Desolation Row: The Silver Market

Commodities / Gold and Silver 2015 Aug 14, 2015 - 11:27 AM GMTBy: DeviantInvestor

Silver peaked in 1980 and then crashed into “Silver Desolation Row” in 1999 – 2001, like now.

Silver peaked in 1980 and then crashed into “Silver Desolation Row” in 1999 – 2001, like now.

The 1970s decade was the time for commodity price increases and inflation. The 1980s and 1990s saw a preference for paper assets and stocks, while commodities, gold, and silver prices collapsed.

Cycles and preferences change. Silver was “bombed out” in “Silver Desolation Row” by 1999 – 2001. Stocks were all the rage from 1982 – 2000. But the NASDAQ could only be pushed so far and then reality intervened.

About like now….

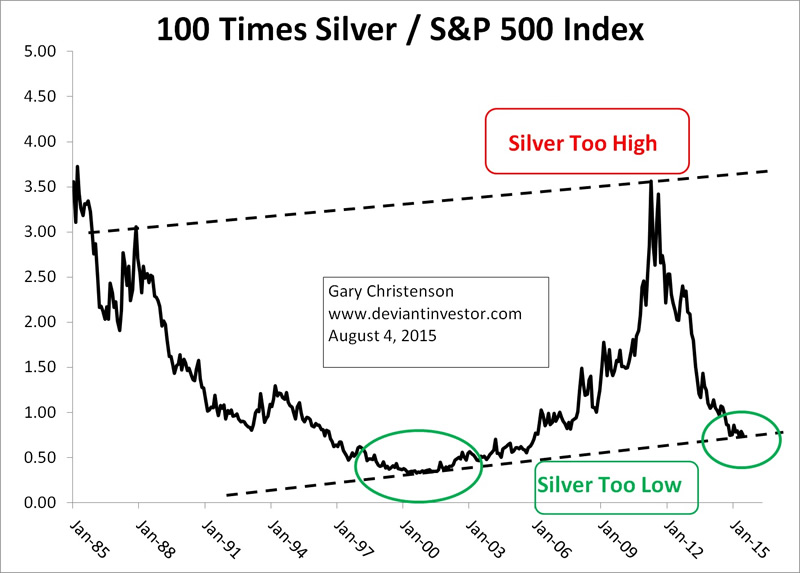

Examine the chart of the silver to S&P 500 Index ratio. Note the low in 2001 when silver was “bombed out” and scratching for a bottom in “Desolation Row.”

The ratio looks about the same in 2015 – bombed out. I haven’t heard people comment about silver that “you can’t give the stuff away,” but we must have been close in July.

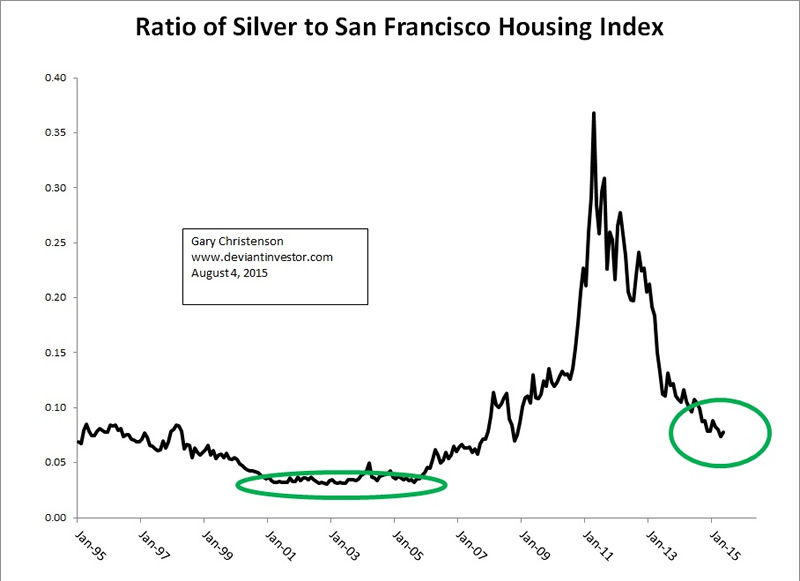

Compare the ratio of silver to the San Francisco Housing Index (Case-Shiller data). Again, silver looks “bombed out.”

