Pretty Good Day For Gold Bugs

Commodities / Gold and Silver 2015 Aug 22, 2015 - 04:43 PM GMTBy: John_Rubino

The bull market that wouldn't end finally has. In a brutal day that just kept getting worse, US stocks followed Asia and Europe into the deflationary vortex.

Whether this was just a speed bump on the road to infinite financial asset valuations or the return of sanity to a previously-insane world remains to be seen. But one thing that has the ring of certainty -- in the sense that it repeats a pattern in place for as long as there's been human civilization -- is the behavior of gold. While equities -- at today's levels a perfect example of hope triumphing over experience -- were being crushed, and even the lesser precious metals were under pressure, gold had a nice, calm, in all respects normal day.

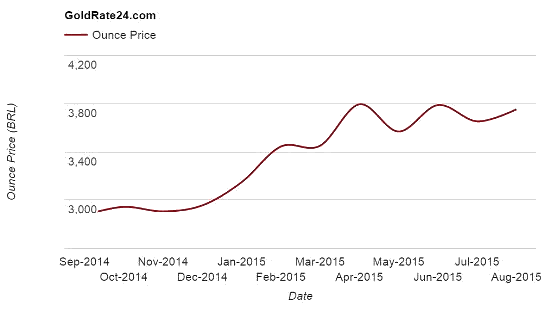

It behaved, in short, like exactly the kind of port-in-a-storm that its fans claim it to be. Already this year it's up dramatically against a long list of national currencies. The chart below is the Brazilian real price, which is par for the emerging market course.

Does this mean we're back in 2009, ready for another epic precious metals run? Who knows? Much, as always, depends on the shape of the central bank response to this week's equity meltdown. And the deflationary forces that are engulfing much of the world could be temporary bad news for an asset that many still see mostly as an inflation hedge. But each new instance of gold shielding its owners from crisis adds credence to the claim that it is sound money which holds its value while make-believe financial assets are getting whacked.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.