Gold Hammered “Unprecedented Attack”

Commodities / Gold and Silver 2015 Jul 21, 2015 - 05:18 PM GMTBy: GoldCore

- Gold market comes under “unprecedented attack” – Telegraph

- Gold market comes under “unprecedented attack” – Telegraph

– “Sharp drop bore similarities to bear raids by Chinese funds” – FT

- Paper contracts for 57 tonnes of gold dumped onto market in two minutes

- Gold still holding up in euros, Canadian dollar and other currencies

- Very negative sentiment towards gold signals close to bottom

- Physical gold still vital financial insurance despite simplistic anti gold narrative

The post mortem continues and many are once again proclaiming the death of gold … as was done in 1999 and again in 2007 … prior to the start of gold’s multi-year bull market and the resumption of the bull market in 2007.

Sentiment is as bad as we have ever seen it and worse than in 2007, after the price of gold fell nearly 5% or $50 with many markets closed and in illiquid market conditions on Sunday night.

Some $2.7 billion worth of gold futures contracts were sold on the COMEX in less than two minutes.

The Financial Times had an interesting article with the wonderfully-balanced headline, Gold bugs squashed by aggressive selling, which speculated that “Chinese funds” may have been responsible for ‘bear raids’:

“Traders and analysts said, however, that the nature and timing of the selling suggested there was more at play than investors responding to a slight strengthening in the US dollar or lower central bank purchases.”

The Telegraph too asked questions about the highly unusual nature of the concentrated selling and described it as an “unprecedented attack” by “speculators”:

“Powerful speculators have launched an unprecedented attack on the world gold market, driving prices to a five-year low … anonymous funds sold 57 tonnes of gold in Shanghai and New York, choosing the moment of minimum market liquidity in what appears to have been a synchronized strike intended to smash confidence.”

While the price recovered somewhat throughout the remainder of the day, the manipulative hammering of the price in the futures market once again has served to undermine confidence in the gold market in the short term.

Paper contracts, the equivalent of 24 tonnes of gold were dumped onto the Globex electronic trading exchange in New York in less than 2 minutes. The action took place at around 9.30 Shanghai time. Japanese markets were closed ensuring a minimal amount of liquidity and potential buyers to support the price. There is some discrepancy in the figures reported by different analysts and media.

Astute analyst Bron Suchecki of the Perth Mint points out that the selling began on the COMEX in the August futures contract:

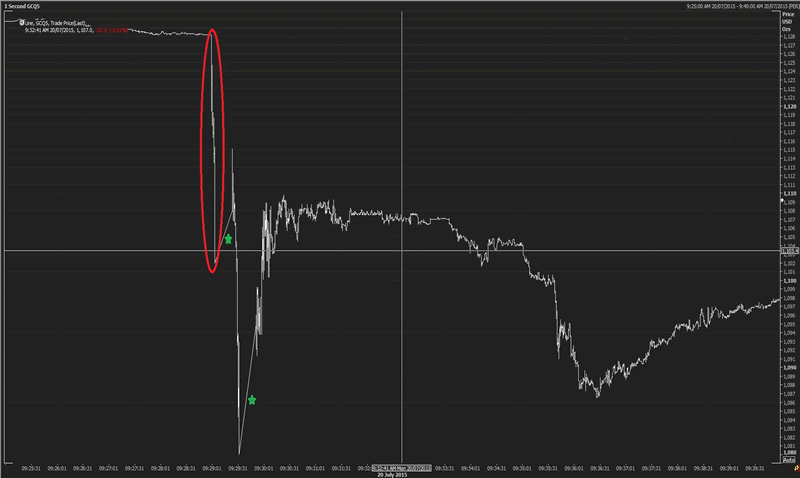

“Below is a 1 second time interval chart of the August futures contract from Reuters. The area in the red circle is the 4 seconds of the Nanex chart above, which puts the move into context.

Note that the volume traded in this one minute was 7,164 contracts, which at 100 ounces a contract is about 22 tonnes.”

That a single entity or a group acting in concert would choose to sell a position in huge volumes at a time when an absence of buyers would guarantee them a poor price is a sign that forcing down the price was the likely objective of the concentrated selling.

Who these “anonymous funds” may be is unclear – the Telegraph describes them as “speculators”. There appears to be little appetite to uncover who they were among the media. Hopefully, financial regulators will see the importance of stamping out such illegal practices.

Already financial markets and the financial system have all the hallmarks of a global casino and this is likely to worsen if such manipulations continue to be tolerated.

Close observers of the gold market will have noticed a slew of particularly negative, and often ill-informed, commentary on gold in recent days and sentiment is as poor as we have seen it.

Since yesterday there has been another of wave of negative, misleading and almost triumphalist commentary on gold most of which studiously ignores the clear evidence of manipulation of the price on Sunday night.

This negativity is unwarranted given the reasonable performance of gold this year in currencies other than the dollar. Even following the smash gold is up 4.4% in euros this year. It is also up in Australian and Canadian dollars – not too mention in Latin American currencies which are again under pressure.

The current negative sentiment towards gold is unjustified given the backdrop of gobal currency debasement and a global economy being force-fed debt to keep it a very fragile recovery from ending and a new global recession or indeed Depression.

Further, technical damage has been inflicted by Sunday night’s manipulation and prices may yet fall further.

However, given the importance of diversification and of holding physical gold as financial insurance – rather than as a speculative tool – the current price weakness may be viewed as an opportunity.

The conditions which led to the 2008 crisis – i.e. excessive debt – have not been dealt with.

They have been papered over with more electronically ‘printed’ currency and debt. The narrative that gold is now irrelevant because the “recovery” has taken hold is not reflected in the conditions of people living in the real world – be they people in most Middle Eastern countries, the majority of people in Ireland, Spain, Italy, Portugal and of course Greece. Nor indeed, the 45 million Americans, 15% of the U.S. population, currently unemployed and having to live on food stamps.

The notion that gold is set to decline further as the Fed raises rates is based on the highly optimistic assumption that the Fed will actually raise rates voluntarily and not continue to defer doing so until forced to by circumstances.

At any rate, the historical record shows that gold tends to rise with nominal interest rate rises – as was seen from 2004 to 2008 and in the 1970s – and the Fed are unlikely to raise rates in any meaningful way while deflationary forces persist.

We advise clients to ignore the noise and pay attention to the factors that caused them to diversify into gold. These conditions have actually deepened in recent years.

Physical gold will protect wealth in the event of banking crises, bank bail-ins, systemic crises caused by cyber warfare and other risks that ourselves and well placed commentators have highlighted in recent months

Must-read guides to international bullion storage:

Essential Guide to Gold Storage in Switzerland

Essential Guide to Gold Storage in Singapore

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,108.00, EUR 1,021.15 and GBP 711.47 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,115.00, EUR 1,029.17 and GBP 717.41per ounce.

Gold fell 3.2% to $1103.20 per ounce and silver fell 1.2% to $14.71 per ounce.

Today, gold in Singapore was flat, prior to gold bullion in Zurich ticking marginally higher.

Silver for immediate delivery rose 1% to $14.90 an ounce. Spot platinum rose 0.6% percent to $989.5o an ounce, while palladium fell 1 percent to $611 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.