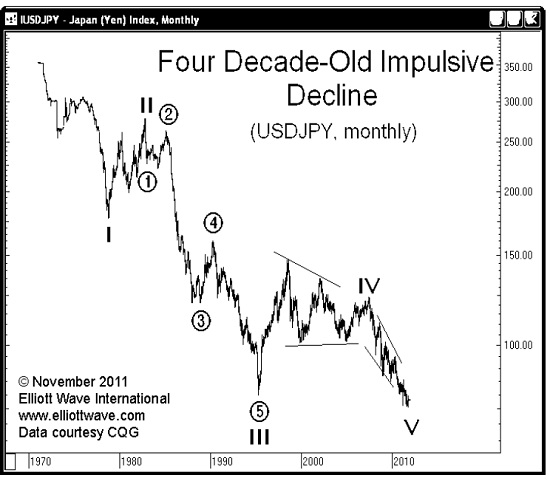

Now, let's go back to the very beginning, to late 2011, and examine the yen's broader trend through the lens of Elliott wave analysis. Here, we come to our November 2011 Global Market Perspective (GMP), where our Senior Currency Strategist, Jim Martens, identified a historic, decades-long Elliott wave "ending diagonal" pattern on the yen's price chart.

As its name implies, an ending diagonal is found at the termination points of larger wave patterns, indicating exhaustion of the larger trend. When an ending diagonal ... well, ends, the prices reverse and carry to the pattern's origin -- or even further.

The terminal nature of ending diagonals fortified the November 2011 Global Market Perspective's bearish yen/bullish U.S. dollar forecast:

"USDJPY has been falling since June 2007 in a thrust from a [4th-wave] triangle that would end an impulsive decline lasting at least 40 years. The thrust [lower] has been unfolding as an ending diagonal, and as such, an abrupt turn [higher -- towards weaker yen and stronger dollar --] should come as no surprise."

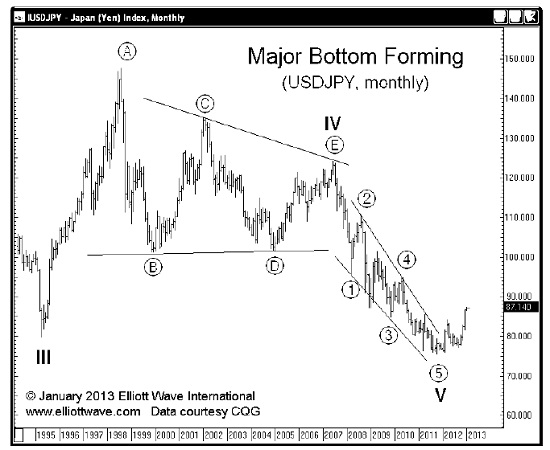

The rally indeed took off the 2011 low, yet took a while to warm up. But, by January 2013 -- coinciding with Prime Minister's Abe taking the office -- Global Market Perspective confirmed a long-term reversal was now underway:

"The recent advance in USDJPY since September [2012] is typical of third waves. There will undoubtedly be pauses along the way but next year or so [i.e., in 2014] should easily see USDJPY in the 124.16 area."

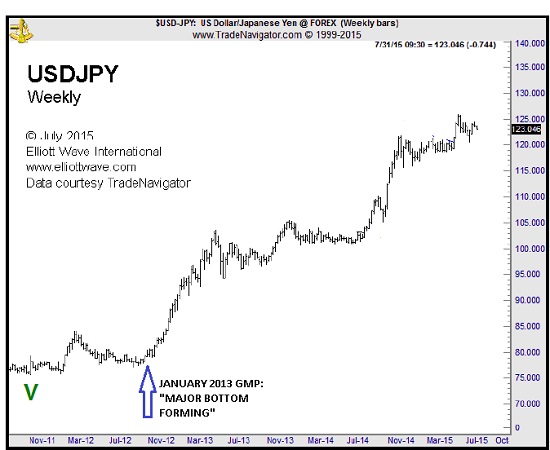

This final chart captures the full extent of the USDJPY's three-year long, 30%-plus uptrend:

Bottom line: Abe's monetary "Yentervention" did not cause the yen's depreciation; it coincided with a terminating Elliott wave ending diagonal pattern on the USDJPY's price chart, which called for an upward reversal (towards weaker yen and stronger dollar).

True story.

You've just seen how invaluable Elliott wave analysis can be in clarifying long-term trend changes before they occur -- and regardless of the political and economic factors.

Now, you can see how equally useful our technical analysis model is in anticipating near-term trend changes in EURUSD, Chinese yuan, and more -- 100% FREE!

Right now, our free-membership Club EWI is featuring an exclusive new interview with EWI's Senior Currency Strategist, Jim Martens.

In this compelling one-on-one ElliottWaveTV interview, Jim walks you through multiple labeled price charts of the world's leading currency pairs -- including the USDJPY.

You'll watch Jim focus on the recent USDJPY "nosedive" towards a stronger yen and give you specific price levels which, if breached, would tell you if the yen is to get even stronger.

So, here's what you need to know:

- This 6-minute Club EWI interview with Jim Martens is absolutely FREE to all Club members

- Besides USDJPY, Jim also shows you the "exciting" road ahead in the EURUSD and China's yuan.

This article was syndicated by Elliott Wave International and was originally published under the headline Why the Japanese Yen's Bull Run REALLY Ended. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.