Silver Pretty, Silver Ugly

Commodities / Gold and Silver 2015 Jul 14, 2015 - 03:42 PM GMTBy: DeviantInvestor

The big picture in simple terms:

The big picture in simple terms:

- US national debt is huge, ugly, unpayable, and accelerating higher.

- Silver Eagles are pretty and are priced low.

- Silver prices will increase erratically, driven higher by a devalued dollar, along with increasing debt.

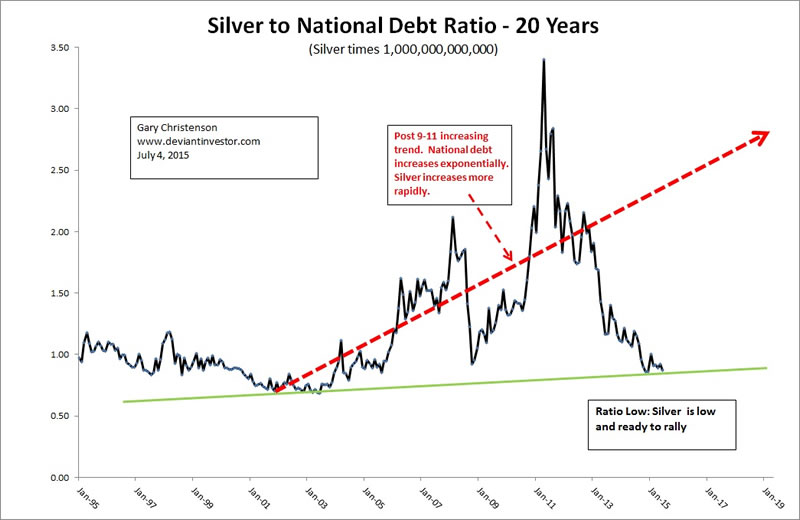

- Silver is currently at the low end of the silver to national debt ratio.

- Silver is currently at an 81 month cycle low.

Examine the next two graphs:

The above log scale chart of silver prices shows important lows in 1995, 2001, 2008, and 2015, all about 81 months apart.

It also shows that silver prices exponentially increased to higher highs from 2001 to 2011 and corrected thereafter.

But national debt has increased exponentially since 1971 about 9% per year and about 10% per year since October 2008. Silver prices have erratically increased from $1.39 in 1971 to nearly $50 in April 2011 and have fallen to about $16.00 today. The increase in national debt parallels price increases in crude oil, postage, food, cigarettes, many consumer goods, and silver.

Since the US government can only pay for entitlements and a few other government functions with current revenues, the interest on the national debt plus excess expenditures must be borrowed every year. Expect borrow and spend politicians to increase debt until they can’t.

That increased debt will drive silver prices higher, along with most other consumer prices.

But the ugly truth, as I see it, is:

- Silver prices must be constrained or gold prices will accelerate higher.

- Gold prices must be constrained or investors, hedge funds, and other governments will realize the dollar is structurally weak and could accelerate lower.

- The dollar must be supported or the $100 Trillion bond market will accelerate lower. The 30+ year bull market in bonds could reverse at any moment and a weak dollar, among several others, could be the pin that pops the bond bubble.

- The bond bubble must be supported or $500+ Trillion in interest rate derivatives might accelerate lower, crash major banks, and freeze the global financial system making the 2008 crash look like a 4th of July picnic.

- Given that silver mining is tiny, less than $20 Billion annually, and silver prices are largely set on the paper COMEX market, constraining silver prices is both possible and relatively easy for the High Frequency Traders, major banks (such as JP Morgan), and central banks. As long as the financial and political elite are able to constrain silver prices, and it remains in their best interest to do so, silver prices will languish at unrealistically low prices.

But the day will come when silver prices can be constrained no longer, or the silver shorts cannot deliver their promised silver, or a major bank will force the silver market far higher. When that day comes, the silver market, like the national debt, will exponentially increase again.

WHEN?

- The silver chart shows an 81 month cycle bottoming about now. Perhaps silver is poised to rally.

- Greece and the Euro are under stress. A sovereign debt or derivative crisis looks more probable every day. The consequences could be ugly for the global bond market and beneficial to silver prices.

- Puerto Rico owes $73 Billion in unpayable debt, but the related derivative contracts are far higher. This will produce more ugly consequences.

- The world will eventually realize that Greece, Puerto Rico, Italy, Spain, and the United States are not dissimilar in terms of their excessive debt and inability to repay that debt. The global bond market is vulnerable because sovereign debts will never be paid, merely rolled over.

- In the words of the IMF describing Greek debt and potential repayment, “these new financing needs render the debt dynamics unsustainable.” “Unsustainable” suggests the sovereign debt market and borrow and spend countries are about to “hit the wall” and burst into flames.

- Silver and gold could begin a massive rally at any time, but the High Frequency Traders and central banks will attempt to restrain prices.

- When central bankers face collapse of the currency and bond bubbles, a silver price rally will seem unimportant compared to the consequences of a dollar and bond market collapse.

CONCLUSIONS:

- National debt will increase. Silver prices will also increase, probably soon.

- Silver prices are currently low as shown by historical ratios with gold, the S&P, and national debt.

- Expect silver prices to rally based on fundamentals, systemic stress, and investor demand. Expect silver prices to be constrained by the financial and political elite, as long as they are able.

- Expect higher prices for silver in the year and decade ahead.

- Stack silver. It is healthy for your retirement and financial well-being.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.