Gold and Silver Shaken, Not Stirred

Commodities / Gold and Silver 2015 Aug 15, 2015 - 12:57 PM GMTBy: Submissions

Chart Freak write: After a solid 5 day rally, gold sold off on Thursday, and the precious metals miners were sold-off indescriminetly. Both GDX and GDXJ were down almost 6%, leading many to be shaken out of position on the pullback. For me, these events are expected and become opportunities, so lets examine the charts to see why.

Chart Freak write: After a solid 5 day rally, gold sold off on Thursday, and the precious metals miners were sold-off indescriminetly. Both GDX and GDXJ were down almost 6%, leading many to be shaken out of position on the pullback. For me, these events are expected and become opportunities, so lets examine the charts to see why.

$GOLD – a pullback to the 10 & 20 sma as support is normal.

In 2013 at the lows, Gold had a one day slam down, and those who were shaken out of position missed out on a nice rally.

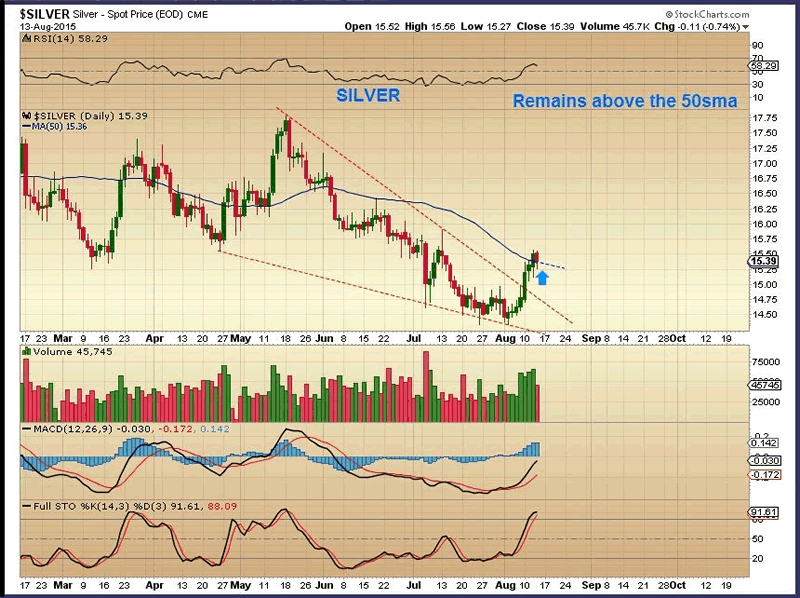

SILVER has remained strong , that’s encouraging.

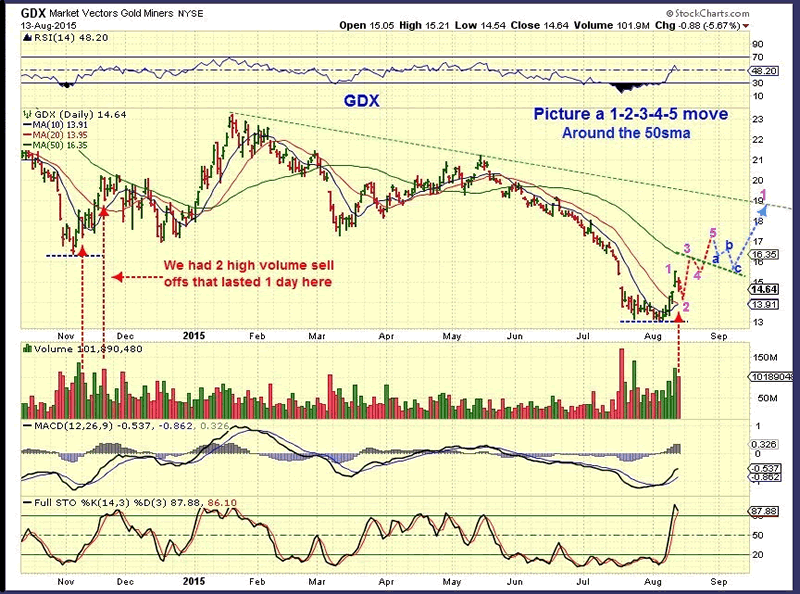

But what about those Miners , down almost 6%.