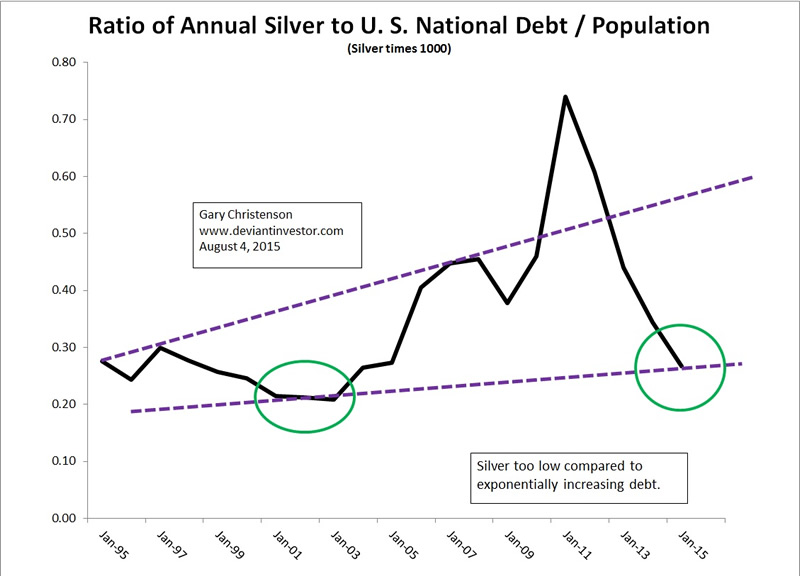

Compare the price of silver to the Population Adjusted National Debt of the U.S. Again, silver looks “bombed out.”

From Bob Moriarty:

“What we can know is prices in relative terms. In absolute terms, the lowest price for silver since 1975 was $3.53 in 1993. In relative terms, silver hit $4.01 in November of 2001 and that was the lowest relative price in 5000 years. So in late 2001, silver was cheap. And I said so. In April of 2011 I saw silver getting nutso again as it did in January of 1980 and I said so.”

“I was reading Steve Saville this weekend and he put in a really important chart. Steve is the publisher of The Speculative Investor and is brilliant. He is a must read. The chart was an inflation-adjusted graph of the Continuous Commodity Index. It used to be called the CRB. Going back to 1956, on an inflation basis, the CCI is the lowest it has ever been measured.”

Note his two statements:

“…silver hit $4.01 in November of 2001 and that was the lowest relative price in 5000 years.”

“Going back to 1956, on an inflation basis, the CCI is the lowest it has ever been measured.”

Silver was “bombed out” in 2001. The same is true today. The inflation adjusted CCI (all commodities index) is the lowest it has ever been measured. It too is “bombed out.”

Will crude oil, silver and gold go even lower? Ask the central banks and the High-Frequency-Traders! But at some point, probably soon, even in our delusional financial world, it will occur to a significant number of people that:

- Stock markets can be levitated for only so long. I think their “expiration date” has been passed or is close.

- Silver prices are “bombed out” much like they were in 2001. Once the COMEX sellers are exhausted (or out of bullion) the buyers will dominate and silver prices will exit from “Desolation Row” and rally much higher.

- Real money (gold and silver) will eventually dominate, as they should, over fiat currencies, digital equivalents, and “extend and pretend” central bank manipulations.

- US money was formerly gold and silver coins. They were replaced by paper certificates. Those were replaced by Federal Reserve Notes (debt) borrowed into existence. Now the Fed “prints” the “money” by monetizing debt. Could this process reset with a return to honest money – gold and silver – replacing the failing paper stuff?

Confidence is what holds the unbacked fiat currency system together. Confidence can evaporate rapidly, though unpredictably. When confidence fades real money, hard assets, and commodities, such as gold and silver, real estate, diamonds, and base metals, will shine.

There are numerous reasons to expect that the US stock markets might follow the Chinese markets downward, particularly by the end of the year. A FEW possibilities are: 7 – 8 year cycles, extended valuations, excessive confidence, new wars, Chinese market crash, bond market reversal, interest rate increases, weak internals, Armstrong’s economic confidence cycles, and Shemitah cycles.

Silver has been crushed and the S&P has been levitated. Both seem likely to turn soon.

Read Bill Holter: “They Will Say “You Were Warned!”

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.