Silver Price Remains in Long-term Downtrend

Commodities / Gold and Silver 2015 Jul 13, 2015 - 06:11 AM GMTBy: Clive_Maund

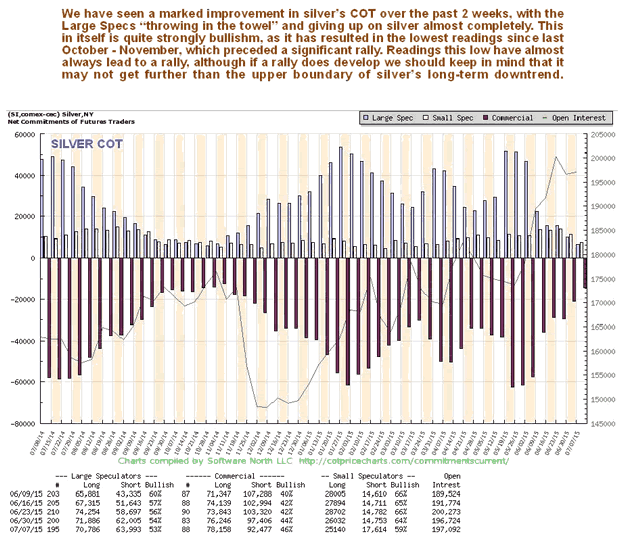

It's a strange situation - the long-term charts for silver continue to look awful, but there has been a quite dramatic improvement in its COTs, which now look positive, with readings that in the past have consistently lead to rallies. However, this doesn't mean that any rally that develops soon will succeed in breaking silver out of its long downtrend.

It's a strange situation - the long-term charts for silver continue to look awful, but there has been a quite dramatic improvement in its COTs, which now look positive, with readings that in the past have consistently lead to rallies. However, this doesn't mean that any rally that develops soon will succeed in breaking silver out of its long downtrend.

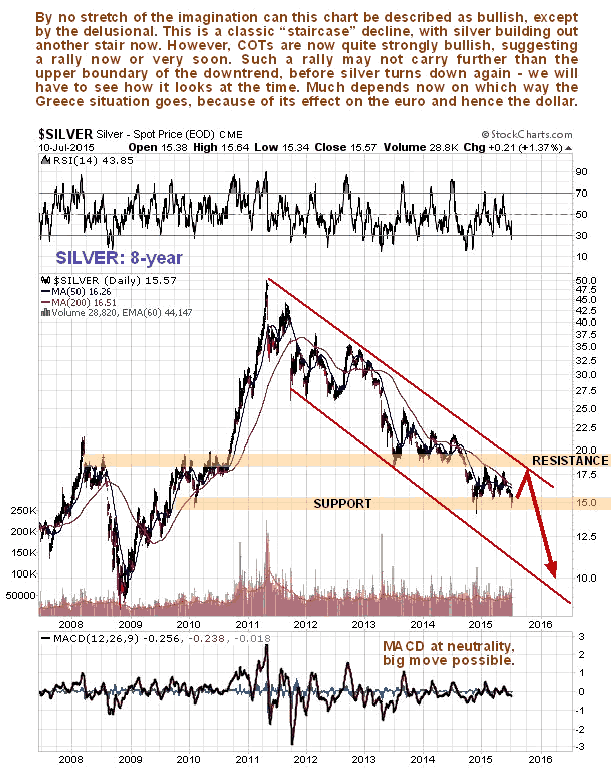

Silver's 8-year chart shows the as yet unrelenting downtrend from its 2011 highs involving a classic "staircase" decline. On this chart it looks set to drop again, but perhaps after another rally first towards the upper boundary of the downtrend channel.

The latest COT is, or should be, encouraging for bulls as it shows that Large Specs have now given up on silver almost completely, with their long positions falling to a very low level. This is what happened last November ahead of a significant rally in January. In itself this COT chart is viewed as strongly bullish.

