Demand for Gold Bullion Surges – Perth Mint, and U.S. Mint Cannot Meet Demand

Commodities / Gold and Silver 2015 Jul 31, 2015 - 02:47 PM GMTBy: GoldCore

- Perth Mint sees surge in demand and cannot keep up with demand

- Perth Mint sees surge in demand and cannot keep up with demand

- “Our biggest restriction is the amount of unrefined gold we’re getting in from producers”

- Very high demand for Perth Mint coins, bars coming from Asia, U.S. and Europe

- U.S. Mint sees highest sales of gold coins in over 2 years

- U.S. Mint restrictions on silver coins due to very high demand

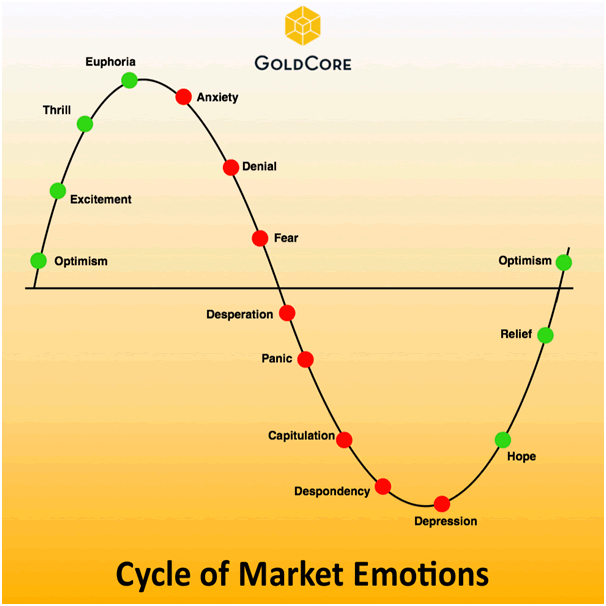

- Gold sentiment has moved from despondency to depression (see chart)

- Current negative sentiment despite strong demand is good contrarian indicator

Depressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.

This is confirmed in conversations we have had with our refiner and mint partners in recent days. There are growing shortages of supply of small coins and bars. This is resulting in delays in receiving bullion and indeed to rising premiums.

Asian gold demand picked up this week keeping premiums robust and slightly higher in the world’s top gold buying regions.

Treasurer for the Perth Mint, Nigel Moffatt has said that the mint has seen a surge in demand for physical gold since the price dropped below $1,100 per ounce.

In an interview on Bloomberg’s “First Up” show he said “Our biggest restriction is the amount of unrefined gold we’re getting in from producers”, adding, “everything we get in is going straight out the door as soon as we refine it.”

Moffatt says that the Perth Mint is seeing strong demand for kilo bars which go to Asia – particularly India, China and now Thailand – adding that traditional buyers in Asia tend to “stock up” on gold when the price falls.

There is also a huge demand for coins from individual buyers in the U.S. and Europe:

Gold “is going straight out the door as soon as we can find it.”

“Our only restriction on coin sales right now is the amount we can produce.”

“We’d be selling more if we could find skilled press operators.”

Sales of Perth Mint Certificates remain robust and he adds that the Perth Mint has seen a lot of interest in its new Depository Online Service despite the fact that it has not yet been officially launched nor has there been any publicity for it.

He points out that central banks are still accumulating gold despite the negative sentiment because “gold still has intrinsic value”.

He does not see the price of gold dropping a whole lot further given the cost of production, although he believes that we may see a fall to $1000 before the price moves upwards again. It now costs on average around $1,000 to mine one ounce of gold.

Meanwhile the U.S. Mint has reintroduced its sales of Silver Eagle coins (1 oz) following a three-week suspension.

On July 7 The U.S. Mint was forced to suspend sales having exhausted its inventory which suggests there was either a shortage in physical silver blanks or of physical silver bullion that makes the blanks. However, they have placed restrictions on sales and sales remain “allocated” to wholesalers in order to maintain some supply.

The U.S. Mint is legally required to supply as much silver as is needed to meet demand. Their inability to do so shows demand remains very robust.

So far this month the Mint has sold 4.03 million Silver Eagles. In June total sales came to 4.8 million coins. There are reports that 2.6 million coins were sold this week alone. So, despite having not been available for three weeks, in July Silver Eagle sales are down only 17% on the previous month.

The U.S Mint is also seeing strong demand for Gold Eagle coins, especially one ounce, which – at 136,500 – is more than double the June figure and is the highest demand since the bear raid which saw prices fall in April 2013.

There has been an unprecedented barrage of negative publicity towards gold in recent weeks. This negativity is not supported in any way by the activity in the markets for physical gold where shortages are showing up despite falling prices.

We believe this to be a good contrarian indicator that gold’s recent bout of weakness is drawing to a close and that the bull market may be set to resume once the current period of weakness runs its course and the forces of supply and demand reassert themselves.

Shortages, delays in delivery and rising premiums suggest that the long awaited short squeeze may be developing.

This shows the importance of taking delivery of bullion or owning allocated, segregated gold coins and bars of which you can take delivery.

MARKET UPDATE

Today’s AM LBMA Gold Prices were USD 1,080.05, EUR 985.45 and GBP 694.19 per ounce.

Yesterday’s AM LBMA Gold Prices were USD 1,085.65, EUR 989.74 and GBP 695.36 per ounce.

Gold and silver on the COMEX fell 0.9% and 0.4% yesterday – to $1,088.10/oz and $14.74/oz.

Silver for immediate delivery has fallen 1.1 percent to $14.66 an ounce, poised for the biggest monthly retreat since September.

Platinum fell 1.4 percent to $978.05 an ounce and July’s 9.6 percent drop is set to be the biggest since 2012. Palladium declined 2 percent to $611.45 an ounce, heading for a third monthly loss.

Gold is down for a sixth week in a row, on course for its longest losing streak since 1999. It is down more than 7 percent in July, the most in any month since June 2013. Sentiment is as bad as we have seen it and some suggest it is as bad as in 1999 and 2000 after the 20 year bear market.

Extreme negativity appears to be already in the price and weak hands have been shook out of market. That is not to say that gold cannot go lower and we remain cautious in the short term.

Gold remains vulnerable as we enter August – a month of declining liquidity when markets may be vulnerable to bear raids. Lower prices are possible and the $1,000 per ounce level may need to be tested before we see a bottom.

Gold in USD – 10 Years

Bullion looks good value at these levels and investors will soon be presented with an opportunity to allocate funds to bullion at very depressed prices. Dollar cost averaging and gradually accumulating remains prudent and will protect against downside risk.

Stocks, bonds and many property markets are at all time highs and look very toppy and vulnerable to sharp corrections – particularly in September and October – the traditional time for sharp stock market corrections and indeed crashes.

It is a good time to rebalance and to reduce allocations to risk assets and increase allocations to gold – or indeed allocate to gold for the first time, if an investor does not own gold … as the vast majority of investors do not given the very low levels of gold ownership among investors in the western world.

Many of the risks that preceded the 2008 crisis are bubbling under surface and new global debt crisis is coming … the question is when?

Physical gold will again protect and grow your wealth in coming years. We know we will be accused of ‘talking our book’ and Martin Armstrong may call us ‘gold promoters’ but we genuinely believe and the academic research, empirical data and historical record shows that gold is a safe haven that will protect investors in the long term again coming volatile months and years.

Breaking News and Research Here

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.