GDX – We’ve seen high volume 1 day drops before, like the lows back in November. They basically amounted to just noise once the rally was done. Even a deeper drop to the 10 & 20 Sma would still be normal.

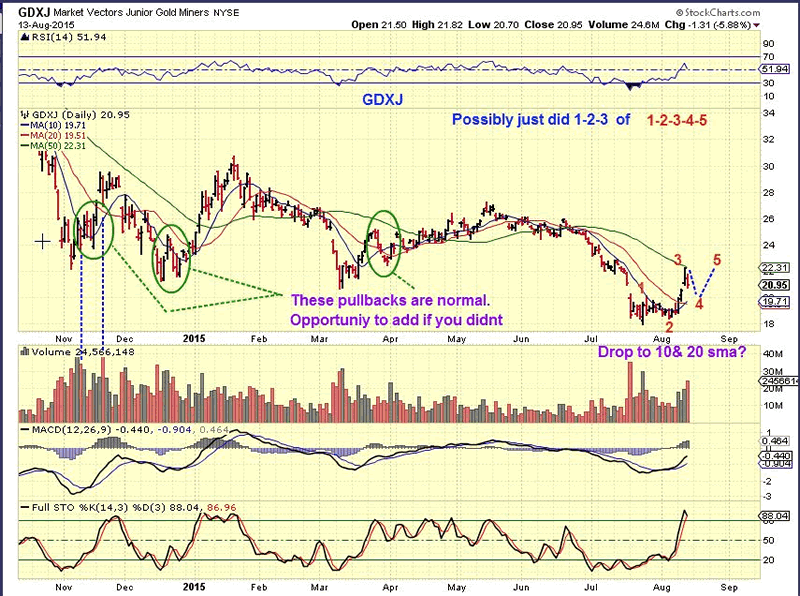

GDXJ – hit the 50sma . Pullbacks like this were buying opportunities in the past.

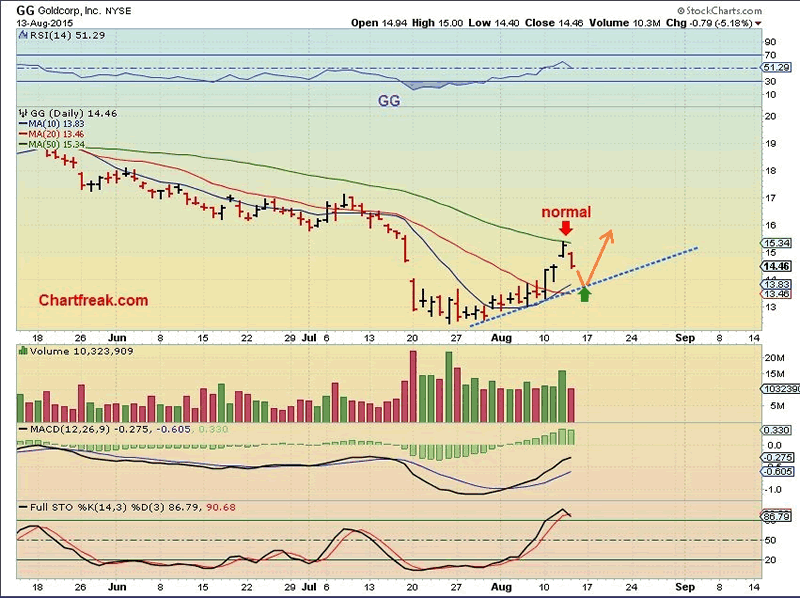

When I see that people are getting concerned about a drop in the price of GDX or GDXJ, I like to check the underlying mining stocks and see if their charts look healthy or sickly. Lets do that here.

Goldcorp Inc (GG) – This is a healthy looking run up, and a normal pullback.

Barrick Gold (ABX) – You can almost picture how this stock may move higher around those moving averages. This is just an idea of how ABX can progress based on past gold rallies.

en sentiment becomes too extreme in any one direction and everything you read is bearish, this leads to an excellent counter trend rally opportunity. I’ve seen these types of setups many times within my professional trading career and the current conditions are very favorable for a rally over the next several weeks. Dips like we saw on Thursday may be your opportunity to enter at lower price.

For more public posts or to join our free email alert list, see us at www.chartfreak.com

By Alex

© 2015 Copyright Chart Freak - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.