Gold Price at a Five-Year Low: Here’s What to Do

Commodities / Gold and Silver 2015 Jul 26, 2015 - 06:49 PM GMTBy: ...

MoneyMorning.com

Keith Fitz-Gerald writes: Gold prices crashed Monday as panicked sellers drove the yellow metal to its lowest level since 2002 before recovering to a five-year low. More significantly, they broke the $1,130/oz “floor” which had previously been regarded as a solid support level – a key indicator to me that the downdraft wasn’t over.

Keith Fitz-Gerald writes: Gold prices crashed Monday as panicked sellers drove the yellow metal to its lowest level since 2002 before recovering to a five-year low. More significantly, they broke the $1,130/oz “floor” which had previously been regarded as a solid support level – a key indicator to me that the downdraft wasn’t over.

So I wasn’t surprised to see gold prices finish yesterday’s U.S. trading session modestly lower – but that doesn’t mean I was any less excited, either.

You’re seeing an enormous opportunity being brought forth by the perfect storm of economic and financial events. Some of these events we’ve known were coming, and some are seemingly random.

Either way, they’re creating an opening you haven’t had access to in years.

Here’s what you need to know about what really caused gold’s plunge this week – and the opportunity no one can know when you’ll have again.

The Most Effective Attack on Gold Prices in Years

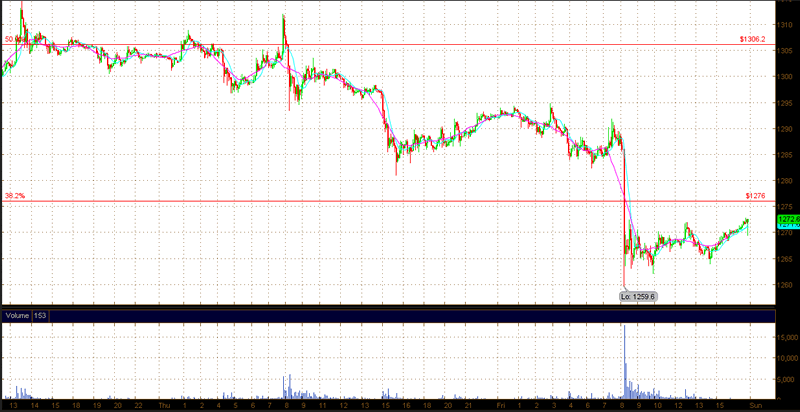

Last Monday, traders sold an estimated 33 tonnes of gold in less than two minutes on the New York and Shanghai Exchanges. Their concerted actions sent gold prices crashing by nearly $50/oz by the end of the day, a plunge of almost 5%.

Contrary to what many believe, this was not simply “market action” taking its normal course. This was something far more sinister, concerted, and brilliantly executed – a “bear raid.”

If you’ve just joined us, a bear raid is a highly technical tactic typically used by large institutional traders or “short and distort” artists. The goal is to create windfall profits though short sales, options, futures contracts, currencies, and whatever else can be brought to bear.

If it works, the targeted stock, bond, currency, or in this case gold, plunges, allowing the short sellers to buy back shares or contracts they’ve borrowed and sold earlier at a huge discount. Typically, the sellers work together to establish a massive sale that overwhelms buyers and inflicts huge losses on anybody who’s long.

In this case, traders took advantage of the fact that Japan’s markets were closed for a national holiday, knowing full well that absent their money, there were even fewer buyers than usual to mount a defense.

And what a move it was!

More than 3 million lots traded on the Shanghai Gold Exchange; a normal day is less than 30,000 lots by comparison. Anybody who tried to hang on got clobbered.

That attack, like Monday’s, was carefully timed to exploit low liquidity conditions. There were no economic reports or industry-significant events when it hit. There just happened to be a slew of stop-loss orders placed at $1275 an ounce.

As intended, the onslaught broke key support levels, took out the stop-loss orders, and created huge profits for the bear raiders. To this day we don’t know who the raiders were because they tend to cover their tracks. Still, a quick scan of the headlines at that time reveals who the interested parties may have been. Not surprisingly, it’s a pretty short list of players having the knowledge and the capacity to mount an attack.

Is it any coincidence that Jeffrey Currie, who headed up commodities research in London for Goldman Sachs at the time, said only three days earlier – on October 8 – that gold was a “slam dunk” sell for the next year? Perhaps, but I’ll leave that to you to decide.

Gold prices finished the day down more than 2.5%.

A week later gold finished up 7.5%, to close at $1,361 per ounce as shrewd traders and investors saw the drop for what it really was… more Wall Street shenanigans.

Honestly, it’s too early to tell if that’s the case now. The ease with which traders brought gold prices below its support levels tells me the downward drift isn’t over.

And therein is your opportunity.

You Need Gold in Your Portfolio – But Not for the Reasons You Might Think

Exactly how much gold you should have in your portfolio is ultimately a question to be answered by you and perhaps your financial advisor. But there are some rules of thumb that can help investors reach a balance that’s close to ideal – and it also helps to clear up some common misconceptions along the way.

Many investors think gold is good for portfolios because it’s a good hedge against inflation. This misconception mainly comes from memories of the 1970s, when gold prices grew by a jaw-dropping 2,300% at a time of rampant inflation.

But correlation doesn’t mean causation. Contrary to what all those late night TV commercials would have you believe, gold prices have never been a proven hedge against inflation.

However, it has been proven to correlate to bond prices which are, in turn, an indirect function of interest rates that are themselves an indirect inflation proxy. So what you really want to do is own gold because it hedges the value of your bonds.

Studies suggest that having 3%-5% of total investable assets in gold can provide meaningful protection against rising interest rates while also reducing overall portfolio volatility.

If you’re game for a more sophisticated approach, consider buying $1 in gold for every $10 you have invested in bonds. That will allow your money to approximate the 10 – 1 relationship that’s historically existed between gold prices and interest rates vis a vis bonds.

As for what kind of gold, that varies considerably and is a function of personal risk tolerance, objectives, and suitability. Some people like bullion while others prefer choices like Perth Mint Certificates that help alleviate storage and insurance issues. Even jewelry can be good.

For most investors, though, simpler is better.

Over the years, I’ve recommended SPDR Gold Shares (NYSEArca:GLD) because it’s a highly liquid ETF that directly tracks to price of gold. If you’re hoping to profit from gold prices’ inevitable rebound, it’s hard to get much simpler than that.

If you have concerns about whether or not there’s enough gold to back GLD as some investors do, consider an alternative like the Physical Swiss Gold Shares ETF (NYSEArca:SGOL). It’s a U.S. listed exchange trade fund offering shares that are physically backed by gold stored in secure Swiss vaults.

At the end of the day, get past the fact that we’re talking about gold and get your emotions out of the picture. Doing so will allow you to treat it just like any other asset class.

While you’re at it, think about what Ray Dalio, who founded Bridgewater Associates, one of the world’s largest hedge funds, had to say…

“If you don’t own gold… you don’t know history or you don’t know the economics of it.”

I’ll be back Friday with a report what may be the most severely overvalued stock trading today. Near $60 right now, I see it being worth less than 1% of that.

Until next time,

Keith Fitz-Gerald

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.