Compelling Reasons Why the Next Move Down in Global Markets is Just Around the Corner

Stock-Markets / Financial Markets 2015 Jul 17, 2015 - 09:11 PM GMTBy: Rajveer_Rawlin

There are some compelling reasons to believe that the next move down in risk assets across the globe is about to begin:

There are some compelling reasons to believe that the next move down in risk assets across the globe is about to begin:

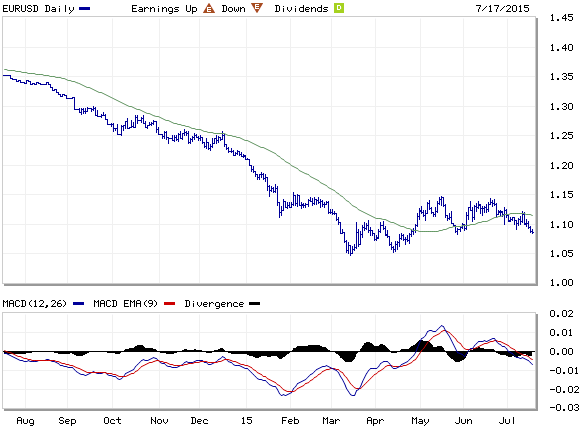

First and foremost the Euro a good proxy for global risk appetite has completely broken down despite the perceived resolution to the crisis in Greece. The strong dollar could eventually cause the liquidation of carry trades (Source marketwatch.com):

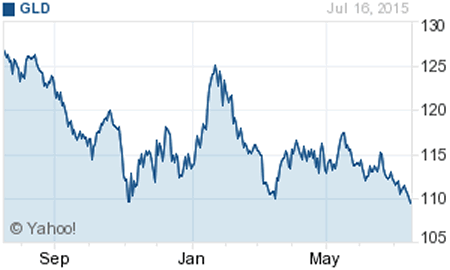

Next Gold often a proxy for global liquidity has broken down below the major support of 1150.

Oil and base metals like copper which are barometers of global economic strength have had major break downs:

The S and P 500's last few highs have been marked by bearish divergences with non conformations in the transportation index which has not hit new highs in over 8 months:

Finally the Vix is yet to take out it's 52 week lows and is reaching levels that suggest complacency:

Yes marginal new highs in the S&P 500 and other indices are possible but the above developments taken together with unfavorable market cycles into mid August make for a possibility of a global market sell off in the not too distant future.

By Rajveer Rawlin

rajveersmarketviews.blogspot.in

http://www.linkedin.com/pub/rajveer-rawlin/3/534/12a

Rajveer Rawlin received his MBA in finance from the University of Wales, Cardiff, UK. He is a Associate Professor in Finance in the Department of Management Studies Acharya Bangalore Business School. His research interests includes areas of Capital Markets, Banking, Investment Analysis and Portfolio Management and has over 15 years of experience in the above areas covering the US and Indian Markets. He has 9 publications in the above areas. The views expressed here are his own and should not be construed as advice to buy or sell securities.

© 2015 Copyright Rajveer Rawlin - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.