The Best Way to Buy Gold Today

Commodities / Gold and Silver 2015 Aug 06, 2015 - 02:38 PM GMTBy: ...

MoneyMorning.com  Peter Krauth writes: At $1,084 per ounce, gold is scraping multiyear lows, down 42% in four years.

Peter Krauth writes: At $1,084 per ounce, gold is scraping multiyear lows, down 42% in four years.

And it seems the gold bears dominate the headlines – everywhere you look, each news item seems more negative than the last.

There have been calls for gold to hit $800… and even lower.

But all this negative buzz really belies excellent fundamentals. The truth is, we're so close to the bottom right now that we've got one of the best chances to buy gold we've seen in a decade.

So here's how – and why – to do it…

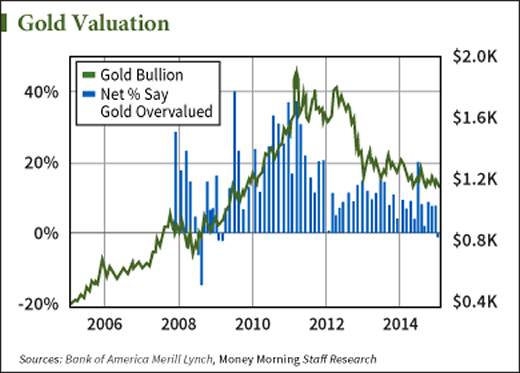

The Smart Money Finds Gold Is "Undervalued"

The survey asked 150 top fund managers worldwide with about $400 billion under management.

While the bullish majority is just 1% ahead of the bears, the shift itself is nonetheless impressive.

According to Merrill, the last time sentiment was bullish dates back to 2009, just before gold began an impressive two-year 90% run-up.

Interestingly, this sentiment has also begun translating into action, at least for some.

In Q1, Canadian mutual fund company CI Investments acquired a massive 6,117,900 shares of the SPDR Gold Trust ETF (NYSE Arca: GLD). That boosted CI's position by about $700 million to roughly $735 million in total to become CI's largest position, representing about 7.5% of CI Investments' portfolio at the end of the first quarter.

Even Swiss banking giant Credit Suisse added over 4 million shares to its own position, as did Blackrock Group, Morgan Stanley, and Lazard Asset Management, all of whom are multi-asset managers rather than precious metals specialists.

The "Dumb Money" Is Massively Shorting Gold

Weekly Commodity Futures Trading Commission numbers recently revealed an astonishing new record set in the gold market.

A recent Commitment of Traders report (COT) showed speculators were short a massive 179,000 gold-futures contracts, setting a 16-year record that spans the entire gold bull market.

Shorting in futures is no different than in stocks. Those shorting are betting the price will fall.

The last record was close with 178,900 short contracts reached in July 2013. At that point, gold quickly gained 17% as a short-covering frenzy ensued, taking gold from $1,200 to $1,400.

The speculators segment of futures traders are widely considered to be the "dumb money." That's because the positions they hold are often trend-following and typically mark reversal points in the markets when they reach extreme levels.

So we could easily see a repeat of July 2013, when gold surged over the following two months.

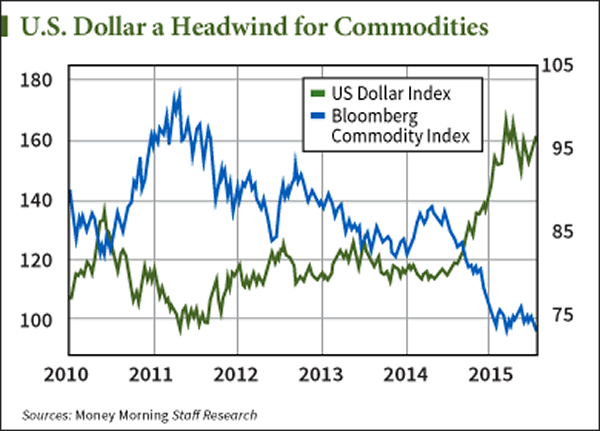

The Dollar's Strength Will Be Temporary

With the U.S. dollar up 21% this year against a basket of major currencies, commodities, including gold, face a significant headwind. That's because a stronger dollar means it takes fewer to buy those resources.

Investment research firm FactSet has said the top complaint by U.S. corporations in their Q2 earnings reports was… the strong dollar. It's making their products and services expensive to overseas buyers.

The dollar has been climbing since late 2014 on the expectation the Fed will begin raising rates later this year.

At this point, it's entirely possible that much of that anticipation has already been factored in.

If Yellen does raise rates this year, we could be faced with a "buy the rumor, sell the news" scenario. That could lead to a sell-off in the dollar, which may help gold (along with other commodities) turn higher.

If instead Yellen doesn't raise rates, the market may decide it's either not happening for some time or, when it finally does, it's likely to be in minimal increments over an extended period of time.

It's no secret that the Fed's dilemma is it needs to raise rates to make good on its promise, yet higher rates will render government debt servicing all the more challenging and will weigh on profits of U.S. multinationals.

When the market gets a lower dollar and/or realizes rates won't rise much for some time, the lack of opportunity cost for gold will make it increasingly attractive.

Sentiment Has Nowhere to Go But Up

We all know investors shift their capital with a herd mentality. So, sentiment is a crucial component in markets, as gauging it helps determine their likely future direction.

SentimenTrader publishes a proprietary "Optix" sentiment indicator covering a large number of markets and sectors.

And right now gold sentiment is awfully bad. According to SentimenTrader.com, gold sentiment is so bad, it's worse than in 2001 when the gold bull market began and gold traded at $260! Talk about hated!

This makes for a great contrarian indicator. But there's also the "headline factor," which is very much against gold right now. Maybe you've seen these recently:

- "Speculators Smash Gold as Dollar Squeeze Tightens," The Telegraph

- "Gold Prices Plunge to 5-Year Low on Chinese Sell-Off and U.S. Rate Hike Hopes, International Business Times

- "Let's be Honest About Gold: It's a Pet Rock, The Wall Street Journal

- "Gold to Fall to $1,000 by Year End, $800 in 2016," ABN Amro

Bullish gold headlines are few and far between. This is not how bull markets peak.

The Best Way to Buy Now

All of this points to an historic opportunity right now – to buy gold at prices like this and ride it all the way back up when the secular bull resumes.

Decide how much you feel comfortable committing to gold and then split that into between five and ten equal parts.

Then buy on weakness now and over the next several months.

Money Morning Members can get a $50 deposit when they open a $5,000 EverBank Metals Select Unallocated account. It's non-FDIC insured, and it's a way to buy into a pool of gold, sidestepping the annual account or storage fee associated with owing specific coins or bars.

Asset Strategies International offers free rare coins to those purchasing $10,000 or more in pre-1933 U.S. gold coins – always a popular method for owning gold and especially attractive at current gold prices.

And investors may want to consider picking up shares of SPDR Gold Trust ETF (NYSE Arca: GLD). It's one of very few ETFs that actually owns physical gold (in this case, in a vault in London) in proportion to the number of shares floated. Owning shares of GLD is in essence owning physical gold. The fund is very liquid and easy to buy.

Buying gold isn't popular right now, and to buy would be going against the so-called "conventional wisdom." But the biggest returns often go to the boldest investors.

(It's all very reminiscent of the major sell-off gold experienced in April 2013. At the time I explained that, when gold futures shed 13% in just two days, it was under what many consider very "questionable circumstances.")

*We have a formal marketing relationship with EverBank to bring you these benefits. Please take a moment to read our disclaimer.

Source :http://moneymorning.com/2015/08/06/the-best-way-to-buy-gold-today/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.