Crude Oil Price Crash Continues: West Texas Crude Below $40, Brent Near $45

Commodities / Gold and Silver 2015 Aug 22, 2015 - 04:17 PM GMTBy: Mike_Shedlock

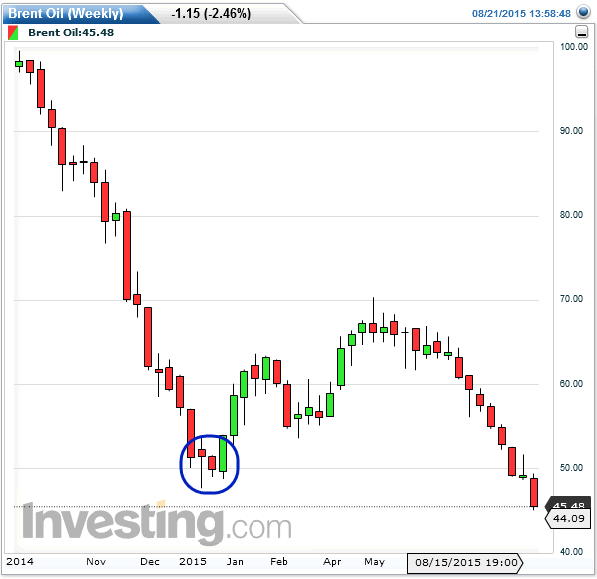

The crash in oil prices continues. Here are a couple charts to consider.

The crash in oil prices continues. Here are a couple charts to consider.

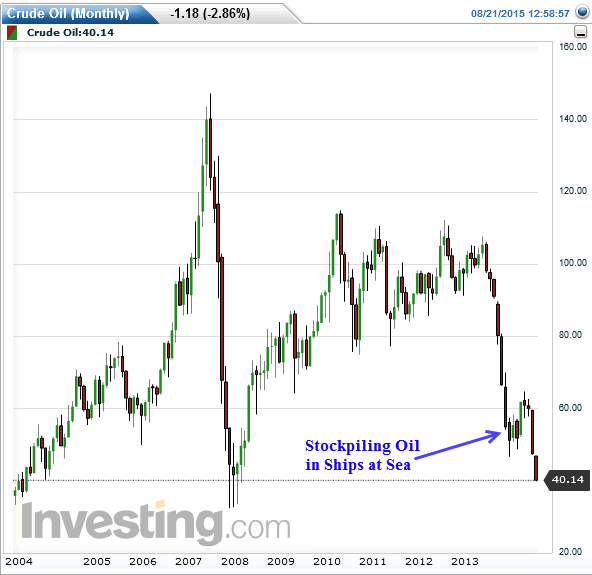

West Texas Crude

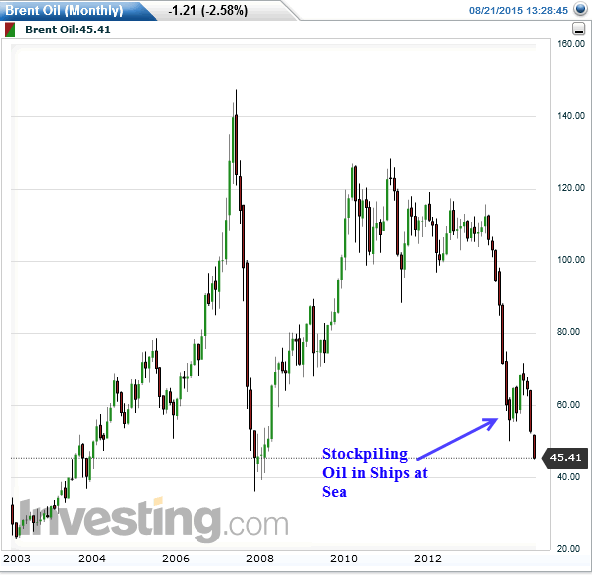

Brent Crude

West Texas Intermediate broke the $40 barrier to the downside today but is slightly above that level now.

WTI last broke $40 to the downside in 2008 but has not had a monthly close below that level dating back to 2004. Brent is near the $45 mark.

Floating Oil Carry Trade Review

In 2008, hedge funds and other big money stockpiled oil in floating ships in the $30s waiting for a rebound. This time they did so at higher prices, and at a cost of $40,000 a day.

Let's investigate how that is working out for anyone still in the trade.

Flashback January 9, 2015: ?Major Oil Traders Book Tankers for Stockpiling Crude at Sea.

A continuous fall in global oil prices has prompted major oil traders to start hiring supertankers as they can benefit from stockpiling crude oil at sea.

The oil giant Shell and energy traders Trafigura and Vitol have booked crude tankers for up to 12 months, said Reuters, referring to the fixture lists provided by tanker brokers and oil traders.

Traders reportedly use the vessels to store excess crude at sea until prices stabilize as in 2009, when more than 100 million barrels were stockpiled this way. Then the news caused outrage over oil "speculators" supposedly waiting to sell oil at higher prices in future.

Shell has reportedly booked two vessels, and Vitol, the world's largest independent oil trader, has booked the TI Oceania Ultra Large Crude Carrier, one of the biggest ocean going vessels with a three million barrel capacity.

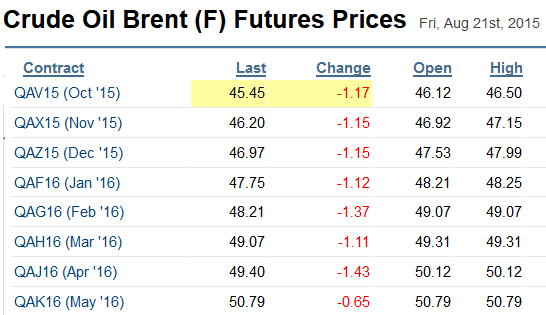

The move can be explained by the market phenomenon known as "contango", when spot or current prices fall below the cost of future shipment. It has happened for the first time since 2009 as spot prices fell by more than 50 percent in the last six months. This gives traders more reason to buy oil now, store it in tanks and benefit when demand recovers.

Trading firms have been able to hire the Very Large Crude Carrier (VLCC) vessels for less than $40,000 a day, compared to spot rates of $60,000 to $70,000 a day, according to the lists.

Traders can currently purchase Brent crude for less than $51 per barrel, while barrel for delivery in August costs more than $57, thus, in this case "contango" is more than $6. Analysts say the contango above $6.50 a barrel is needed to cover expenses on hiring a tanker, providing insurance and gaining profit from offshore storage.

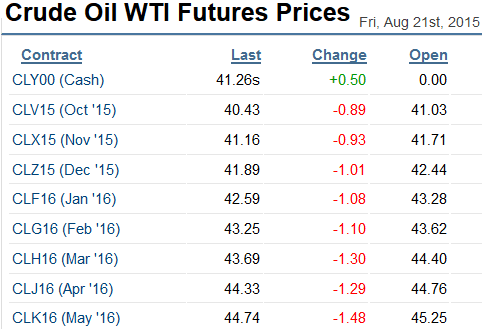

West Texas Contango

West Texas Contango

Anyone still in the floating oil carry trade business is getting their ass seriously kicked.

Perfect Timing Anyone?

Stockpilers did have a chance for a nice profit between February thru June if they bought Brent near $50. But to that, they had to have near-perfect buy-timing, and they better have already sold.

Losses have mounted since. And anyone who thought this was a good idea above or near $60 is in deep serious trouble.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.