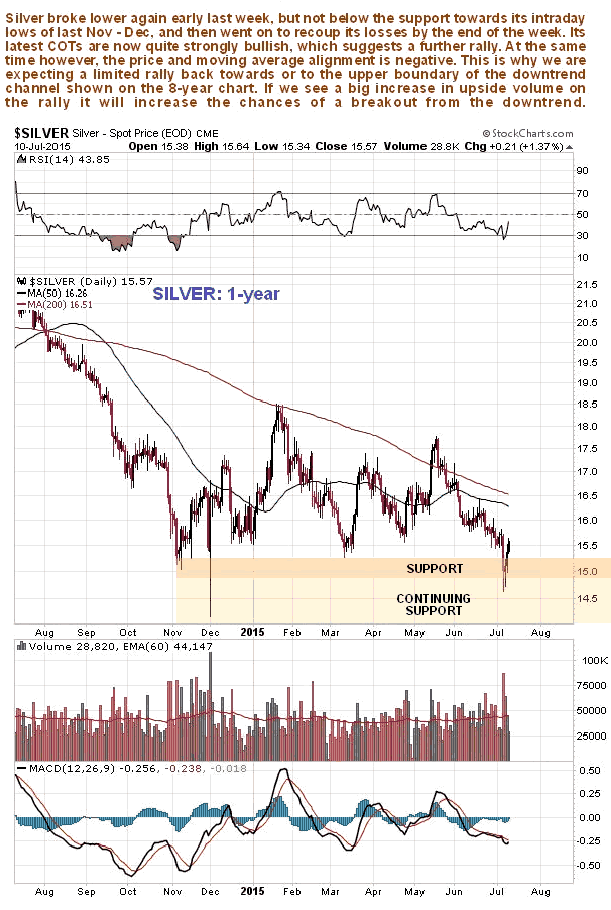

The 1-year chart shows that silver broke lower last week, but not below its November - December lows where there is quite strong support, and then bounced back later in the week to recoup the losses. So we are at a good point for a rally to develop, although the lurking danger of a drop to new lows is emphasized by the bunching of the price with its bearishly aligned descending moving averages not far above.

Taking all of the above into consideration what could happen is a rally soon back towards or to the upper boundary of the major downtrend channel, which, depending on how things develop, could be followed by a reversal leading to a possible break to new lows later.

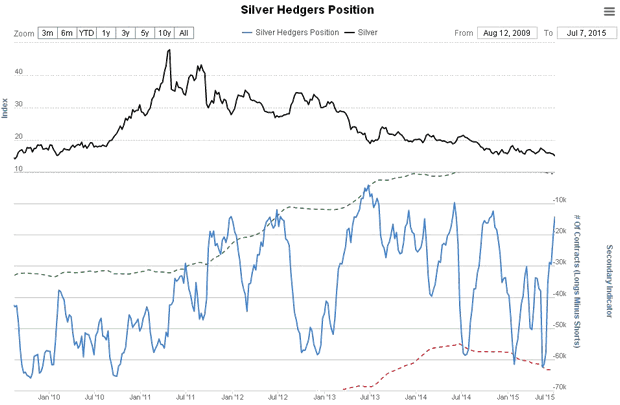

The Silver Hedgers chart, a form of long-term COT, now looks quite strongly bullish, although it could get even more so. By itself this suggests a rally soon.

Chart courtesy of www.sentimentrader.com

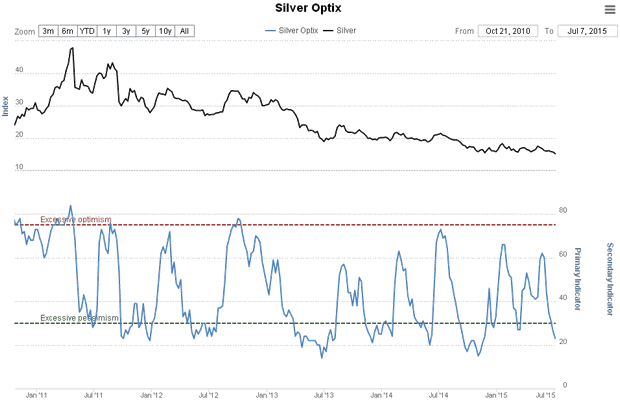

The Silver Optix chart is now quite strongly bullish too - more evidence of a least a short-term rally in the offing.

Chart courtesy of www.sentimentrader.com

Finally, it is worth keeping in mind that we are now entering the most bullish time of year for gold, as the seasonal chart below shows...

What happens to silver now - and gold - depends in large part on how things pan out between Greece and the EU, which will determine the course of the euro, and thus the dollar, which has been discussed in the parallel Gold Market update.

Conclusion: Silver remains in a long-term downtrend until proven otherwise by a base pattern completing or a breakout from this downtrend on strong volume occurs. COTs are now looking more positive than for a long time, suggesting that there is a good chance of a rally developing soon. Over the short-term what happens depends on whether Greece accedes to the demands of the EU and sticks with the euro, or walks away.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.